Excel is not just a tool for crunching numbers, it’s a powerful ally in achieving financial clarity and reaching your financial goals. ‘Unlocking Your Financial Goals: A Guide to Personal Finance Excel Templates’ is an essential read for anyone looking to harness the capabilities of Excel for personal budgeting. From selecting the perfect template to integrating with other financial tools, this guide provides step-by-step instructions and advanced techniques to help you take control of your personal finances.

Key Takeaways

- Excel templates can be customized to fit individual financial goals, offering a personalized approach to budgeting.

- Advanced Excel features like formulas, pivot tables, and macros can enhance financial management and automate tasks.

- Integrating Excel with other financial tools creates a unified system for more efficient tracking and analysis.

- Strategic financial planning within Excel allows for future savings projection and preparation for significant life purchases.

- Common challenges in personal finance can be navigated with Excel, supported by a wealth of online resources and community advice.

Mastering Budget Creation with Excel

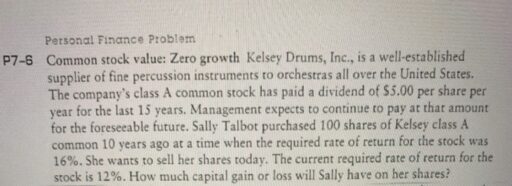

Choosing the Right Template for Your Needs

Selecting the ideal Excel budget template is a pivotal step in mastering your personal finances. The best template aligns with your financial habits and goals, ensuring that you can track expenses, set savings goals, and manage debt effectively. When considering free versus paid options, weigh the pros and cons carefully.

Adjust the template until it paints a true picture of your money life. It should feel like a custom-made suit, fitting your financial shape perfectly.

Quality templates can be found in various places, including Microsoft Office’s Template Gallery, personal finance blogs, and educational websites. Always verify the source’s reputation to avoid issues with incorrect formulas or insecure downloads. Here’s a quick guide to help you decide:

- Free Templates: No cost, suitable for beginners, and cover basic functions.

- Paid Templates: Offer more features, customization options, and are better for complex budgets.

Remember, not all templates will match your needs immediately. Be prepared to tailor the categories to reflect your spending habits and lifestyle. This customization process is crucial for creating a budget that truly works for you.

Setting Up Your Personal Budget Template

Once you’ve selected the perfect Excel template for your financial needs, it’s time to set it up to start tracking your finances. Begin by inputting your financial information, which includes all sources of income, fixed and variable expenses, and any savings goals you might have.

A personal budget template is a dynamic tool that adapts to your financial life, making it essential to tailor it to your specific situation.

Here’s a simple guide to get you started:

- Create budget headers for categories like housing, utilities, groceries, and entertainment.

- Enter your monthly income, listing all the sources separately.

- Detail your expenses under each category, ensuring you capture all costs.

- Calculate the balance to see what you have left after expenses.

Remember, the goal is to make your budget work for you, so feel free to adjust categories and amounts as needed. By adopting a personal budget Excel template, you embrace fiscal responsibility and take a significant step towards financial clarity.

Customizing Your Budget to Reflect Personal Goals

Customizing your budget with an Excel template is a crucial step in aligning your financial management with your personal aspirations. Adjust the template until it paints a true picture of your money life. It should feel like a custom-made suit, fitting your financial shape perfectly. This process involves a few key actions:

- Review Income: Confirm the accuracy of your income streams.

- Track Spending: Categorize and examine expenditures.

- Compare Goals: Measure current spending against set goals.

- Adjust as Needed: Make tweaks to reflect any new financial priorities.

By adopting this simple yet powerful tool, users gain insight into their financial habits, allowing for smarter budgeting decisions.

Remember, not all budget templates will match your needs right away. This is your cue to tailor it. Rename categories to reflect your spending, delete irrelevant sections, and add new categories for expenses or income unique to you. The aim is to have a budget that works for you, helping you to stay on top of your finances with ease.

Advanced Excel Techniques for Financial Management

Utilizing Formulas for Smarter Calculations

Excel’s vast array of formulas can transform your financial management from a manual, time-consuming task into a streamlined, efficient process. Mastering the use of formulas is essential for performing complex calculations with ease and accuracy. For instance, the SUMPRODUCT function is a powerful tool that can calculate weighted averages or total portfolio returns, providing you with deeper insights into your financial health.

- SUMPRODUCT: Multiplies corresponding elements in arrays and sums the results.

- INDIRECT: Allows dynamic referencing of cells based on text values.

By leveraging Excel’s advanced formulas, you can automate calculations that would otherwise require extensive manual work, freeing up time to focus on strategy and analysis.

