Next Gen Personal Finance (NGPF) is a treasure trove of resources designed to empower individuals with the financial knowledge and skills necessary to navigate the complexities of personal finance. This guide delves into the NGPF’s comprehensive suite of tools and educational materials, offering insights into how the NGPF Answers PDF and other resources can be instrumental in achieving financial literacy and savvy. From understanding the basics of budgeting to mastering the intricacies of investing, this guide provides a roadmap for anyone looking to enhance their financial acumen and apply these lessons to real-life situations.

Key Takeaways

- NGPF offers a holistic approach to personal finance education, covering essential topics such as budgeting, credit management, and investing.

- The NGPF Answers PDF is a valuable asset for learners and educators alike, providing answers and explanations to common financial questions.

- Interactive tools and simulations available through NGPF make learning about finance engaging and practical for real-world application.

- NGPF not only educates but also fosters a community where individuals can continue their learning journey through webinars, workshops, and networking.

- Educators can leverage NGPF’s customizable lesson plans and curriculum guides to teach financial literacy effectively in diverse classroom settings.

Exploring the Core Concepts of Next Gen Personal Finance

Understanding Budgeting and Saving

At the heart of personal finance is the ability to manage one’s income and expenses effectively. Budgeting is a foundational skill that allows individuals to plan for their financial future and allocate resources where they are most needed. Saving, on the other hand, is about setting aside money for future use, whether for emergencies, large purchases, or long-term goals.

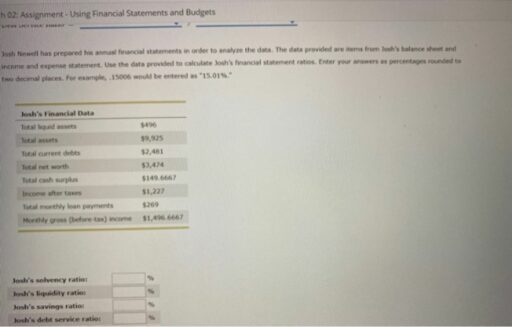

To begin with budgeting, one must first understand their income and expenses. A simple way to visualize this is through a table:

| Category | Income | Expenses |

|---|---|---|

| Salary | $X | |

| Groceries | $Y | |

| Utilities | $Z | |

| Savings | $S |

It’s crucial to prioritize savings by including it as a fixed category in your budget. This ensures that you are consistently building your financial safety net.

Once you have a clear picture of your financial situation, you can start setting goals and adjusting your spending habits accordingly. The NGPF offers a variety of resources, including the Budgeting Unit, to help individuals and educators teach and learn these essential skills. Their lesson plans, such as ‘Budgeting With Roommates’ for grades 9-12, are designed to provide practical experience in managing finances.

Mastering Credit and Debt Management

Mastering credit and debt management is crucial for maintaining financial health and achieving long-term goals. Understanding the intricacies of credit scores, interest rates, and loan terms is essential for making informed decisions that can save you money and prevent financial pitfalls.

- Know your credit score and what factors influence it.

- Learn the difference between various types of debt, such as secured vs. unsecured.

- Compare interest rates and fees before committing to a loan or credit card.

- Create a debt repayment plan that prioritizes high-interest debts.

Effective debt management is not just about paying off what you owe; it’s also about leveraging debt as a tool to build wealth and invest in your future.

The NGPF offers a Full-Year Course that includes comprehensive lessons on credit and debt, providing a solid foundation for students to handle their finances responsibly.

Investing Fundamentals and Wealth Building

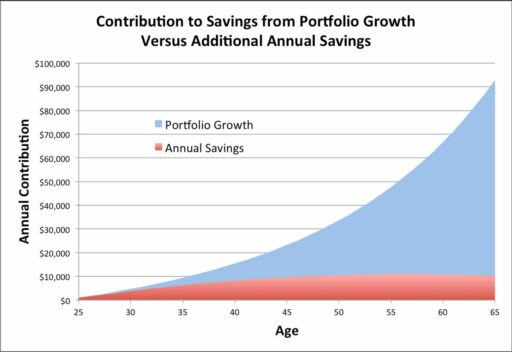

Building wealth is a marathon, not a sprint. It requires a clear understanding of various investment vehicles and strategies. Next Gen Personal Finance (NGPF) provides a comprehensive overview of investing fundamentals that are crucial for long-term financial success.

