Corporate finance is an essential aspect of any business, focusing on managing a company’s finances to ensure growth, stability, and shareholder value. It encompasses a broad range of activities including capital investment decisions, funding strategies, financial analysis, working capital management, and understanding the implications of various financial decisions on a company’s strategy and operations. For those new to the field, grasping the fundamentals of corporate finance is crucial for making informed decisions and contributing to a company’s success.

Key Takeaways

- Corporate finance is integral to a company’s success, involving financing, capital structure, and money management to maximize shareholder value.

- The field encompasses three main areas: capital budgeting, capital financing, and working capital management, each vital for strategic financial planning.

- Understanding different funding strategies, such as equity and debt financing, is crucial for a company’s capital management and long-term growth.

- Financial analysis, including net interest rate spread and profit analysis, is key to making informed investment decisions and assessing risks.

- Career opportunities in corporate finance are diverse and can offer attractive salaries, with roles requiring a mix of qualifications and skills.

The Essence of Corporate Finance

Defining Corporate Finance

Corporate finance is the backbone of a company’s financial health, focusing on the strategic allocation of financial resources. It is essential for maximizing profits and ensuring long-term sustainability. Corporate finance encompasses a range of activities, from capital budgeting and financing to working capital management and dividend decisions.

- Capital Budgeting: Evaluating and selecting long-term investments.

- Capital Financing: Determining the best mix of debt, equity, and internal funds for financing operations.

- Working Capital Management: Handling day-to-day financial operations and managing the company’s short-term assets and liabilities.

Corporate finance is integral to a company’s ability to thrive in a competitive market, ensuring that financial decisions are aligned with strategic business goals.

Understanding the nuances of corporate finance is crucial for anyone looking to unlock financial success in the business world. Whether it’s through financial analysis, investment strategies, or career preparation, grasping the fundamentals can pave the way for informed decision-making and strategic planning.

Key Objectives and Responsibilities

The core objectives of corporate finance revolve around optimizing a company’s financial performance and increasing shareholder value. Effective capital management is central to these goals, ensuring that resources are allocated efficiently and that investments yield profitable returns.

Key responsibilities in corporate finance include:

- Capital budgeting: Evaluating and selecting long-term investment opportunities.

- Financing decisions: Determining the best mix of debt, equity, and internal funds for financing operations.

- Liquidity management: Maintaining the necessary level of liquidity to meet short-term obligations and fund ongoing operations.

Corporate finance professionals must balance the pursuit of profitability with the management of risks, making strategic decisions that align with the company’s overall business objectives.

Understanding and managing the financial risks associated with various business activities is also a critical responsibility. This includes assessing market conditions, forecasting financial outcomes, and developing strategies to mitigate potential financial losses.

The Role of Corporate Finance in Business Strategy

Corporate finance plays a pivotal role in shaping business strategy, as it provides the financial backbone for any corporate decision-making process. The strategic allocation of financial resources supports a company’s long-term goals and immediate operational needs. This involves a careful analysis of potential investments, the management of risks, and the pursuit of sustainable growth.

Corporate finance teams work closely with management to develop strategies that align with the company’s financial capabilities and market position. They are responsible for:

- Identifying and securing sources of capital

- Balancing risk and profitability

- Managing mergers, acquisitions, and divestitures

- Forecasting future financial performance

In essence, corporate finance ensures that financial strategies are not only feasible but also optimized to enhance shareholder value. It is a critical component in the execution of business strategies, from expanding market reach to innovating product lines.

Ultimately, the success of business strategies heavily relies on the financial health and strategic financial planning provided by corporate finance. It is the cornerstone that supports a company’s ambitions and navigates through the complexities of market dynamics and economic fluctuations.

Capital Management and Funding Strategies

Capital Budgeting Techniques

Capital budgeting stands at the core of corporate finance, determining the future direction and performance of an organization. It involves evaluating potential investment opportunities and deciding which projects to undertake based on their potential return on investment. This process requires a thorough analysis of expected cash flows and the assessment of the risk associated with each project.

Capital budgeting is a critical financial tool that helps companies plan for the future and allocate resources effectively. It ensures that the capital invested is directed towards the most beneficial projects, aligning with the company’s strategic objectives.

The following table outlines the common methods used in capital budgeting:

| Method | Description |

|---|---|

| Net Present Value (NPV) | Calculates the value of projected cash flows relative to the initial investment. |

| Internal Rate of Return (IRR) | Estimates the profitability of potential investments. |

| Payback Period | Determines the time required to recoup the initial investment. |

| Profitability Index | Compares the present value of future cash flows to the initial investment. |

Each method has its own merits and is used based on the specific context of the investment decision. For instance, NPV is highly regarded for its focus on value creation, while the payback period is often favored for its simplicity in assessing the liquidity aspect of a project.

