Embarking on the journey of personal finance in your twenties and thirties is a pivotal step towards long-term financial well-being. This critical period is the ideal time to establish sound financial habits, set the foundation for wealth accumulation, and navigate the complexities of budgeting, saving, and investing. With the right guidance, you can turn your financial goals into reality and enjoy the security and freedom that come with fiscal responsibility.

Key Takeaways

- Mastering budgeting and spending is foundational to financial health; track your income and expenses, and prioritize needs over wants.

- An emergency fund is a critical safety net; determine its size based on personal circumstances and contribute regularly to maintain it.

- Investing is a powerful tool for future wealth; start with basic knowledge of stocks and retirement accounts, and continuously expand your financial education.

- Effectively managing debt and credit is essential; understand the difference between good and bad debt, and work towards a healthy credit score.

- Financial planning with a partner requires open communication; have essential financial conversations early and plan for major life events together.

Mastering Budgeting and Spending

Creating a Sustainable Budget

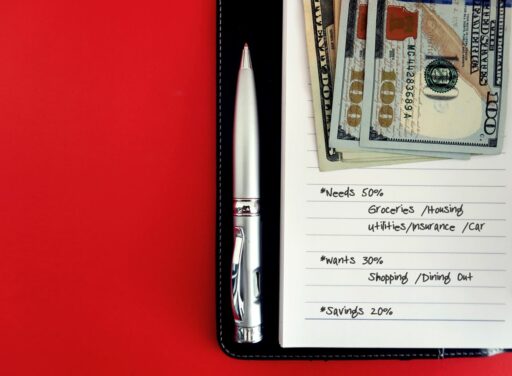

Creating a sustainable budget is the cornerstone of personal finance. It’s about understanding your cash flow and allocating your income efficiently. Begin by tracking your income and expenses to gain a clear picture of where your money is going. A simple method to structure your budget is the 50/30/20 rule, which divides your income into three categories:

- 50% for necessities (rent, groceries, bills)

- 30% for wants (dining out, entertainment)

- 20% for savings

Changing your perspective on spending is crucial. Consider the long-term impact of your expenses. That $30 meal today could add up significantly over time.

To avoid overspending, implement a waiting period for non-essential purchases. A 72-hour rule can help curb impulse buys, allowing emotions to settle and rational decision-making to take over. Remember, a sustainable budget is not just about restriction, it’s about creating a financial plan that supports your goals and lifestyle.

Understanding Needs vs. Wants

Distinguishing between needs and wants is a fundamental aspect of creating a sustainable budget. Needs are essential expenses required for daily living, such as housing, food, and healthcare. Wants, on the other hand, include non-essential items like dining out, entertainment, and luxury goods. To effectively manage your finances, it’s crucial to prioritize needs over wants.

Here’s a simple guideline to help categorize your expenses:

- Needs: 50% of your income (rent, groceries, bills)

- Wants: 30% of your income (dining out, entertainment)

- Savings: 20% of your income

By consistently applying this framework, you can ensure that your spending aligns with your financial goals and prevents overspending on non-essentials.

To curb impulse purchases, consider implementing a waiting period, such as 72 hours, before buying items that are not necessities. This allows time for reflection and can help you avoid emotional spending. Remember, every dollar spent on wants is a dollar less for savings or investing in your future.

Curbing Impulse Purchases

Impulse purchases can derail even the most carefully constructed budget. To combat this, adopt a 72-hour rule for non-essential buys. If you still want the item after three days, reconsider its value in your life.

- Track Your Income: Know what you earn to manage what you spend.

- Categorize Expenses: Divide your spending into necessities, wants, and savings.

- Long-Term View: Assess purchases by their impact over time, not just today.

By shifting focus from immediate gratification to long-term financial health, you empower yourself to make decisions that align with your financial goals.

Remember, the goal isn’t to eliminate all joy in spending, but to ensure that each purchase is a step towards personal finance mastery.

Establishing a Robust Emergency Fund

Determining the Size of Your Emergency Fund

The cornerstone of financial preparedness is an emergency fund that can cover unexpected expenses. According to Bankrate’s 2024 annual emergency savings report, a general rule of thumb is to save three to six months of living expenses. This provides a buffer against life’s unforeseen events, such as job loss or medical emergencies.