- Understanding the stock market and its indices

- Exploring bonds, mutual funds, and ETFs

- The role of retirement accounts in wealth accumulation

- Diversification and risk management strategies

It’s essential to start investing early and to stay consistent. Time in the market is more valuable than timing the market, as compound interest works best over long periods.

By mastering these concepts, individuals can create a robust financial plan that aligns with their goals and risk tolerance. The NGPF resources offer guidance on navigating the complexities of the financial markets, ensuring that users are well-equipped to make informed decisions.

Navigating the NGPF Resources

Accessing the NGPF Answers PDF

The NGPF Answers PDF is a comprehensive resource designed to complement the Next Gen Personal Finance curriculum. To access this valuable tool, follow these simple steps:

- Visit the official NGPF website.

- Navigate to the ‘Teacher Resources’ section.

- Locate the ‘Answer Keys’ link and click on it.

- Register or log in with your educator account to gain full access.

Once you have the PDF, you can easily reference the answers for various modules, including budgeting, credit, and investing. This ensures that educators can provide accurate guidance and support to students as they work through the NGPF coursework.

The NGPF Answers PDF not only serves as a quick reference for educators but also enhances the teaching and learning experience by offering clear explanations and solutions to the financial challenges presented in the curriculum.

Utilizing Interactive Tools and Simulations

NGPF’s suite of interactive tools and simulations is designed to provide a hands-on learning experience that complements the theoretical knowledge gained from the curriculum. These simulations offer a safe environment for students to practice real-world financial decision-making without the risk of actual financial consequences.

- Online Banking Simulation: A realistic platform that mimics the functionalities of online banking while ensuring student privacy.

- Being Underbanked: An exploration of the challenges faced by individuals with limited access to traditional financial services.

- The Challenges: Insightful simulations that address common financial hurdles, encouraging problem-solving and critical thinking.

By engaging with these interactive elements, students can better understand the complexities of personal finance and develop the confidence to apply these skills in their daily lives.

The NGPF resources are particularly effective because they are grounded in practical scenarios. Students are not just learning abstract concepts; they are applying them in contexts that mirror the situations they will encounter in the real world.

Leveraging Lesson Plans and Curriculum Guides

NGPF’s comprehensive lesson plans and curriculum guides are invaluable resources for educators aiming to impart financial literacy. These materials are meticulously crafted to align with educational standards and provide a structured approach to teaching personal finance. They cover a broad spectrum of topics, ensuring that students receive a well-rounded financial education.

- Lesson plans include detailed instructions, activities, and discussion points.

- Curriculum guides offer a roadmap for the course, highlighting key objectives and outcomes.

- Supplementary materials such as worksheets, quizzes, and projects complement the core content.

By integrating NGPF’s lesson plans and curriculum guides into their teaching, educators can create an engaging and informative experience that equips students with the necessary skills to navigate their financial futures confidently.

Real-Life Applications of NGPF Lessons

Case Studies: Success Stories from NGPF Users

The transformative power of financial literacy is vividly illustrated through the success stories of NGPF users. Real-life applications of budgeting, saving, and investing principles have led to remarkable outcomes for individuals and educators alike.

- John, a high school senior, managed to save $2,000 for college by following NGPF’s saving strategies.

- Emma, a teacher, incorporated NGPF’s curriculum into her classroom, resulting in a 30% increase in her students’ financial literacy test scores.

- The Smith family paid off $15,000 in debt by utilizing NGPF’s debt management resources.

The success stories underscore the importance of practical financial education and its impact on real-world financial decisions.

These case studies not only highlight the effectiveness of NGPF’s resources but also serve as a beacon of inspiration for others striving to achieve financial well-being. The journey to financial savvy begins with the right knowledge and tools, and NGPF has proven to be a pivotal resource in that journey.

Integrating NGPF Concepts into Daily Life

Incorporating the principles of Next Gen Personal Finance (NGPF) into everyday life can transform the way individuals manage their finances. Adopting a proactive approach to budgeting and saving is crucial for long-term financial stability. By setting clear financial goals and tracking expenses, one can gain better control over their economic future.

To effectively integrate NGPF concepts, consider the following steps:

- Review your monthly income and expenses to create a realistic budget.

