Navigating the world of personal finance can be daunting, but with the right education, you can gain the knowledge and confidence needed to manage your money effectively. From understanding the basics of financial literacy to advanced topics like investing and retirement planning, personal finance classes offer invaluable insights. Whether you’re a student, an educator, or simply looking to improve your financial well-being, this guide will help you find the best personal finance classes near you and highlight the long-term benefits of financial education.

Key Takeaways

- Free online personal finance classes provide a convenient way to improve financial literacy without the need to register or incur costs.

- The trend towards mandatory in-school personal finance education is growing, with many states requiring or considering legislation for such programs.

- A one-semester personal finance course during high school can yield a lifetime financial benefit of approximately $100,000 per student.

- Virtual financial classes and events offer interactive learning experiences and the opportunity for organizations to request tailored financial literacy workshops.

- Comprehensive personal finance education covers a range of topics from basic budgeting and money management to complex issues like debt management and investing.

Understanding the Basics of Personal Finance Education

The Importance of Financial Literacy

Financial literacy is more than just being able to balance a checkbook or understanding your paycheck deductions. It’s about making informed and effective decisions regarding all aspects of personal finance, from budgeting to investing. Financial literacy lays the foundation for the future, enabling individuals to build wealth, become self-sufficient, and achieve financial stability.

Financial education is not just a luxury but a necessary skill in today’s economy. It empowers people to navigate the complexities of the financial world with confidence.

The benefits of financial literacy are clear and measurable. Studies have consistently shown a direct correlation between financial knowledge and financial well-being. For instance, those who have taken a personal finance course tend to have better credit scores and lower debt delinquency rates. Here’s a snapshot of the impact:

- Better average credit scores

- Lower rates of debt delinquency

- Positive correlation with asset accumulation

- Increased net worth by age 25

The value of personal finance education can be quantified, with reports suggesting a lifetime benefit of approximately $100,000 per student. This underscores the importance of integrating financial literacy into educational curriculums and making it accessible to all.

Key Concepts in Personal Finance

Understanding personal finance is essential for financial stability. Key topics include financial literacy, setting goals, credit management, debt navigation, and investing for the future. These foundational concepts are the building blocks for managing your financial life effectively.

- Financial Literacy: Comprehending financial principles and applying them to make sound decisions.

- Setting Goals: Establishing clear, achievable financial objectives.

- Credit Management: Understanding and utilizing credit responsibly.

- Debt Navigation: Managing and repaying borrowed funds wisely.

- Investing: Allocating resources to grow wealth over time.

Mastery of these key concepts paves the way for a secure financial future and empowers individuals to take control of their economic destiny.

Free Online Resources and Courses

In the digital age, the quest for financial education can be as simple as a click away. Free online personal finance courses are readily available and can be accessed at any time, providing flexibility for those with busy schedules. These courses cover a range of topics, from budgeting to debt management, and are designed to cater to various learning styles.

Many organizations, such as Credit.org, offer these educational resources without the need for registration, emphasizing their commitment to financial literacy for all. Their courses are not only free but also comprehensive, ensuring that you can gain a solid understanding of personal finance without financial strain.

The availability of free online courses marks a significant step towards inclusive financial education, allowing anyone with internet access to improve their financial well-being.

For those looking to expand their knowledge further, virtual financial classes and events provide an interactive experience. Participants can engage with experts in real-time, asking questions and receiving personalized advice. This hands-on approach to learning can be particularly effective for complex topics like credit management and homeownership.

Evaluating Personal Finance Classes and Their Benefits

Criteria for Selecting the Right Class

Choosing the right personal finance class can be a pivotal decision in your financial education journey. Look for classes that align with your financial goals and learning style. Consider the credentials of the institution or the instructor offering the class. For example, certifications like the AFC (Accredited Financial Counselor) from the AFCPE (Association for Financial Counseling & Planning Education) are indicative of a high standard of financial education.

When evaluating potential classes, it’s also important to assess the curriculum’s relevance to your personal situation. Here’s a quick checklist to help you make an informed decision:

- Does the class cover the topics you’re interested in?

- Is the class tailored to your current financial knowledge level?

- What is the class format (in-person, virtual, self-paced)?

- Are there any success stories or testimonials from past students?