Understanding and applying array formulas can be particularly transformative. These formulas enable you to perform operations on entire ranges of data simultaneously, akin to running mini-programs within a cell. With functions like MMULT, you can engage in sophisticated financial modeling, such as portfolio optimization or covariance calculations, which are crucial for informed decision-making.

Leveraging Pivot Tables for Data Analysis

Pivot Tables in Excel are a game-changer for anyone looking to delve deep into their financial data. They transform extensive datasets into meaningful insights, enabling you to summarize and analyze information with ease. By organizing data into a pivot table, you can quickly identify trends, calculate totals, and compare figures without extensive formulae.

- Summarize large datasets: Quickly aggregate data to see totals, averages, and more.

- Dynamic reports: Create interactive reports to explore different data aspects.

- Visualize data: Use PivotCharts for graphical representations like column or pie charts.

Pivot Tables empower you to make data-driven decisions, ensuring that your financial management is backed by solid analysis rather than guesswork.

Mastering Pivot Tables involves learning to group, filter, and format data effectively. With practice, you can customize your financial reports to highlight key insights, making it simpler to track progress towards your financial goals.

Automating Tasks with Macros

Excel’s macro and VBA capabilities are transformative features that can automate and customize financial models, enhancing efficiency and accuracy. By recording actions into macros, users can execute a series of commands with a single click or keyboard shortcut. For those looking to delve deeper, VBA (Visual Basic for Applications) is a programming language that allows for the creation of user-defined functions, interactive dashboards, and advanced model functionality.

Macros and VBA not only save time but also reduce the likelihood of errors, making them indispensable for rigorous financial analysis.

Learning to record and run macros is just the beginning. As you become more proficient, you can use VBA to develop custom buttons, menus, and dialogs, which contribute to a more user-friendly and interactive experience. Below is a list of steps to get started with automating tasks in Excel:

- Learn how to use the macro recorder and the Visual Basic Editor.

- Practice writing and editing simple VBA code.

- Debug and test your macros and VBA code to ensure reliability.

- Explore advanced VBA techniques to create sophisticated solutions for unique business needs.

Integrating Excel with Other Financial Tools

Synchronizing Data Across Platforms

In the pursuit of financial empowerment in 2024, integrating Excel with other financial tools is essential. By synchronizing data across platforms, you can achieve a seamless financial management experience. Here are some benefits:

- Sync accounts automatically, saving time and effort.

- Witness real-time data updates for precise tracking and decision-making.

- Consolidate all financial information in one location for simplicity and clarity.

This integration is not just about convenience; it’s about having the ability to make informed decisions with all your financial data at your fingertips. The right platform or tool can make a significant difference. Consider these factors when choosing:

- User Interface: Opt for something user-friendly and intuitive.

- Functionality: Look for comprehensive features like categorizations and visual reports.

- Integration: It should sync seamlessly with your bank accounts and cards.

By integrating your financial tools, you not only streamline your financial management but also set the stage for more advanced features like forecasting future earnings and expenses.

Remember, the goal is to integrate investments with everyday finances, creating a unified system that reflects your complete financial picture. Tools like the Empower app can offer comprehensive financial management, helping you to stay on top of your finances with ease.

Tracking Investments and Bank Statements

Keeping a meticulous record of your investments and bank statements is a cornerstone of sound financial management. Track your assets and liabilities with precision to ensure you’re always aware of your financial health. Here’s a simple structure to follow for your Excel finance sheet:

- Incomes: Regular salaries and ad-hoc gains.

- Expenses: Detailed categorization of outgoings.

- Savings: Amounts set aside.

- Investments: Status of stocks, bonds, or other assets.

- Debts: Current loans or credit card balances.

By consistently updating these elements, you create a comprehensive snapshot of your financial landscape, allowing for informed decisions and strategic planning.

Remember, the goal is to align your tracking practices with your financial goals, choosing tools that fit your lifestyle and objectives. Privacy and security are paramount; ensure your data is protected while you monitor your cash flow, balance trends, and investment performance. With a well-maintained finance sheet, you’re not just recording numbers—you’re crafting a roadmap to financial success.

Creating a Unified Financial Management System

Achieving a unified financial management system through Excel involves more than just meticulous data entry; it’s about creating a seamless ecosystem for your financial data. Integrating various financial tools and apps with Excel enhances efficiency and provides a comprehensive view of your financial health.

- Sync accounts automatically to eliminate repetitive manual entries.

- Enjoy real-time updates for accurate financial tracking.

- Consolidate all financial information in one place for simplified management.

By centralizing your financial data, you gain the ability to analyze and make decisions with the full context of your financial situation at your fingertips.

This approach not only saves time but also reduces the risk of errors associated with manual data handling. With everything in one place, you can more easily spot trends, prepare for future expenses, and ensure that your financial goals are on track.