- Set aside funds for emergency savings and future investments.

- Regularly monitor credit reports and understand the impact of debt on financial health.

- Educate yourself on investment options and start building a diversified portfolio.

Embracing these habits not only prepares one for unexpected financial challenges but also paves the way for wealth accumulation and financial independence. It’s about making informed decisions that align with personal financial goals and adapting as those goals evolve over time.

Integrating games and real-life experiences can make lessons more engaging, enhancing the progress in developing money skills. This hands-on approach ensures that the knowledge gained from NGPF is not just theoretical but also practical and applicable in various life scenarios.

Preparing for Major Financial Milestones

Financial milestones such as buying a home, saving for retirement, or funding a child’s education require careful planning and disciplined saving. Developing a strategic financial plan early on can make these goals more attainable. It’s important to prioritize your goals and understand the time frame for each.

- Identify your major financial milestones

- Estimate the cost for each milestone

- Create a savings plan

- Invest to grow your funds

- Monitor and adjust your plan as needed

By breaking down each goal into actionable steps, you can systematically approach your financial future with confidence. Regularly reviewing and adjusting your plan ensures that you stay on track, even when life throws unexpected challenges your way.

Mastering Money Management is not just about understanding the concepts; it’s about applying them to real-life situations. With the right tools and a solid plan, you can navigate through life’s financial milestones with greater ease and security.

Advancing Your Financial Knowledge with NGPF

Continuing Education: Webinars and Workshops

Next Gen Personal Finance (NGPF) offers a comprehensive suite of professional development opportunities designed to enhance financial literacy teaching skills. These include a variety of webinars and workshops that cater to educators at all levels of experience.

Educators can choose from a range of topics that align with their teaching goals and areas they wish to develop further. The sessions are interactive, providing practical insights and strategies that can be immediately applied in the classroom.

NGPF’s commitment to education is evident in their offering of free professional development courses. This ensures that all educators, regardless of budget constraints, have access to high-quality financial education resources.

To maximize the benefits of these educational opportunities, it’s recommended to plan a personalized professional development path. This can include a mix of live webinars, on-demand workshops, and collaborative sessions with peers.

Here is a snapshot of what NGPF offers:

- Live Webinars: Engage in real-time with experts.

- On-Demand Workshops: Learn at your own pace.

- Collaborative Sessions: Share experiences with fellow educators.

- Comprehensive Topics: Covering all aspects of financial literacy.

- Personalized Learning: Tailor your PD to meet your needs.

Joining the NGPF Community for Support and Networking

The Next Gen Personal Finance (NGPF) community is a vibrant ecosystem where individuals can engage with peers and experts to strengthen their financial knowledge. By joining this community, members gain access to a supportive network that can provide guidance, answer questions, and share experiences.

- Connect with fellow learners and educators through forums and discussion boards.

- Participate in local and online meetups to exchange ideas and best practices.

- Access mentorship opportunities from experienced financial educators.

Embracing the collective wisdom of the NGPF community can significantly enhance your journey toward financial savvy. It’s a place where collaboration meets innovation, ensuring that every member has the tools and support needed to navigate their financial path confidently.

Becoming an active participant in the NGPF community not only enriches your own understanding but also contributes to the growth and enrichment of others. It’s a reciprocal relationship where shared knowledge leads to collective empowerment.

Staying Updated with the Latest Financial Trends and Tools

In the ever-evolving world of finance, staying abreast of the latest trends and tools is crucial for maintaining financial savvy. Next Gen Personal Finance (NGPF) provides a wealth of resources to keep you informed and ahead of the curve.

- Subscribe to financial newsletters and blogs recommended by NGPF.

- Regularly check the NGPF website for new tools and updates.

- Participate in online forums and discussions to learn from peers.

By dedicating time each week to explore new financial tools and read up on emerging trends, you can ensure that your knowledge remains current and comprehensive. This proactive approach is essential in a landscape where financial technologies and regulations are constantly changing.

Teaching Financial Literacy with NGPF

Strategies for Educators to Implement NGPF

Educators looking to incorporate Next Gen Personal Finance (NGPF) into their curriculum can follow a strategic approach to maximize student engagement and learning outcomes. Begin by familiarizing yourself with the NGPF resources, including lesson plans, activities, and the comprehensive Answers PDF. This foundational step ensures that you can confidently navigate the materials and tailor them to your classroom needs.

