The strategic partnership between TD Bank and Samsung has paved the way for innovative financing solutions that benefit consumers. This collaboration offers Samsung customers a range of financing options through Samsung Financing, backed by the financial expertise and support of TD Bank. With favorable terms such as 0% APR for selected periods and seamless integration with Samsung’s ecosystem, consumers can enjoy enhanced purchasing power and added value in their electronic acquisitions. This article explores the multifaceted advantages of this alliance, from financial flexibility to long-term savings.

Key Takeaways

- Samsung Financing, supported by TD Bank, provides customers with flexible payment options and 0% APR offers on select purchases, subject to credit approval.

- The partnership enhances the overall Samsung experience by offering exclusive deals, extended warranties, and integration with Samsung Wallet.

- Consumers benefit from trade-in programs, improved credit accessibility, and opportunities for long-term financial planning through this collaboration.

- TD Bank’s extensive financial ecosystem, including small business banking and wealth management services, complements the financing options for Samsung customers.

- It is crucial for consumers to understand the terms and conditions, such as the standard purchase APR of 29.99% after promotional periods, to avoid unexpected charges.

Unlocking Financial Flexibility with Samsung Financing

Overview of Samsung Financing Terms

Samsung Financing, in partnership with TD Bank, offers a range of flexible payment options designed to make Samsung’s latest technology accessible to more consumers. The program includes attractive terms such as 0% APR for 12, 18, or 24 months on select purchases, ensuring that customers can enjoy their new Samsung products without the immediate financial burden.

- Minimum purchase to qualify: $50

- To avoid interest, full payment must be made before the promotional period ends

- Standard Purchase APR after the promotional period: 29.99%

- Minimum interest charge: $1

The Samsung Financing program is tailored to fit various budgets and lifestyles, allowing for easier management of personal finances without compromising on the quality of the products.

It’s important to note that the advertised payment may be higher than the minimum required monthly payment. This flexibility gives consumers the power to choose how they manage their payments over time. The account must be in good standing and is subject to credit approval by TD Bank, N.A.

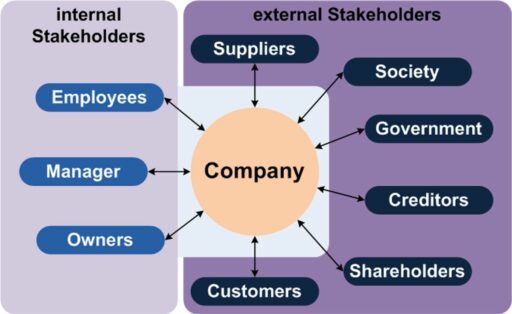

The Role of TD Bank in Facilitating Credit

TD Bank plays a pivotal role in the Samsung Financing program by providing the necessary credit facilities to consumers. By offering tailored credit solutions, TD Bank enables customers to purchase Samsung products with the convenience of installment payments. This partnership reflects TD Bank’s commitment to enhancing customer experiences through accessible financial services.

- TD Bank assesses the creditworthiness of applicants, ensuring a smooth application process.

- The bank sets the credit terms, including interest rates and payment schedules, in line with Samsung’s promotional offers.

- Customers benefit from TD Bank’s robust customer service for any credit-related inquiries or issues.

The collaboration between TD Bank and Samsung is designed to make cutting-edge technology more attainable for a wider audience, by simplifying the credit approval process and offering manageable payment solutions.

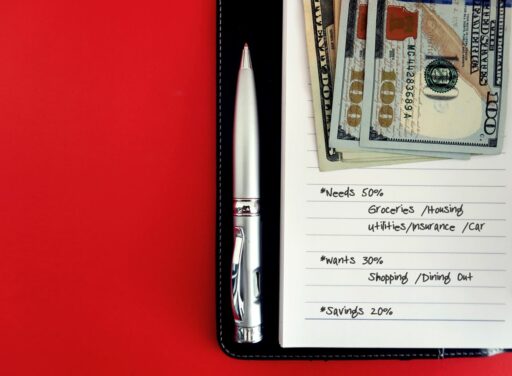

Understanding the 0% APR and Payment Options

Samsung Financing, facilitated by TD Bank, offers a range of payment options to suit different consumer needs. The 0% APR on select purchases allows for an easier and more manageable way to own Samsung products without the immediate financial burden. This promotional offer requires consumers to make minimum monthly payments, with the caveat that failing to pay off the balance within the promotional period will result in standard APR charges.

Payment options include one-time payments, monthly installments, and pay-in-four installments, each designed to provide flexibility. For example, a one-time payment is straightforward, while monthly installments spread the cost over 24 months at 0% APR, and pay-in-four installments split the total cost into four equal payments made every two weeks.

