Navigating the realm of furniture financing can be a daunting task, especially for those with less than stellar credit. This guide aims to demystify the process, providing insights into various financing options available at furniture stores for people with bad credit. It also highlights the potential risks and rewards of financing furniture purchases and offers expert advice on making smart buying decisions to avoid financial strain.

Key Takeaways

- No-interest financing deals can be advantageous if the balance is paid within the set timeframe, as advised by financial experts.

- Seasonal sales and in-store financing options, like layaway programs or retail credit cards, can offer significant savings, but require careful planning to avoid high interest rates.

- Snap Finance and similar inclusive financing solutions cater to customers with bad credit, offering the chance to make purchases with manageable repayment plans.

- Understanding your credit score is crucial when considering financing options, as it influences interest rates and approval chances for loans and store credit cards.

- Buy now, pay later options and personal loans can provide immediate purchase power, but should be used judiciously to prevent financial overextension.

Understanding Furniture Financing Options

Assessing No-Interest Financing Deals

No-interest financing deals can be a tempting offer for those looking to furnish their homes without paying the full price upfront. Be cautious of the terms and conditions that accompany these deals. Often, these promotions require you to pay off the balance within a specific period, such as 12 months. Failing to do so could result in retroactive interest charges, which are typically very high.

It’s crucial to understand the full implications of a no-interest deal before committing. Ensure that you have a solid plan to pay off the balance within the promotional period to avoid hefty interest charges.

Here are some steps to consider when assessing no-interest financing deals:

- Review the promotional period and ensure it’s realistic for your budget.

- Calculate the total cost of ownership, including any potential late fees or penalties.

- Understand the consequences of not meeting the payment deadline.

- Consider the impact on your credit score if you fail to pay on time.

Remember, while no-interest deals can be beneficial, they are not without risks. It’s important to approach them with a clear financial strategy.

Seasonal Sales and In-Store Financing

Seasonal sales can be a boon for those looking to furnish their homes without breaking the bank. Retailers often provide significant discounts on select items during these periods. Be vigilant for in-store financing options that may accompany these sales, such as layaway programs or retail credit cards offering deferred interest. It’s crucial to ensure that you can clear the balance within the specified timeframe to avoid accumulating high interest fees.

When considering in-store financing, it’s important to understand the terms and conditions. Deferred interest plans can be attractive, but they require discipline to pay off the balance before the promotional period ends.

Here are some common seasonal sales periods when you might find the best deals:

- Black Friday

- After Christmas

- Labor Day

- Memorial Day

Remember, while these sales can offer immediate gratification, it’s essential to consider the long-term financial implications of any financing agreement you enter into.

Layaway Programs and Retail Credit Cards

Layaway programs and retail credit cards present unique opportunities for consumers with less-than-ideal credit scores to purchase furniture. Layaway allows customers to pay for items over time without incurring interest, making it a budget-friendly option. Retail credit cards often come with special financing deals, such as deferred interest; however, it’s crucial to pay off the balance within the promotional period to avoid hefty fees.

- Layaway: Pay over time, no interest

- Retail Credit Cards: Special financing, watch for deferred interest

When considering these options, always be mindful of the payment terms and potential fees to ensure they align with your financial plan. Remember, defaulting on payments can lead to more debt and further damage your credit score.

Retail credit cards can also be a tool for credit improvement if used responsibly. They are often easier to obtain than traditional credit cards and can come with rewards. Here’s a list of some accessible retail credit cards:

- Kohl’s Credit Card

- Walmart Store Card

- Fingerhut Credit Account

- TJX Store Card

- Amazon Store Card

While these cards can offer purchase power and flexibility, it’s important to prioritize low or no annual fees and to understand the rewards structure to maximize benefits.

The Risks and Rewards of Financing with Bad Credit

The Impact of High Interest Rates

Financing furniture with bad credit often comes with high interest rates, which can significantly increase the total cost of your purchase over time. For instance, if you miss a payment or fail to meet the terms of a no-interest loan, rates can skyrocket, sometimes reaching nearly 30 percent. This can turn an affordable piece of furniture into a financial burden that lasts for years.

The burden of high interest rates extends beyond the immediate impact on monthly payments. It also affects your overall financial health, potentially leading to a cycle of debt that is difficult to escape.

Understanding the implications of these rates is crucial. Here’s a quick breakdown of how interest rates can affect your payments:

- Initial Purchase Price: The amount you pay for the furniture upfront.

- Interest Rate: The percentage charged on top of the principal amount.

- Total Cost Over Time: The sum of the initial price plus all interest payments.