Strategic Planning for Future Financial Security

Projecting Savings and Expenses

By anticipating financial needs and tailoring your spending, projecting future savings and expenses empowers you to set realistic goals and optimize your financial strategy. Utilizing a personal budget Excel template not only helps in planning for life’s significant events but also in maintaining control over your finances.

With expenses logged daily, patterns in spending emerge, revealing habits that may not be immediately obvious. This insight is crucial for identifying areas where costs can be cut, such as unnecessary subscriptions, and for setting budgets that reflect actual spending habits.

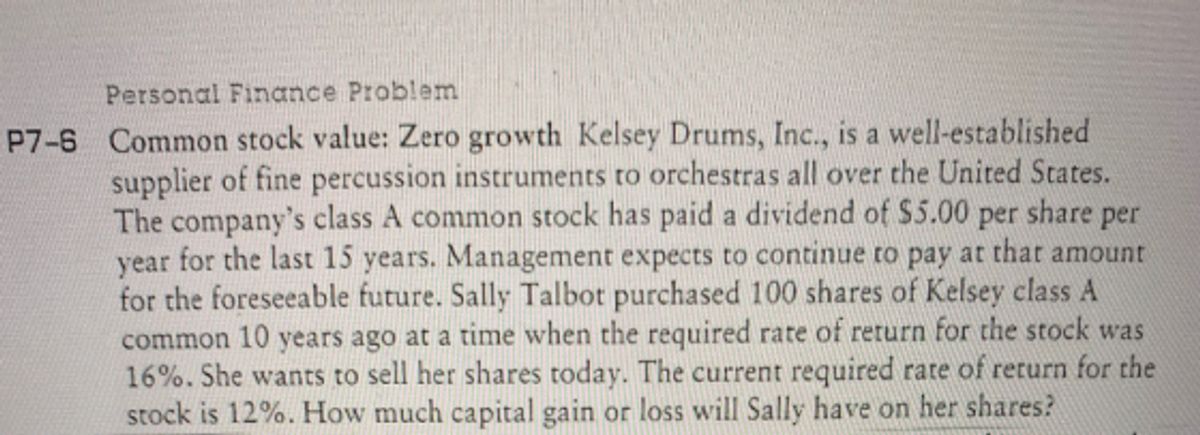

Forecasting future earnings and expenses is a key feature of a robust financial plan. It allows you to plan for big purchases and adjust budgets before overspending occurs, ensuring you’re always one step ahead. Here’s a simple table to help you set SMART savings goals:

| Goal | Timeframe | Monthly Savings Target |

|---|---|---|

| Emergency Fund | 12 months | $200 |

| Vacation | 6 months | $150 |

| Mortgage Principal | 5 years | $500 |

Remember to track your progress towards these goals monthly, and don’t hesitate to adjust your plans as your income or expenses change.

Planning for Big Life Purchases

Life’s significant milestones, such as buying a home or planning a dream vacation, require a strategic approach to saving. By utilizing a budget Excel template, you can map out the necessary steps to accumulate the funds for these substantial expenses. It’s essential to set saving milestones, breaking down your ultimate goal into smaller, more manageable parts. This not only makes the task less daunting but also allows for regular monitoring of your progress, ensuring you stay on track.

To effectively plan for big life purchases, consider the following:

Estimate the total cost of the purchase.

Determine a realistic timeline for achieving your goal.

Identify potential sources of funding, such as savings or loans.

Adjusting your budget to accommodate these savings goals is crucial. If your financial situation changes, such as receiving a raise or encountering unexpected expenses, revisit your plan. Modify your saving strategies and budget allocations to align with your current financial landscape, always keeping your big purchase in sight.

Adjusting Budgets for Long-Term Goals

When it comes to long-term financial planning, adjusting your budget is crucial as your life circumstances and goals evolve. Significant life events, such as a new job, marriage, or the birth of a child, necessitate a review and realignment of your financial strategy. Here’s a simple table to help you visualize the adjustments needed for various life changes:

| Life Event | Action Required |

|---|---|

| Increased Income | Allocate extra funds to savings, debt, or investments. |

| Decreased Income | Identify and reduce non-essential spending. |

| New Expenses | Add the expense category and adjust your spending. |

| Reduced Expenses | Decide where to reallocate the freed-up money. |

By actively updating your budget, you stay in control. Your financial goals stay within reach. A well-maintained budget means peace of mind and financial progress.

Remember to revisit your budget regularly to ensure it reflects your current financial situation and priorities. This habit will help you maintain momentum towards your goals and make informed decisions when life throws a curveball. Adjusting your budget allows you to stay agile and responsive to both opportunities and challenges.