It’s crucial for consumers to understand that while the 0% APR offer is enticing, it’s a limited-time offer and regular account terms will apply to non-promotional purchases. Additionally, to maintain the promotional rate, the account must be in good standing and subject to credit approval.

Here’s a quick breakdown of the payment options:

- One-time payment: Pay the full amount upfront, excluding taxes and shipping.

- Monthly installments: Pay a fixed amount each month for 24 months at 0% APR.

- Pay in four installments: Make four interest-free payments every two weeks, with no impact on credit score.

Enhancing the Samsung Experience through TD Bank’s Partnership

Exclusive Offers for Samsung Customers

TD Bank’s partnership with Samsung brings a plethora of exclusive offers that enhance the value proposition for customers. During promotional periods, such as the Samsung Holi sale, consumers can enjoy substantial discounts across a wide range of products. For instance, Samsung televisions, including premium and lifestyle models, are available at discounts of up to 48%, with additional exchange benefits on select models.

Samsung’s financing options, in collaboration with TD Bank, allow customers to make the most of these offers without straining their finances. The synergy between the two companies ensures that the benefits are not just immediate but also contribute to a more satisfying ownership experience over time.

Moreover, the partnership often includes special deals on Samsung’s latest technology, such as Galaxy smartphones, laptops, and tablets, with discounts reaching up to 60%. These offers are typically coupled with bank cashback deals and other incentives, making high-end technology more accessible to a broader audience.

Here’s a snapshot of the savings consumers can expect:

- Up to 60% off on select Galaxy models

- Up to 48% off on Samsung TVs with additional exchange benefits

- Up to 55% off on Galaxy tablets, wearables, and accessories

- Special bank cashback offers and cart discounts during sale events

These promotions are a testament to the commitment of TD Bank and Samsung to provide value to their customers, ensuring that the latest technology is within reach while fostering customer loyalty.

Extended Warranty and Support with Samsung Care+

Samsung Care+ is a comprehensive service plan that offers peace of mind to Samsung customers. For a one-time fee, users can extend their warranty coverage and enjoy a range of support services that ensure their Samsung products remain in top condition. The extended warranty covers mechanical and electrical breakdowns, providing a safety net beyond the standard manufacturer’s warranty.

With Samsung Care+, customers have access to 24/7 tech support for any troubleshooting needs. Whether it’s a software glitch or hardware malfunction, expert assistance is just a call away. The program is akin to the popular Apple Care+ program, offering similar benefits and protection for Samsung users.

Here are the available Samsung Care+ plans:

- 3 Years plan: $179.99

- 5 Years plan: $229.99

Coverage begins from the date of purchase, ensuring long-term reliability and support for your Samsung devices. By opting for Samsung Care+, consumers can avoid unexpected repair costs and enjoy a seamless Samsung experience.

Seamless Integration with Samsung Wallet

The partnership between TD Bank and Samsung has led to a seamless integration with the Samsung Wallet, enhancing the user experience significantly. This integration allows for a more streamlined financial management process, where users can easily monitor their Samsung Financing account directly within the wallet application.

The Samsung Wallet acts as a hub for not only managing your Samsung Financing but also for a variety of other financial services and transactions.

The integration is designed to be intuitive, providing a hassle-free way to access credit information, make payments, and review transaction history. With the banking API embedded within the Samsung Wallet, customers can enjoy features such as data exchange and account management without leaving the digital wallet environment.

- Commit data exchange by reading data from the bank

- Perform actions like opening a bank account

- Receive real-time responses on the success or failure of transactions

This level of integration represents a significant step forward in digital wallet functionality, moving beyond mere payment processing to become a comprehensive financial tool.

Consumer Advantages in the TD Bank-Samsung Collaboration

Trade-In and Recycling Benefits

The partnership between TD Bank and Samsung introduces a trade-in program that not only offers financial incentives but also promotes environmental responsibility. Customers can receive up to $150 in trade-in credit towards a new appliance, with the assurance that their old appliance will be recycled in an environmentally sustainable manner.

- Instant trade-in credit for eligible appliances

- Environmentally responsible recycling

- Seamless pick-up and haul-away service

The process is straightforward: select your old appliance, receive an instant credit estimate, and agree to the terms. At delivery of your new appliance, the old one is taken away for recycling.

This initiative not only provides immediate financial benefits but also aligns with consumer values of sustainability and responsible consumption. By choosing to trade in and recycle, customers are contributing to a greener planet while enjoying the perks of the latest Samsung technology.

Impact on Credit Accessibility for Consumers

The strategic alliance between TD Bank and Samsung has significantly widened the horizon for consumer credit accessibility. By offering tailored financing options, Samsung customers can now enjoy the benefits of advanced technology without the immediate financial burden. This partnership has made it easier for a broader range of consumers to obtain credit, which can be particularly beneficial for those looking to build or improve their credit scores.