It’s important to consider not only the sticker price but also the long-term financial commitment you’re making. High interest rates can erode the value of any ‘deal’ you might think you’re getting, especially if your credit score is already low.

Credit Score Considerations

When exploring furniture financing options, your credit score plays a pivotal role in determining the terms you’ll receive. Applicants with credit scores below 670 often face the most challenges in securing credit. This is particularly true for those with scores in the ‘poor’ category, where access to financing becomes increasingly difficult.

Credit scores not only influence approval rates but also the interest rates and terms of the financing. For instance, individuals with higher credit scores are more likely to receive lower interest rates and more favorable terms. Conversely, those with lower scores may encounter higher interest rates, which can significantly increase the total cost of furniture over time.

It’s essential to understand that bad credit furniture financing options are available, but they come with their own set of challenges and considerations. Being aware of how your credit score impacts your financing options is crucial in making an informed decision.

Here’s a breakdown of how different credit scores affect the likelihood of financing approval and the potential for higher rejection rates:

- Poor credit (300-579): 73% faced at least one loan or financial product denial

- Fair credit (580-669): 63% faced a denial

- Good credit (670-739): 55% faced a denial

- Very good credit (740-799): 44% faced a denial

- Exceptional credit (800-850): 29% faced a denial

Improving your credit score should be a priority, especially if you’re considering financing. Look for credit cards with low or no annual fees to minimize costs and avoid missed payments, which are a common cause of credit score damage.

Alternatives to Traditional Financing

When traditional financing isn’t an option, exploring alternatives can be a lifeline for those needing to furnish their homes. Peer-to-peer lending platforms offer a more personalized approach, often with more flexible terms. Another option is seeking special financing promotions from furniture stores; for instance, Rooms To Go occasionally promotes special financing on their credit card, such as no interest for three years, though availability may vary by location.

For those wary of high-interest pitfalls, community lending circles or borrowing from family and friends can provide a more supportive financial environment. These methods can help avoid the stress and potential credit damage associated with payday loans or cash advances.

Here’s a quick list of alternative financing options to consider:

- Peer-to-peer lending platforms

- Special financing promotions from furniture stores

- Community lending circles

- Borrowing from family or friends

- Nonprofit organizations offering low-interest loans

Remember, each alternative comes with its own set of risks and benefits. It’s crucial to evaluate the terms carefully and consider the long-term impact on your financial health.

Expert Strategies for Smart Furniture Purchases

Finding the Best Deals on Furniture

When searching for furniture deals, it’s crucial to compare prices and quality before making a purchase. Websites that cover a range of finance categories, including furniture stores with no credit check financing, can be a valuable resource. Here are some tips to ensure you’re making a smart buy:

- Look for seasonal sales where retailers offer significant discounts.

- Check if the store offers in-store financing options like layaway programs or retail credit cards.

- Investigate the construction quality of the furniture; for instance, dovetail drawers indicate better craftsmanship.

- Consider the sustainability of the furniture and whether it’s made from solid wood or less durable materials like particle board.

Remember, the best deal isn’t just about the lowest price—it’s about finding the best value for your money. Opting for a piece that balances cost with quality and longevity can save you more in the long run.

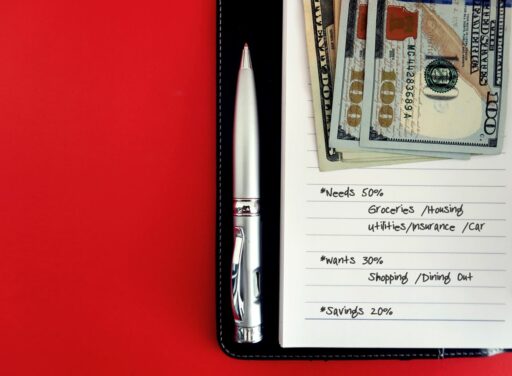

Evaluating Financing Versus Saving

When considering the purchase of new furniture, it’s crucial to evaluate whether financing or saving is the more prudent choice. Financing allows for immediate acquisition but often comes with interest and the potential to impact your credit score. Saving, on the other hand, may delay gratification but avoids debt and interest.

- Financing: Immediate possession, potential for credit building, risk of high interest and debt.

- Saving: No debt or interest, delayed purchase, requires budget discipline.

It is essential to consider your financial stability before deciding to finance. Ensure that your job is secure and that you have an emergency fund in place. Reflect on whether the furniture is a need or a want, and if the monthly payments are comfortably within your budget.

Remember, a good to excellent credit score can increase your chances of qualifying for favorable loan terms and lower interest rates. However, if financing is not aligned with your financial goals or if it poses a risk to your financial health, it may be wiser to save and pay in cash.