Equity Financing vs. Debt Financing

When businesses consider raising capital, they are faced with a critical choice: should they opt for debt financing or equity financing? Debt financing involves borrowing funds that must be repaid over time with interest, while equity financing entails exchanging a portion of ownership in the company for capital.

- Debt Financing: Capital you repay over set terms with interest.

- Equity Financing: Exchange of capital for partial ownership.

The decision between debt and equity financing affects a company’s balance sheet and future financial flexibility. Companies must weigh the cost of capital against the potential for growth and the expectations of shareholders and creditors.

Equity represents not just the funds invested by owners but also the cumulative value of a business’s assets minus its liabilities. A strong equity position can signal financial health and attract further investment.

Ultimately, the choice hinges on the strategic goals of the business, the cost of capital, and the desire to maintain control. Each option carries its own set of implications for short-term liquidity, long-term obligations, and the overall financial structure of the company.

Venture Debt and Alternative Funding Options

Venture debt is a form of debt financing provided to startups and growth companies that may not yet be profitable or have sufficient cash flow to secure traditional bank loans. It offers a middle ground between equity financing and conventional debt, allowing businesses to leverage their potential without diluting ownership. Venture debt typically comes with warrants or options, giving lenders the right to purchase equity at a later date.

Alternative funding options have emerged as vital instruments for companies seeking flexibility in their capital structure. These include crowdfunding, peer-to-peer lending, and revenue-based financing, each with its unique advantages and considerations. For instance, crowdfunding can validate a product in the market, while peer-to-peer lending bypasses traditional financial institutions.

The strategic use of alternative funding can propel a company’s growth trajectory by aligning financing with business milestones and reducing reliance on equity dilution.

Understanding the nuances of each funding option is crucial for entrepreneurs and finance professionals. Here’s a quick comparison of venture debt and two common alternative funding methods:

| Funding Type | Typical Use Case | Advantages | Risks |

|---|---|---|---|

| Venture Debt | Growth capital for startups | Less dilution, retains control | Higher interest rates |

| Crowdfunding | Product launch, market validation | Community engagement, pre-sales | Public exposure, success not guaranteed |

| Peer-to-Peer Lending | Small business loans | Quick access to funds, no collateral | Variable interest rates, credit risk |

Financial Analysis and Decision Making

Understanding Net Interest Rate Spread

The net interest rate spread is a critical metric for financial institutions, representing the difference between the interest income generated by banks or other financial entities and the amount of interest paid out to their lenders. It is a key determinant of a bank’s profitability.

The net interest rate spread is essential for profit analysis as it directly impacts the earnings from the core business activities of lending and borrowing.

Understanding this spread can provide insights into the financial health and operational efficiency of a bank. For example, a wider spread typically indicates a higher net income from interest-earning activities. Conversely, a narrow spread could signal competitive pressures or lower interest rates affecting the bank’s earnings.

Here’s a simple breakdown of how the net interest rate spread can affect a bank’s financial statements:

- Interest Income: Money earned from loans and investments.

- Interest Expense: The cost paid on deposits and borrowed funds.

- Net Interest Income: The difference between interest income and interest expense.

Profit Analysis and Financial Metrics

Understanding the financial health of a business is crucial for making informed decisions. Profit analysis and financial metrics provide a comprehensive view of a company’s performance. These tools help stakeholders determine the viability and profitability of a business over time.

To effectively analyze profit, one must consider various financial statements and performance metrics. The income statement, for instance, is essential as it details the company’s profitability by showing the revenue earned and expenses incurred over a specific period. Similarly, the balance sheet provides insights into the company’s assets and liabilities, offering a snapshot of its financial standing at a given point in time.

Financial metrics such as net profit, which is the difference between income, cost of goods sold (COGS), and expenses, are pivotal in assessing a company’s success. These figures not only influence tax planning but also guide strategic financial decisions. It’s important to explore multiple ways to assess business performance in order to guide financial strategy.

Here is a simple table summarizing key financial metrics:

| Metric | Description |

|---|---|

| Revenue | Total income from sales before expenses |

| COGS | Cost of goods sold; direct costs attributable to production |

| Net Profit | Revenue minus COGS and expenses |

| Tax Liability | Taxes owed based on net profit |

Proactive financial planning and analysis are indispensable for maintaining a healthy business. Regularly reviewing these metrics can lead to better strategic decisions and improved financial outcomes.