- Credit Building: Customers with limited credit history can establish credit.

- Credit Improvement: Timely payments contribute to a positive credit history.

- Financial Literacy: Access to resources that help understand credit better.

The collaboration is not just about purchasing power; it’s about empowering consumers with the tools and knowledge to manage their financial health effectively.

The availability of 0% APR and flexible payment options through Samsung Financing, facilitated by TD Bank, allows consumers to make informed decisions without the pressure of high-interest rates. This initiative also aligns with TD Bank’s commitment to financial education, as their website page covers various financial topics, including loans, credit scores, and financial literacy, providing insights that help consumers navigate their financial journey.

Long-Term Savings and Financial Planning

The strategic alliance between TD Bank and Samsung extends beyond immediate financing solutions, offering a pathway to long-term financial well-being for consumers. By leveraging the diverse financial products available through TD Bank, such as the Tax-Free Savings Account (TFSA), Retirement Savings Plan (RSP), and Education Savings Plan (RESP), customers can align their electronics investments with broader financial goals.

- TFSA: Grow savings tax-free, ideal for emergency funds or short-term goals.

- RSP: Save for retirement with tax-deferred growth.

- RESP: Invest in a child’s future education with grants and tax benefits.

This partnership not only simplifies the purchasing process but also encourages consumers to consider their financial future, integrating their tech acquisitions with personal savings and investment strategies.

By taking advantage of TD Bank’s comprehensive financial services, customers can enjoy the benefits of Samsung’s cutting-edge technology while also nurturing their financial health, paving the way for a secure and prosperous future.

TD Bank’s Broader Financial Ecosystem and Its Benefits

Synergies with TD Small Business Banking

TD Bank’s partnership with Samsung not only enhances the consumer experience but also creates a robust support system for small businesses. TD Small Business Banking offers a suite of services tailored to the unique needs of entrepreneurs and startups. From credit solutions to cheque deposit services, the bank provides tools to manage cash flow effectively.

The Small Business Resource Centre is a hub of information, featuring a variety of guides and tips to help businesses reach their potential. Categories cover a wide range of financial topics and small business advice, ensuring that every aspect of business banking is addressed.

- Credit solutions

- TD Merchant Solutions

- Manage cash flow

- Cheque deposit solutions

TD Bank’s commitment to small businesses extends beyond financial products. The website page provides valuable insights on starting a thrift store, making money with a 3D printer, and offers practical tips for small businesses to thrive.

TD Investing and Wealth Management Services

TD Bank’s suite of investment and wealth management services is designed to cater to a diverse range of financial needs and goals. From Direct Investing to Private Wealth Management, clients have access to a comprehensive set of tools and resources to help them make informed decisions and grow their wealth over time.

The bank’s commitment to investor education ensures that individuals, regardless of their experience level, can enhance their financial literacy. This is complemented by the robust Markets and Research section, which provides valuable insights and analysis for strategic investment planning.

TD Wealth’s financial planning services are tailored to align with each client’s unique life stages and aspirations, offering a personalized approach to wealth management.

For those interested in hands-on investment management, TD’s trading platforms offer a range of investment types, supported by competitive commissions and fees. The following list outlines key services available through TD Investing:

- Direct Investing

- Accounts tailored to individual investment strategies

- Comprehensive investor education resources

- Access to diverse markets and research

TD Bank’s investment services are not only about providing tools but also about fostering a community where investors can thrive.

TD Corporate Commitment to Community and Environment

TD Bank’s dedication to corporate citizenship and environmental stewardship is a cornerstone of its broader mission. By integrating sustainability into its business model, TD has shown a commitment to not only financial success but also to the well-being of the communities it serves. The bank’s initiatives focus on reducing its carbon footprint, promoting diversity and inclusion, and ensuring responsible corporate practices.

TD’s approach to corporate responsibility is holistic, encompassing a range of activities that support economic inclusion and environmental sustainability.

TD’s efforts in community development and environmental conservation are reflected in its support for various programs and partnerships. These include investments in renewable energy, community grants, and educational programs aimed at fostering financial literacy and economic empowerment.

Navigating the Fine Print: What Consumers Should Know

Annual Interest Rates and Fees

Understanding the annual interest rates and fees associated with Samsung Financing through TD Bank is crucial for making informed financial decisions. The terms provided under this partnership are designed to be transparent, allowing consumers to plan their purchases and payments effectively.

| Fee Type | Amount |

|---|---|

| Annual Fee | $0 |

| Interest: Purchases | 19.99% |

| Interest: Cash Advances | 22.99% |

For purchases made with Samsung Financing, it’s important to note that promotional interest rates may apply. For instance, a promotional interest rate of 8.99% on purchases can be available for the first 6 months after account opening, subject to approval and conditions.