When starting your emergency fund, aim for a more manageable initial goal, like $500, and gradually increase your savings as you become more financially stable.

Here’s a simple breakdown of how you might allocate your savings goals:

- Start Small: Begin with an attainable target to build the habit of saving.

- Build Up: Gradually increase your savings until you reach the recommended three to six months’ worth of expenses.

- Maintain: Regularly review and adjust your fund to match any changes in your financial situation.

Remember, the exact amount you’ll need varies based on individual circumstances, such as monthly expenses, income stability, and personal comfort levels.

Strategies for Building Your Fund

Building an emergency fund is a critical step in securing your financial future. Start small and focus on setting attainable goals, such as saving an initial $500, before scaling up. Consistency is key; make saving a regular part of your budget. Aim to save a portion of your income each month, even if it’s a small amount.

- Determine your emergency fund goal based on your monthly living expenses.

- Automate your savings to ensure you contribute regularly without having to think about it.

- Review and adjust your contributions as your financial situation changes or as you reach your initial savings milestones.

Remember, an emergency fund is not static; it should grow with you and your financial needs. It’s okay to use these funds when necessary, but always replenish what you’ve used to maintain your financial safety net.

Maintaining and Managing Your Emergency Savings

Once you’ve established your emergency fund, it’s crucial to maintain and manage it effectively. Regular contributions are key, even if they’re small. Aim to save a portion of your income monthly, treating it as a non-negotiable expense. Here’s a simple guideline to help you allocate your income effectively:

- 50% for necessities (rent, groceries, bills).

- 30% for wants (dining out, entertainment).

- 20% for savings, including your emergency fund.

Remember, your emergency fund is a dynamic resource. It’s okay to use it when necessary, but always prioritize replenishing it. This ensures that you’re prepared for any unexpected expenses that may arise.

Additionally, keep an eye on your expenses and look for opportunities to reduce costs. This might involve negotiating better rates on recurring bills or cutting back on non-essential spending. By doing so, you can free up more money to bolster your emergency savings.

Investing in Your Future

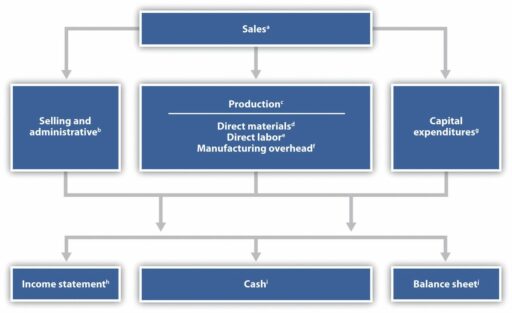

Getting Started with Investments

Embarking on the investment journey in your twenties and thirties can be both exciting and daunting. The key is to start early and educate yourself on the various investment vehicles available. A solid understanding of stocks, bonds, and mutual funds is essential as these are the building blocks of most investment portfolios. Begin with small, manageable investments and as your confidence grows, so too can your portfolio.

It’s crucial to recognize that investing is not just about immediate gains; it’s about setting the stage for long-term financial health.

Retirement accounts should not be overlooked. Contributing to employer-sponsored plans like 401(k)s and Individual Retirement Accounts (IRAs) can significantly benefit from the power of compounding interest over time. Here’s a simple breakdown to consider:

- Learn About Investing: Start with the basics and progressively expand your knowledge.

- Retirement Accounts: Take advantage of time and start contributing to 401(k)s and IRAs as early as possible.

Remember, mastering personal finance is not just about budgeting and saving; it’s about making informed decisions that will pave the way for financial success throughout the various stages of your life.

Retirement Planning: IRAs and 401(k)s

Planning for retirement is a critical step in securing your financial future. Understanding the differences between a Roth IRA and a Traditional IRA is essential. Both offer unique tax advantages that can significantly impact your retirement savings.

- Roth IRA: Contributions are made with after-tax dollars, and withdrawals during retirement are tax-free.

- Traditional IRA: Contributions may be tax-deductible, but withdrawals are taxed as income during retirement.

When considering your retirement plan, it’s important to evaluate your current tax situation and future expectations. Your choice between a Roth IRA and a Traditional IRA should align with your long-term financial goals.