Investment Appraisal and Risk Assessment

Investment appraisal is a critical component of corporate finance, involving the evaluation of potential investments to determine their viability and alignment with a company’s strategic goals. Risk assessment is equally important, as it helps identify and mitigate potential losses associated with investment choices.

Investment decisions should be made with a thorough understanding of both the potential returns and the risks involved.

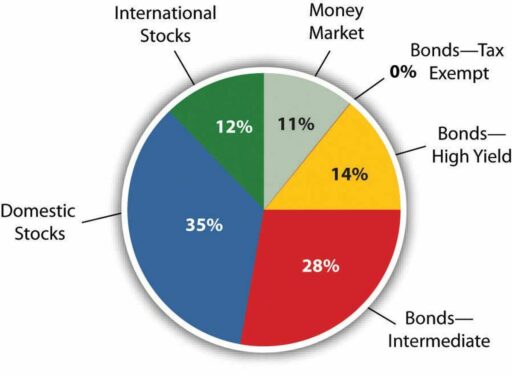

Understanding the different types of investments and their associated risks is essential. For example, stocks can offer high returns but come with market volatility, while bonds provide more stable income but may offer lower returns. Diversifying investments is a key strategy to spread risk.

Here is a simple breakdown of common investment vehicles:

- Stocks: Equity investments that offer a share in a company’s profits.

- Bonds: Debt investments that provide regular interest payments.

- Real Estate: Tangible property that can appreciate over time.

- Mutual Funds: Pooled investments managed by professionals.

Assessing the creditworthiness of an investment is also crucial, as indicated by factors like the credit score. A higher score suggests a lower risk of default, which is an important consideration for debt financing.

Working Capital and Cash Flow Management

Optimizing Day-to-Day Operations

Effective management of day-to-day financial operations is crucial for the smooth functioning of any business. Limiting accounting to material transactions can streamline processes, ensuring that only significant financial information is recorded and reported. This approach not only saves time but also keeps stakeholders informed without overwhelming them with minutiae.

Regular reviews of financial methods are essential to maintain accuracy and prevent issues from escalating. Businesses typically benefit from auditing their processes monthly, quarterly, and annually. Such a disciplined schedule ensures that all financial activities are accounted for and that the company’s financial health is consistently monitored.

Time management is a key factor in the realm of finance. Whether it’s meeting internal deadlines or preparing for audits, the ability to manage time effectively can make a significant difference in the efficiency of financial operations.

Incorporating automation tools can further optimize accounting tasks. By reducing the time spent on data entry, these tools allow finance teams to focus more on data analysis, which is pivotal for making informed decisions that drive business improvement.

Maintaining Liquidity and Solvency

Ensuring that a company can meet its short-term obligations is crucial for maintaining operational continuity. Liquidity management involves having sufficient current assets that can be quickly converted into cash to cover immediate liabilities. This balance is vital to avoid disruptions in a company’s operations and to uphold the confidence of investors and creditors.

In practice, maintaining liquidity might mean securing additional credit lines or issuing commercial paper as a form of liquidity backup. These actions help safeguard against liquidity risk, which is the danger of not being able to sell assets quickly enough to meet debt obligations.

Capital financing decisions play a significant role in liquidity and solvency. Striking the right balance between debt and equity is essential to minimize the risk of default while avoiding the dilution of earnings for shareholders.

It’s also important for businesses to prepare for uncertainties. While relying on ongoing projects and expected income is common, companies should not solely depend on anticipated profits but should also be ready for potential losses. Accurate and timely financial records are the cornerstone of effective liquidity management.

Dividend Policy Decisions

Dividend policy decisions are a critical aspect of corporate finance, impacting both the company’s financial health and shareholder satisfaction. Determining the right balance between reinvesting profits and distributing dividends is a complex task that requires careful consideration of various factors, including the company’s growth prospects, current financial performance, and shareholder expectations.

- Residual Dividend Model: This approach suggests that dividends should be paid out from the residual or leftover earnings after all suitable investment opportunities have been funded.

- Stable Dividend Policy: Companies may opt for a consistent dividend payout, which can provide a sense of reliability to shareholders, even if earnings fluctuate.

- Hybrid Approach: Some firms combine elements of both, adjusting dividends according to profitability while maintaining a base dividend level.

A well-crafted dividend policy not only addresses the return expectations of shareholders but also reflects the company’s strategic financial planning and commitment to fiscal responsibility. It is essential to align dividend decisions with the overall business strategy to ensure long-term value creation.