- What is the cost, and is it within your budget?

Remember, the best class is one that not only provides comprehensive knowledge but also empowers you to take practical steps towards improving your financial well-being.

The Long-Term Value of Financial Education

The long-term benefits of personal finance education are both measurable and significant. Financial literacy is closely linked to financial well-being, with studies indicating a lifetime benefit of around $100,000 per student who takes a personal finance course in high school. This value is not just in monetary terms but also in the practical life skills acquired.

- Better credit scores

- Lower debt delinquency rates

- Preferential borrowing rates

These are just a few of the tangible outcomes of a solid financial education. Moreover, the knowledge gained from understanding how to manage debt, budget effectively, and make informed financial decisions can lead to a ripple effect of positive financial behaviors throughout one’s life.

The mastery of personal finance skills empowers individuals to navigate the complexities of the financial world with confidence and foresight. It’s an investment in one’s future that pays dividends in the form of financial security and freedom.

Success Stories: Real-Life Impact

The transformative power of personal finance education is best illustrated through the success stories of those who have benefited from it. Real-life testimonials highlight the profound effect that financial literacy can have on an individual’s life.

-

AUDIENCE MEMBER, THE OTHER SIDE ACADEMY: "My quality of life has improved with the help and financial assistance of the financial education team. I will forever be indebted to the wonderful organization that has given me financial independence."

-

WELLNESS COORDINATOR, SALT LAKE COUNTY EMPLOYEE WELLNESS: "We have worked with the team for several years. Every time we work together, they are quick to respond, provide excellent customer service and have useful materials and resources. The team’s genuine passion shines through."

The ripple effect of financial education extends beyond individuals to families and communities, creating an incredible economic engine.

The data speaks volumes about the community impact of these programs:

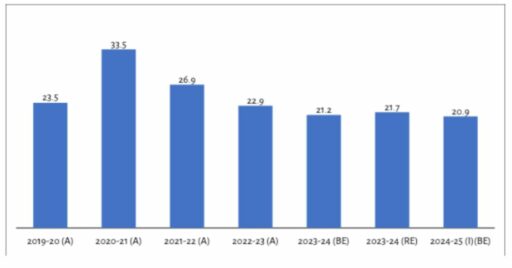

| Year | Individuals Reached | Organizations Supported |

|---|---|---|

| 2019 | 12,000+ | 200+ |

These figures underscore the importance of accessible financial education and its capacity to empower people to take control of their financial futures.

Navigating In-School Personal Finance Programs

State Requirements for Financial Education

The landscape of financial education in schools is rapidly evolving. As of 2024, a significant milestone has been reached, with half of all states mandating personal finance courses for high school graduation. This movement underscores the growing recognition of financial literacy as a critical life skill.

The commitment to financial education is further evidenced by the numerous legislative efforts underway. Currently, there are 35 personal finance education bills pending across 15 states, signaling a potential increase in the number of states with such requirements.

The integration of personal finance into high school curriculums is not just about meeting graduation requirements; it’s about equipping students with the knowledge to make informed financial decisions that can shape their future.

The impact of these educational initiatives is tangible. Students who complete personal finance courses are more likely to attend college, armed with the understanding of financial resources available to them. Moreover, they exhibit healthier financial behaviors, such as higher credit scores and lower debt delinquency rates, as they transition into adulthood.

Integrating Personal Finance into School Curriculums

The movement to integrate personal finance education into school curriculums is gaining significant momentum. As of 2024, half of all states mandate or are in the process of mandating personal finance courses for high school graduation. This trend is supported by a growing body of research that underscores the profound impact of financial literacy on students’ futures.

Educators like Kerri Herrild have witnessed the ‘trickle up effect’ firsthand, where students not only learn to manage savings and checking accounts but also impart this knowledge to their families. The curriculum often includes foundational topics such as income generation, budgeting with the 50-30-20 rule, savings, investing, and retirement planning.

The value of a personal finance education is immense, with studies indicating a lifetime benefit of approximately $100,000 per student. This underscores the importance of advocating for financial literacy in schools, a mission that is gaining traction through initiatives like #Mission2030.