Employer-sponsored 401(k) plans are another cornerstone of retirement planning. They often come with the benefit of employer matching, which can substantially increase your retirement fund. Start contributing early to take full advantage of compound interest over time.

Investing in Knowledge and Skills

Investing in your own knowledge and skills is a critical component of personal finance. Your education and abilities are assets that can generate returns throughout your life. It’s not just about formal education; it’s also about continuous learning and professional development. Here are some steps to consider:

- Learn About Investing: Start with the basics of stocks, bonds, and mutual funds. As your confidence grows, so too can your investment portfolio.

- Retirement Accounts: Time is on your side when you’re young. Make regular contributions to plans like 401(k)s and IRAs.

- Expand Your Skillset: Whether it’s learning a new language or a programming skill, enhancing your abilities can open up new career opportunities.

By focusing on personal growth and lifelong learning, you’re not just preparing for the future; you’re actively building it. Remember, the investment you make in yourself is often the most profitable one.

As you navigate through your twenties and thirties, keep in mind that the landscape of knowledge and skills is ever-changing. Stay adaptable and be proactive in seeking out educational opportunities that align with your career goals and personal interests.

Navigating Debt and Credit

Understanding Good Debt vs. Bad Debt

Not all debts are created equal, and distinguishing between good debt and bad debt is crucial for financial health. Good debt is an investment that will grow in value or generate long-term income, such as student loans for education or a mortgage for a home that appreciates over time. On the other hand, bad debt typically involves borrowing for depreciating assets or expenses that have no lasting value, like high-interest credit card debt for luxury items.

When managed wisely, good debt has the potential to increase your wealth, while bad debt can drain your financial resources with high interest rates and depreciating values.

Understanding the difference can help you make informed decisions about borrowing and managing your finances effectively. Here’s a simple list to help identify the characteristics of each:

-

Good Debt

- Often has lower interest rates

- Is used to finance investments or assets that may appreciate

- Can potentially improve your financial situation in the long term

-

Bad Debt

- Usually comes with high interest rates

- Is used for non-essential items that lose value quickly

- Can lead to financial strain and limit your ability to build wealth

Strategies for Paying Off Debt

Developing a clear strategy for paying off debt is crucial for financial stability and growth. Prioritize debts with the highest interest rates to minimize the total interest paid over time. This method, often referred to as the ‘avalanche’ approach, targets the most costly debts first, potentially saving you money in the long run.

Establishing a debt repayment plan is a fundamental step towards achieving financial freedom. It’s essential to be realistic about your budget and timelines to avoid setting yourself up for failure.

Another effective strategy is the ‘snowball’ method, where you pay off the smallest debts first to build momentum and confidence. Here’s a simple breakdown of how you might structure your debt repayment using this method:

- List all debts from smallest to largest balance.

- Make minimum payments on all debts except the smallest.

- Pay as much as possible on the smallest debt until it’s paid off.

- Roll over the amount you were paying on the smallest debt to the next smallest debt.

- Repeat this process until all debts are cleared.

Remember, the key to successful debt repayment is consistency and persistence. Regularly review and adjust your plan as needed to stay on track.

Building and Maintaining a Healthy Credit Score

A healthy credit score is essential for financial stability and accessing the best credit terms. Monitoring your credit score regularly is a crucial step in maintaining good credit health. It’s like keeping track of your financial GPA, and it allows you to address any issues promptly.

Credit cards can be a double-edged sword. Use them wisely by paying on time, keeping balances low, and avoiding unnecessary debt. This disciplined approach can help you build credit over time. Remember, your credit habits have a significant impact on your score, so practice good credit habits like making payments on time and paying at least the minimum due.

Building a strong credit score doesn’t happen overnight. It requires consistent effort and smart financial decisions. Start by understanding the factors that affect your score and work on improving them one by one.

Here are some key factors that influence your credit score:

- Payment History: Timeliness of bill payments.

- Credit Utilization: The ratio of your credit card balances to your credit limits.

- Length of Credit History: How long you’ve had credit.

- New Credit: Frequency of credit inquiries and new account openings.

- Credit Mix: The variety of credit products you have, including credit cards, loans, and mortgages.