Careers in Corporate Finance

Exploring Various Corporate Finance Roles

The landscape of corporate finance is diverse, offering a range of roles that cater to different skills and interests. Positions in corporate finance are highly sought after, often attracting a large pool of candidates due to the attractive salaries and the pivotal role these positions play in a company’s success.

- Chief Financial Officer (CFO)

- Financial Planning and Analysis Manager

- Controller

- Auditor

- Investor Relations

- Financial Analyst

- Treasurer

- Corporate Accountant

Each role carries its own set of responsibilities and requires a unique blend of skills. For instance, a CFO is responsible for the overall financial strategy of a company, while a financial analyst might focus on data analysis to inform investment decisions.

Corporate finance careers span a spectrum of opportunities, from overseeing large financial operations to conducting detailed financial analyses. The right role for an individual will depend on their qualifications, experience, and career aspirations.

Qualifications and Skills Required

To excel in corporate finance, professionals must possess a blend of formal education and practical skills. A strong foundation in accounting, economics, and finance is essential, as is the ability to apply this knowledge to real-world scenarios.

Professionals should have:

- Strong analytical and quantitative skills

- Proficiency in financial modeling and data analysis

- Knowledge of tax codes, financial regulations, and best practices

- Excellent communication and interpersonal abilities

- Deductive reasoning and critical thinking

The ability to organize information efficiently and maintain secure data storage systems is crucial for managing sensitive financial data.

In addition to these skills, a keen sense of curiosity and the capacity for strategic thinking will serve finance professionals well as they navigate the complexities of corporate finance.

Salary Expectations and Career Progression

Embarking on a career in corporate finance offers a range of salary expectations, depending on the role and experience level. The typical salary range for a senior analyst in the US is $65,000-$125,000, with an average of $90,430. This reflects the competitive nature of the field and the value placed on strategic financial roles.

Salaries across various corporate finance positions, as reported by Indeed, are as follows:

| Position | Average Annual Salary (USD) |

|---|---|

| Chief Financial Officer | $133,898 |

| Financial Planning and Analysis Manager | $113,770 |

| Cost Analyst | $83,304 |

| Financial Analyst | $71,556 |

| Treasurer | $80,428 |

| Corporate Accountant | $66,515 |

Career progression in corporate finance often involves moving through these roles, gaining experience, and taking on more responsibility. The journey from an entry-level position to a CFO requires dedication, strategic career planning, and continuous learning.

Career advancement in this sector is not just about climbing the corporate ladder; it’s about acquiring the skills and experience that enable you to contribute significantly to an organization’s financial health.

Conclusion

In summary, corporate finance is the backbone of a company’s financial health, encompassing a wide range of activities from capital budgeting and financing to working capital management. It is essential for maximizing returns and shareholder value, ensuring liquidity, and managing day-to-day operations efficiently. Whether you’re a beginner looking to understand the basics or an aspiring professional aiming for a lucrative career, grasping the fundamentals of corporate finance is a critical step. By leveraging resources such as beginner’s guides, expert books, and educational courses, anyone can build a solid foundation in corporate finance and contribute to the strategic financial decisions that drive business success.

Frequently Asked Questions

What is corporate finance and why is it important?

Corporate finance deals with financing, capital structure, and money management to help maximize returns and shareholder value. It is important because it involves making the critical financial decisions that drive a company’s strategic direction and financial health.

What are the main areas of corporate finance?

The main areas of corporate finance are capital budgeting (prioritizing funds towards profitable projects), capital financing (determining how investments will be financed), and working capital management (managing day-to-day cash flow and maintaining liquidity).

How does corporate finance fit into overall business strategy?

Corporate finance is integral to business strategy as it provides the financial framework for strategic decisions, ensuring that a company has the necessary funds to pursue opportunities and manage risks effectively.

What is the difference between equity financing and debt financing?

Equity financing involves raising capital by selling shares of the company, while debt financing involves borrowing funds that must be repaid over time, typically with interest. Each has its own advantages and implications for a company’s financial structure.

What are some career options in corporate finance?

Careers in corporate finance include roles such as financial analyst, corporate finance manager, treasurer, and chief financial officer (CFO). These positions involve financial planning, analysis, and decision-making to support a company’s objectives.

How do corporate finance professionals make investment decisions?

Corporate finance professionals use financial analysis, metrics, and risk assessment tools to evaluate potential investments. This includes analyzing profitability, cash flow projections, and the potential return on investment to make informed decisions.