The table below outlines the current state of personal finance education legislation:

| State | Requirement Status | Bills Pending |

|---|---|---|

| Total | 25 States | 35 Bills |

The push for financial education in schools is not just about teaching money management—it’s about setting up our youth for long-term success in managing debt, improving credit scores, and increasing retirement savings.

Resources for Educators and Students

Educators and students have a wealth of resources at their fingertips to enhance their understanding of personal finance. Online courses, often free and accessible 24/7, provide a flexible learning environment for those looking to expand their financial education. These courses cover a range of topics, from budgeting and debt solutions to credit score education.

In addition to online courses, interactive presentations such as ‘The Game of Money’ and ‘Tax Basics’ offer practical, real-life scenarios for students to engage with financial concepts. These sessions can fast forward students into the future, allowing them to see the cumulative effect of their financial decisions.

Additional resources, including books, websites, and videos, are also recommended for a comprehensive understanding of personal finance. These materials can provide valuable insights and guidance for individuals at any stage of their financial journey.

Here is a list of resources that can be particularly useful for educators and students:

- Credit.org’s free online personal finance classes

- Interactive sessions like ‘The Game of Money’ and ‘Tax Basics’

- Comprehensive video guides on financial literacy

- Tools for policy advocacy and financial literacy initiatives

Advanced Personal Finance Topics for Continued Learning

Investing and Retirement Planning

Understanding the landscape of investing and retirement planning is crucial for securing your financial future. Navigating the myriad of investment options and retirement accounts can be daunting, but with the right knowledge, you can make informed decisions that will benefit you in the long run.

- Equity and brokerage accounts

- 529 college savings plans

- Retirement planning with 401(k)s and IRAs

- Investment strategies and account reviews

It’s essential to start planning early and to review and adjust your investment portfolio regularly to align with your changing financial goals and market conditions.

Investing calculators and tools, such as retirement and Roth IRA calculators, can help you project your financial trajectory and refine your savings strategy. By taking advantage of these resources, you can better prepare for retirement and ensure that your investments are working effectively towards your dreams.

Managing Debt and Improving Credit

Understanding how to manage debt and improve credit is crucial for financial stability and freedom. The cornerstone of managing debt is to prioritize your spending and tackle debts strategically. Methods such as the debt snowball or avalanche technique can be effective in paying off debt efficiently.

- Credit card basics

- Applying for a credit card

- Choosing a credit card

- Managing credit card debt

- Credit card resources

Working with a credit coach or utilizing credit building services can provide personalized advice tailored to your financial situation. These services often help you monitor and improve your credit score, guiding you towards a debt-free life.

To truly break free from debt, it’s essential to understand the components of your credit score and your rights as a consumer. Staying informed and vigilant against common scams is also key to protecting your financial health.

Financial growth involves setting future goals like homeownership or retirement planning. Investing in your financial education now can lead to significant long-term benefits, including the ability to manage and eliminate debt.

Real Estate and Homeownership Education

Understanding the intricacies of real estate and homeownership is crucial for anyone looking to invest in property or secure their own home. Homebuyer education courses are designed to empower individuals with the knowledge to make informed decisions. These courses typically cover topics such as determining if homeownership is right for you, shopping for a home, and maintaining your property.

The journey to homeownership is complex and requires a solid grasp of various financial aspects, including credit building and understanding your credit report.

For those seeking to deepen their knowledge, resources are available that delve into managing a mortgage, refinancing, home improvement, and navigating home insurance. The table below outlines key areas of focus in homeownership education:

| Homeownership Topic | Description |

|---|---|

| Homebuyer Course | Learn the basics of purchasing and maintaining a home. |

| Credit Education | Understand and improve your credit score for better loan terms. |

| Mortgage Management | Manage and possibly refinance your mortgage to save money. |

| Home Insurance | Navigate the complexities of insuring your property. |

It’s also important to stay updated with the latest trends and challenges in the market. A website that covers personal finance, real estate, and wealth management can be a valuable resource for ongoing education.

Interactive Learning: Virtual Classes and Financial Events

Upcoming Virtual Workshops and Webinars

In the digital age, staying informed and educated about personal finance has never been easier. Virtual workshops and webinars are an excellent way to engage with financial experts and gain insights into managing your finances effectively. These events cater to a variety of topics, from homebuyer education to identity theft prevention, and are often free or at a minimal cost.