- Start with the NGPF Teacher Toolkit to understand the scope of resources available.

- Integrate NGPF lessons with existing financial literacy curriculum to provide a seamless learning experience.

- Encourage interactive learning by utilizing NGPF’s simulations and games.

- Schedule regular assessments to track student progress and adapt teaching methods accordingly.

By methodically implementing NGPF resources, educators can create a dynamic classroom environment that fosters financial literacy and empowers students to master their money. It’s essential to keep the content relevant and engaging, adapting to different learning styles and financial backgrounds.

Assessment and Feedback: Measuring Student Progress

Assessment and feedback are critical components in the educational process, providing both educators and students with valuable insights into learning progress and areas for improvement. NGPF’s resources offer a variety of assessment tools to measure student understanding and engagement with financial literacy concepts.

- Pre- and post-tests to gauge knowledge acquisition

- Quizzes and tests aligned with lesson objectives

- Project-based assessments to evaluate practical application

By regularly utilizing these tools, educators can track student progress, tailor instruction to meet individual needs, and ensure that learning objectives are being met.

Furthermore, NGPF provides feedback mechanisms that encourage student reflection on their performance. This continuous loop of assessment and feedback helps to create a dynamic learning environment where students can thrive and become financially savvy individuals.

Customizing NGPF Resources for Diverse Classrooms

Next Gen Personal Finance (NGPF) offers a wealth of resources that can be tailored to meet the needs of diverse classrooms. Educators have the flexibility to modify lesson plans and activities, ensuring that every student can engage with the material in a way that resonates with their unique learning style.

- Identify the core financial concepts that align with your educational goals.

- Assess the varying levels of financial literacy among students.

- Choose from NGPF’s extensive library of activities to suit different learning preferences.

- Adapt the length and complexity of lessons to match student capabilities.

By customizing NGPF resources, teachers can create an inclusive learning environment that accommodates all students, regardless of their background or prior knowledge in personal finance.

The NGPF team supports this customization by providing a diverse menu of ready-to-use activities. These can be seamlessly integrated into existing curricula, making lessons memorable and impactful.

Conclusion

In conclusion, the journey to financial literacy is an ongoing process that requires dedication, education, and practical application. The NGPF’s Next Gen Personal Finance Answers PDF serves as a valuable resource for individuals seeking to enhance their financial savvy. By providing comprehensive answers and explanations to common financial questions, this guide empowers readers to make informed decisions, develop sound financial habits, and navigate the complexities of personal finance with confidence. Whether you’re a student, educator, or simply someone looking to improve your financial well-being, the insights offered by NGPF can pave the way to a more secure and prosperous financial future.

Frequently Asked Questions

What is Next Gen Personal Finance (NGPF)?

Next Gen Personal Finance is an organization that provides a comprehensive set of free educational resources designed to teach students critical personal finance skills. NGPF offers curriculum materials, interactive tools, and professional development for educators to enhance financial literacy education.

How can I access the NGPF Answers PDF?

NGPF Answers PDFs are typically available to educators who have registered for an account on the NGPF website. Once registered, teachers can access answer keys for quizzes, tests, and other resources by navigating to the specific resource page and downloading the PDFs.

What topics are covered in the NGPF curriculum?

The NGPF curriculum covers a wide range of personal finance topics, including budgeting, saving, credit, debt management, investing, taxes, financial decision-making, and more. It is designed to provide students with the knowledge and skills needed to manage their personal finances effectively.

Can students use NGPF resources directly?

Yes, students can directly use NGPF’s resources, such as interactive tools and simulations, which are designed to be engaging and educational. However, access to certain materials like answer keys is restricted to educators.

How can educators integrate NGPF resources into their teaching?

Educators can integrate NGPF resources into their teaching by utilizing the provided lesson plans, curriculum guides, and interactive activities. NGPF offers a flexible curriculum that can be customized to fit various class formats and lengths, and educators can select specific modules or lessons to fit their educational goals.

Does NGPF offer support for continuing education for teachers?

Yes, NGPF provides ongoing support for educators through professional development opportunities such as webinars, workshops, and a supportive community of fellow educators. These resources help teachers stay current with financial education trends and best practices.