When to Choose Buy Now, Pay Later Options

Buy Now, Pay Later (BNPL) programs offer a convenient way to acquire furniture without the immediate financial burden. Before opting for BNPL, consider your budget and the potential impact on your financial health. It’s essential to understand the terms, as some BNPL plans may not require a credit check, aligning with topics on no credit check financing for furniture.

- Plan your purchases: Avoid multiple simultaneous BNPL plans to prevent overdrawing your account.

- Understand the terms: Look for interest-free periods and be aware of any fees.

- Assess your budget: Ensure you can meet the payment schedule without financial strain.

BNPL can be a smart choice for immediate furniture needs, provided you have a clear repayment strategy. It’s a flexible option that can be managed well with careful planning and consideration of your overall financial commitments.

For those with bad credit, BNPL schemes can be particularly appealing as they often offer fast online approvals and may not affect your credit score. However, always be cautious of the allure of instant gratification and make sure it doesn’t lead to further financial stress.

Navigating Store Credit Cards and Loans

Easiest Store Credit Cards to Obtain with Poor Credit

For individuals with less-than-ideal credit scores, obtaining a store credit card can be a strategic move to rebuild credit. Certain store credit cards are known for their more lenient approval criteria, making them accessible even to those with poor credit histories. It’s important to note that while these cards may be easier to get, they often come with higher interest rates and fees, which can add to the cost of your purchases if not managed properly.

- Fingerhut Credit Account is frequently mentioned as one of the easiest to obtain due to its approval process that accommodates bad credit.

- The OpenSky Plus Secured Visa Card is notable for requiring no credit check, appealing to those with poor or no credit history.

- Capital One offers a range of cards such as the Platinum Credit Card and the Quicksilver Secured Cash Rewards Credit Card, which are tailored to different needs but still cater to those with fair to poor credit.

While these options provide an opportunity to improve credit, it’s crucial to use them responsibly. Late payments are reported to credit bureaus and can further damage your credit score.

Before applying for any store credit card, it’s advisable to compare the terms and benefits to find the best fit for your financial situation. Remember, the goal is to use these cards as tools for credit improvement, not to accrue additional debt.

Understanding Personal Loan Options

When considering financing options for furniture purchases, personal loans can be a versatile and often more affordable choice compared to credit cards. Personal loans offer a range of amounts typically from $1,000 to $100,000 and are known for having interest rates that are usually lower than those of credit cards. This makes them an attractive option for larger purchases or consolidating high-interest debt.

Personal loans provide the flexibility to cover various expenses, and with proper research, you can find lenders that cater to those with below-average credit.

Before applying for a personal loan, it’s beneficial to review your credit score and explore ways to improve it if possible. Here’s a quick guide to help you understand the types of personal loans available:

- Best personal loans for bad credit: Designed for individuals with credit scores that fall below the average range.

- Best personal loans for fair credit: Aimed at those with credit scores that are not poor but not excellent either.

Remember, securing a personal loan with bad credit might still be possible, but it often comes with higher interest rates. Weighing the pros and cons of each option is crucial to making a financially sound decision.

The Process of Fast Online Approvals

The advent of fast online approvals has revolutionized the way consumers with less-than-perfect credit can access financing for furniture purchases. With options like ‘Buy Now Pay Later’ (BNPL) and personal loans, instant online approvals offer a quick and convenient path to acquire needed items.

The BNPL option typically allows for 4 payments over 4 weeks with no interest, and importantly, it won’t affect your credit score. Personal loans, on the other hand, provide a broader range of lending from $2,000 to $50,000+, offering more flexibility in purchase choices.

For those seeking immediate financial assistance, the process is straightforward and user-friendly. Here’s a simplified breakdown:

- Select the financing option that suits your needs.

- Complete the online application form.

- Receive instant approval notification.

- Review and accept the terms of the financing agreement.

It’s essential to note that some financing solutions, like the OpenSky Plus Secured Visa Credit, report to all three major credit bureaus, potentially aiding in credit improvement over time. This can be a significant advantage for individuals aiming to rebuild their credit history.

Making the Most of Furniture Store Financing Programs

Snap Finance and Other Inclusive Financing Solutions

In the realm of furniture financing, Snap Finance stands out as a beacon for consumers with less-than-ideal credit histories. Their model is designed to welcome individuals who have faced financial hurdles, such as bad credit or bankruptcy, and still provide them with the opportunity to furnish their homes with ease. Snap Finance’s approach is not only about enabling purchases; it’s also about empowering customers to make manageable payments over time, which can be a crucial step towards financial rehabilitation.