Engaging with these virtual events not only provides valuable information but also offers the convenience of learning from the comfort of your own home.

To ensure you don’t miss out on these opportunities, here’s a list of upcoming virtual events:

- Homebuyer Education Course: Learn the ins and outs of homeownership.

- Identity Theft Prevention: Protect yourself from fraud and theft.

- Financial Wellness Workshops: Enhance your workplace financial wellness program.

For those looking to host a workshop, many organizations offer customizable sessions that can be tailored to your group’s needs. Remember to reserve your spot or request a workshop well in advance, as these events are in high demand. To sign up or request a virtual class for your organization, simply fill out the provided contact form or download the necessary request documents from the respective service provider’s website.

How to Participate in Live Financial Classes

Participating in live financial classes can be a transformative experience, offering real-time interaction and personalized answers to your questions. To ensure a seamless experience, it’s important to follow a few simple steps.

- First, research and select a live class that aligns with your financial goals and interests.

- Register for the class ahead of time, as spots may be limited.

- Ensure you have a stable internet connection and the necessary technical setup.

- Join the class promptly and engage actively by asking questions and participating in discussions.

Remember, the more you engage with the class material and instructors, the more you’ll gain from the experience.

Many organizations offer virtual financial literacy classes that can be requested for groups or workplaces. To request a virtual workshop or webinar, typically you would need to download and submit a request form. Pricing and availability may vary, so it’s advisable to plan in advance and consider the specific needs of your audience.

Requesting a Virtual Financial Literacy Class for Your Organization

Organizations seeking to enhance their members’ financial acumen can greatly benefit from hosting a virtual financial literacy class. Requesting a virtual workshop or webinar is a straightforward process that begins with downloading the necessary request form and pricing matrix. This initial step is crucial for tailoring the experience to your organization’s specific needs.

To ensure a successful event, consider the following steps:

- Identify the financial topics most relevant to your group.

- Estimate the number of attendees to accommodate everyone comfortably.

- Choose a suitable date and time that maximizes participation.

- Review and understand the pricing structure to align with your budget.

By proactively addressing the financial education needs of your organization, you can foster a culture of informed decision-making and long-term financial wellness.

Remember, these classes are not only informative but also interactive, allowing participants to engage with experts and ask questions in real time. The value of such an educational opportunity cannot be overstated, as it equips individuals with the knowledge to make sound financial decisions.

Conclusion

In conclusion, the journey to financial literacy is both essential and accessible. With a wealth of resources available, from free online courses offered by organizations like Credit.org to in-school personal finance classes mandated in many states, there is no shortage of opportunities to enhance your financial education. The benefits of such education are clear, with studies indicating a potential lifetime financial advantage of around $100,000. Whether you’re a high school student, a college attendee, or an adult seeking to improve your financial well-being, taking the time to learn about personal finance can be a transformative investment in your future. Remember, the best personal finance class is the one that resonates with you and empowers you to take control of your financial destiny.

Frequently Asked Questions

Are there any free personal finance classes available?

Yes, there are many free personal finance classes available online. Organizations like Credit.org offer online courses that are open to the public without any need to register, and they are accessible 24/7.

Is personal finance education becoming mandatory in schools?

As of 2024, half of all states in the U.S. require or are in the process of requiring high school students to take a personal finance course before graduating. Additionally, there are numerous bills pending in various states to further integrate personal finance education into school curriculums.

What financial topics are covered in a basic personal finance guide?

A basic personal finance guide typically covers topics such as income generation, managing a checking account, budgeting with the 50-30-20 rule, savings, investing, and retirement planning. It also provides practical tips for financial success.

What is the estimated value of a personal finance education?

Studies have shown that there is a strong connection between financial literacy and financial well-being, with a reported lifetime benefit of roughly $100,000 per student from taking a one-semester course in personal finance during high school.

Can I participate in virtual financial classes and events?

Yes, there are virtual financial classes and events available where you can interact and ask questions in a live chat. Organizations often offer the option to request a virtual financial literacy class for your organization.

What are some additional resources for personal finance education?

Additional resources for personal finance education include books, websites, and videos that offer insights and guidance on managing finances. These resources are suitable for individuals of all ages looking to improve their financial knowledge.