After the promotional period, the standard annual interest rate for purchases will revert to 13.90%. This rate adjustment occurs on the first day of the statement period following the end of the promotional rate period.

It’s essential to maintain timely payments to avoid rate increases and additional fees. Failure to make the minimum payment by the due date can result in the standard interest rate being applied earlier than scheduled.

Terms and Conditions of Samsung Premium Care

When opting for Samsung Care+, consumers are agreeing to a set of terms designed to ensure clarity and fairness in the service provided. The coverage begins from the date of purchase, and includes an extended warranty for mechanical and electrical breakdowns, as well as power surge coverage. A dedicated expert help-line is available to assist with any issues that may arise.

Samsung Care+ is available in different plans, allowing customers to choose the level of protection that best suits their needs. For instance, a 3-year plan is priced at $179.99, while a 5-year plan is offered at $229.99. These plans provide peace of mind by extending coverage beyond the standard warranty and offering 24/7 support for troubleshooting, repairs, and more.

It’s important to note that the advertised payment may be greater than the required minimum payment, and interest is charged from the purchase date if the purchase amount is not paid in full within the specified period.

Before finalizing the purchase, customers should review the full Terms of Sale as pricing and promotions are subject to change, and orders may be cancelled if errors occur or payments are not received in a timely manner.

Credit Approval and Account Standing Requirements

Securing financing through TD Bank’s partnership with Samsung requires adherence to certain credit approval and account standing requirements. Creditworthiness is a key factor in the approval process, and maintaining a good credit score is essential. Many loan companies like Prosper, Upgrade, Barclays, and Alliant Credit Unions use TransUnion reports. It’s important to monitor credit scores and reports regularly from all three bureaus.

To be eligible for promotional rates or bonus points, accounts must not only be approved but also remain open, active, and in good standing. For instance, a promotional rate of 8.99% is contingent upon the account being in good standing during the promotional period. Similarly, eligibility for welcome bonus points requires the account to be active for 12 months with a minimum of $10,000 in net purchases within the first year of account opening.

Maintaining account standing is not just about timely payments; it involves meeting all the terms and conditions set forth by TD Bank and Samsung. This includes making the required purchases within a stipulated time frame to benefit from bonus offers.

It’s also important to note that there are restrictions on the number of accounts one person can open and the number of bonus points one can receive. These limitations are in place to prevent abuse of the system and ensure fair access to offers for all customers.

Conclusion

The partnership between TD Bank and Samsung introduces a compelling financing option that significantly enhances the purchasing power of consumers. By offering 0% APR Samsung Financing for up to 36 months, customers can invest in Samsung’s cutting-edge technology without the immediate financial burden. The inclusion of Samsung Care+ adds value by providing extended warranty and support, ensuring peace of mind for the long term. While the standard APR of 29.99% post-promotion period is steep, the benefits during the interest-free period, coupled with the potential for trade-in credits, make this a lucrative deal for savvy shoppers. It’s essential, however, for consumers to be mindful of the terms and to ensure payments are made in full within the promotional period to avoid high interest charges. Overall, this strategic alliance leverages TD Bank’s robust financial services to bolster Samsung’s customer offerings, thereby enriching the consumer experience with accessible, value-added financing solutions.

Frequently Asked Questions

What are the terms of Samsung Financing through TD Bank?

Samsung Financing, issued by TD Bank, offers a 0% APR for a limited time on eligible purchases, with the option to pay over 24 months. Standard Purchase APR after the promo period is 29.99%. A minimum interest charge of $1 applies, and the account must be in good standing for credit approval.

Can I get exclusive offers as a Samsung customer with TD Bank financing?

Yes, customers using Samsung Financing through TD Bank may receive exclusive offers, such as trade-in credits and discounts, as well as special promotions on Samsung products and services.

What additional benefits come with Samsung Care+ in the TD Bank partnership?

Samsung Care+ offers extended warranty protection for mechanical and electrical breakdowns, power surge coverage, and access to a dedicated expert help-line. It may be included with certain Samsung Financing plans.

How does the trade-in and recycling program work with Samsung and TD Bank?

Samsung offers a trade-in and recycling program where customers can receive credit towards new purchases by trading in eligible devices. The discount is applied at checkout when using Samsung Financing.

What financial services does TD Bank offer beyond consumer financing for Samsung?

TD Bank offers a broad range of financial services including Small Business Banking, Wealth Management, Asset Management, and Commercial Banking, among others. These services are designed to cater to various financial needs beyond consumer financing.

What should consumers be aware of regarding the credit approval process for Samsung Financing?

Consumers should know that credit approval for Samsung Financing requires an assessment of credit history and account standing. It’s important to review the terms and conditions, including the Standard Purchase APR and minimum interest charges, before applying.