For businesses, partnering with Snap Finance can lead to a significant uptick in sales. The company claims that their marketing services can boost business sales by up to 30 percent. This symbiotic relationship between finance companies and retailers creates a win-win scenario, where increased accessibility to financing can drive consumer spending and business growth.

While exploring financing options, it’s essential to consider the long-term implications of any financial agreement. Snap Finance and similar inclusive financing solutions offer a pathway to ownership for those who might otherwise be excluded from traditional financing due to their credit history.

The landscape of inclusive financing is not limited to Snap Finance alone. Many other companies are recognizing the importance of providing financial lifelines to individuals with poor credit. First Capital Business Finance, for example, has launched specialized programs aimed at supporting entrepreneurs and businesses, even amidst economic uncertainty. These initiatives reflect a growing trend of financial inclusivity, ensuring that more people have the means to invest in their personal and professional aspirations.

Payment Flexibility and Purchase Power

Furniture stores offer a range of flexible financing options to accommodate various financial situations. These options often include buy now pay later and rent-to-own programs, which can be particularly appealing for those with less-than-perfect credit. Quality furniture selection is typically available with these programs, and some even provide no credit check financing options for a more seamless shopping experience.

Furniture financing programs are designed to give consumers the ability to acquire desired items without the immediate financial burden, enhancing their purchase power.

Here’s a quick overview of common financing terms you might encounter:

- Buy Now Pay Later (BNPL): Typically involves 4 payments over 4 weeks with no interest on purchases.

- Personal Loan Options: Lending ranges from $2,000 to $50,000+, offering flexibility in purchase choices.

- Lease-to-Own Solutions: Options like Acima allow ownership in 12 months or less with early buyout, reporting payment activity to credit bureaus.

It’s important to understand the terms and conditions associated with each financing option. For instance, while BNPL programs won’t affect your credit score and offer instant online approvals, personal loans provide more substantial funding but may require a more thorough approval process.

Maximizing Benefits from Store-Specific Credit Facilities

To fully leverage store-specific credit facilities, it’s essential to understand the rewards and terms associated with each card. Retailer-affiliated credit cards can be powerful tools for credit improvement and often come with enticing rewards. They are generally accessible to individuals with fair credit and rarely charge annual fees.

When considering store cards for furniture financing, prioritize cards that offer significant rewards on purchases. For instance, some cards may provide 0% APR promotions, which can lead to substantial interest savings if the balance is paid within the promotional period. Here’s a list of steps to ensure you’re getting the most out of these programs:

- Review the rewards rates and compare them across different store cards.

- Check for any annual fees and opt for cards that don’t charge them.

- Look for promotions like 0% APR and plan your purchases around these offers.

- Ensure you can pay off the balance before the end of any deferred interest period to avoid high fees.

Remember, the key to maximizing benefits is not just in selecting the right card, but also in managing your purchases and payments effectively to avoid additional charges.

Lastly, keep an eye on seasonal sales and in-store financing options that may align with your credit card’s benefits, enhancing your overall savings and rewards.

Conclusion

Navigating furniture financing with bad credit can be a challenging endeavor, but it’s not without solutions. By understanding the various options available, such as no-interest financing deals, in-store layaway programs, and retail credit cards with deferred interest, individuals can make informed decisions that align with their financial situation. It’s crucial to shop around for the best deals, check credit scores, and ensure that any financing plan is manageable within one’s budget to avoid high interest fees. Companies like Snap Finance cater to those with less-than-perfect credit, offering the chance to furnish homes without the immediate financial burden. However, it’s important to remember that financing should be used responsibly and as a last resort when savings aren’t sufficient. Ultimately, the goal is to make your living space comfortable and inviting without compromising financial stability.

Frequently Asked Questions

What should I consider when looking for no-interest furniture financing deals?

Ensure you’re getting good value and can pay off the financing within the agreed timeframe to avoid high interest rates later on.

How can seasonal sales and in-store financing benefit my furniture purchase?

Retailers may offer discounts during seasonal sales and provide in-store financing options like layaway programs or retail credit cards with deferred interest.

What are the easiest store credit cards to obtain with poor credit?

Most department store credit cards require fair credit (640+ score), but there are options available for those with lower scores.

Can Snap Finance help if I have bad credit or no credit history?

Yes, Snap Finance offers financing solutions for customers with bad credit, bankruptcy, or no credit history, allowing them to make easy payments over time.

What are the risks of financing furniture with bad credit?

Financing with bad credit can lead to high interest rates and negatively impact your credit score if you fail to make timely payments.

Is it better to finance furniture or save and pay in full?

It’s generally better to save and pay in full to avoid interest charges and credit risks, but financing can be useful if you secure a good deal and manage payments responsibly.