Financial Planning with a Partner

Essential Financial Conversations to Have

When embarking on a financial journey with a partner, it’s crucial to lay a foundation of transparency and shared goals. Discussing your financial histories, current situations, and future aspirations can prevent misunderstandings and build a stronger bond. Consider these points:

- Financial Histories: Be open about your past financial experiences, including debts, savings, and investments.

- Current Financial Status: Share details about your income, expenses, and financial commitments.

- Future Goals: Align on your short-term and long-term financial objectives.

It’s not just about the numbers; it’s about setting a course for mutual financial security and support.

Creating a shared budget can be a practical first step in managing joint finances. This involves understanding each other’s spending habits and agreeing on how to allocate funds. Remember, regular check-ins on your financial plan can help you stay on track and adjust as needed.

Managing Joint Finances

When it comes to managing joint finances, communication and collaboration are key. Creating a shared budget is the first step towards aligning your financial goals and expectations. Utilize tools like budgeting apps to track spending and savings progress together. Here’s a simple way to structure your joint budget:

- Income: Combine your total monthly incomes.

- Expenses: List all shared expenses, such as rent, utilities, and groceries.

- Personal Spending: Allocate funds for individual needs and wants.

- Savings: Decide on a monthly savings goal and contribute to it regularly.

It’s essential to regularly review and adjust your budget to reflect any changes in income or expenses, ensuring that both partners are on the same page.

When disagreements arise, it’s important to have a system in place for resolving financial conflicts. This might include setting spending limits or having regular finance meetings. Remember, the goal is to build a strong financial foundation together.

Planning for Major Life Events Together

When it comes to planning for major life events together, communication and collaboration are key. It’s essential to discuss your individual and joint aspirations, whether that includes buying a home, starting a family, or preparing for retirement. These discussions should lead to actionable financial strategies that support your shared goals.

- Discuss long-term goals and timelines

- Assess your combined financial situation

- Create a joint savings plan

- Consider insurance and estate planning

- Review and adjust plans regularly

Aligning your financial plans with your partner is not just about numbers; it’s about shaping a future that reflects both of your dreams and values. It’s important to make financial promises to each other that foster trust and ensure mutual progress.

Remember, life events can be unpredictable, and having a flexible approach can help you navigate through changes smoothly. Regularly revisiting your financial plans allows you to adapt to new circumstances and keep your shared objectives on track.

Conclusion

As we conclude this guide on personal finance for those in their twenties and thirties, it’s clear that the journey to financial stability and freedom is both challenging and rewarding. By focusing on controlling spending, saving regularly, investing in knowledge, and planning for the future, you can lay a solid foundation for your financial well-being. Remember to adapt the principles to your unique situation and always be open to learning more. Your financial decisions today will shape the quality of your life for years to come, so take the time to make informed choices and seek professional advice when needed. Embrace the process, and watch as your efforts compound into a secure and prosperous future.

Frequently Asked Questions

How can I create a sustainable budget in my twenties and thirties?

Begin by tracking your income and categorizing your expenses into necessities, wants, and savings. A common recommendation is allocating 50% for necessities, 30% for wants, and 20% for savings. Adjust these percentages based on your financial goals and needs.

What’s the difference between needs and wants, and how do I manage them?

Needs are essential for your survival and well-being, such as rent, groceries, and bills. Wants are non-essential items like dining out and entertainment. To manage them, prioritize your needs and set limits for your wants to ensure you don’t overspend.

What strategies can help curb impulse purchases?

One effective strategy is the 72-hour rule: wait three days before making a non-essential purchase. This allows time for emotional impulses to fade and for you to consider the long-term impact of the expense.

How much should I save in my emergency fund?

The size of your emergency fund should typically cover 3 to 6 months of living expenses. This ensures you have a financial safety net in case of unexpected events like job loss or medical emergencies.

What are some effective ways to build my emergency fund?

Start by setting a monthly savings goal and automating transfers to your emergency fund. Cut back on non-essential expenses and consider allocating any windfalls, such as tax refunds or bonuses, to build your fund more quickly.

How should I approach investing in my twenties and thirties?

Begin by learning about different investment options like stocks, bonds, and mutual funds. Consider starting small with a Roth IRA or employer-sponsored 401(k), and focus on long-term, diversified investments that align with your financial goals.