Navigating Common Challenges and Questions

Addressing Frequently Asked Questions

When embarking on the journey of personal finance management, numerous questions arise. Understanding the common inquiries can significantly streamline the process. Below is a list of frequently asked questions that we’ve compiled to aid in your financial planning endeavors:

- How can I ensure my budget is realistic and achievable?

- What strategies can I use to stick to my budget?

- Are there any tools to help track my spending and savings?

- How often should I review and adjust my budget?

It’s essential to remember that personal finance is a dynamic field, and staying informed is key to adapting to changes in your financial landscape.

For more detailed explanations and resources, our Knowledge Base and FAQ sections are continuously updated to address your concerns. Additionally, the guide ‘Visualizing Your Fiscal Path: A Redditor’s Guide to the Personal Finance Flowchart’ offers a comprehensive roadmap for managing your finances effectively.

Overcoming Common Budgeting Obstacles

When embarking on the journey of personal finance management, it’s common to encounter a few stumbling blocks along the way. Simplifying your life by automating as much of the budgeting process as possible can be a game-changer. This approach not only saves time but also reduces the likelihood of errors and oversights.

Here are some strategies to tackle frequent budgeting challenges:

- Irregular Income: Utilize a budget template that accommodates variable cash flows.

- Unexpected Expenses: Establish an emergency fund to buffer against financial shocks.

- Spending Temptation: Be proactive in recognizing and resisting impulse purchases.

- Lack of Goals: Clearly define your financial objectives to maintain focus.

- Tracking Difficulty: Leverage a Personal Budget Excel Template for meticulous record-keeping.

By methodically addressing these obstacles, you can enhance the effectiveness of your budget and secure your financial well-being.

Finding Support and Resources

When embarking on the journey of personal finance management, finding the right support and resources is crucial. Engaging with online communities and forums, such as Reddit’s r/personalfinance, can provide a wealth of knowledge and shared experiences. These platforms allow for the exchange of strategies and tools that can enhance your financial planning.

It’s important to not only consume information but also contribute to discussions. By actively participating, you gain diverse perspectives and can discover new, effective approaches to managing your finances.

In addition to community engagement, consider the following resources to support your financial journey:

- Schedules and checklists to stay organized

- Reminders to keep track of important dates and tasks

- Free consultations with financial experts

- Access to financial tools and apps for automated money management

- Coaching or mentorship for personalized guidance and motivation

Remember, the path to financial literacy involves continuous learning and adaptation. Utilize the resources available to you and don’t hesitate to reach out for help when needed.

Conclusion

In conclusion, personal finance Excel templates are invaluable tools for anyone looking to take control of their financial future. By leveraging the power of Excel, you can create a detailed and customizable budget that fits your unique financial situation. Whether you’re planning for big purchases, projecting future savings, or simply trying to gain clarity on your spending, Excel templates provide the structure and flexibility needed to achieve your financial goals. Remember, the key to successful budgeting is not just in the planning but also in the consistent tracking and reviewing of your finances. So, dive into the world of Excel budgeting, utilize the resources available, and start your journey towards financial clarity and freedom today.

Navigating Common Challenges and Questions

How do I use a personal budget template in Excel?

To use a personal budget template in Excel, start by selecting a template that suits your financial situation. Input your income sources, expenses, and savings goals. Utilize Excel’s formulas and functions to automatically calculate totals and analyze your spending patterns. Customize categories as needed to align with your personal goals.

Can Excel templates be integrated with other financial tools?

Yes, Excel templates can be integrated with other financial tools. You can import data from banking apps or investment platforms, synchronize with cloud storage for real-time updates, and use add-ins to enhance functionality. This integration helps create a unified financial management system.

What are some advanced Excel techniques for financial management?

Advanced Excel techniques include using formulas for complex calculations, leveraging pivot tables for summarizing and analyzing data, and creating macros to automate repetitive tasks. These techniques can help you gain deeper insights into your financial health and streamline the management process.

How can I project my future savings and expenses using Excel?

To project future savings and expenses in Excel, create a forecast model using historical data. Input your expected income, planned expenses, and savings rate. Utilize Excel’s built-in forecasting tools to predict future trends and adjust your budget accordingly to meet your long-term financial goals.

What should I do if I encounter budgeting obstacles in Excel?

If you encounter budgeting obstacles in Excel, seek out resources such as online tutorials, forums, and webinars that offer guidance on Excel budgeting. You can also consult financial advisors or join community groups for personalized advice. Regularly review and adjust your budget to overcome these challenges.

Where can I find support and resources to improve my Excel budgeting skills?

Support and resources for improving Excel budgeting skills can be found on educational websites, personal finance blogs, Microsoft Office Template Gallery, and through financial advisors. Additionally, participating in community forums and enrolling in online courses can provide valuable learning opportunities.