In an ever-evolving financial landscape, arming oneself with knowledge is key to prosperity. Personal finance books are treasure troves of wisdom, offering strategies to manage, invest, and grow your wealth. This article highlights top personal finance books that promise to transform your financial future, providing a roadmap to financial literacy and independence. Whether you’re a seasoned investor or taking your first steps towards financial planning, these books are essential reads to navigate the complexities of money management and secure a prosperous tomorrow.

Key Takeaways

- The selected books provide comprehensive guides on mastering money management, investing, and the psychology of personal finance.

- They offer actionable advice and strategies to overcome debt, create emergency funds, and build a solid financial foundation.

- Insights on various investment vehicles, including the stock market and real estate, are covered to help accumulate wealth.

- Behavioral finance is addressed, teaching readers to overcome psychological barriers and cultivate a successful financial mindset.

- The books cater to readers of all ages, ensuring financial literacy is accessible and imparted from childhood to pre-retirement.

Mastering Money Management

Budgeting for a Brighter Tomorrow

Embarking on the journey of financial well-being begins with mastering the art of budgeting. Understanding where your money goes each month is vital; it’s the foundation upon which all other financial planning is built. ‘Broke Millennial’ offers a straightforward approach to budgeting basics, teaching you to track your expenses, make smart spending decisions, and set achievable financial goals.

Creating a budget is more than just tracking dollars and cents; it’s about aligning your spending with your values and priorities. Here’s a simple list to get started:

- Identify your income sources

- List your monthly expenses

- Categorize your spending

- Set realistic financial goals

- Monitor and adjust as needed

With a solid budget in place, you can confidently navigate future financial decisions while avoiding repeating past mistakes – ultimately transforming their relationship with money for years.

Remember, budgeting is not a one-time event but a continuous process. As ‘Broke Millennial’ emphasizes, it’s about making your money work for you, not the other way around. Start small, stay consistent, and watch your financial future brighten with every smart decision you make.

Debt Defeat Strategies

Conquering debt is a pivotal step towards financial freedom. Prioritizing payments and negotiating with creditors are just the beginning. By understanding the ‘snowball approach,’ you can tackle debts from smallest to largest, creating a sense of achievement and maintaining motivation.

Debt can often feel overwhelming, but with a structured plan and consistent effort, it becomes manageable and eventually, conquerable.

Here’s a simple plan to start your journey out of debt:

- List all debts from smallest to largest.

- Focus on paying off the smallest debt first while making minimum payments on others.

- Once the smallest debt is paid off, move to the next one, rolling over the previous payments.

- Repeat this process until all debts are cleared.

Remember, not all debt is bad, but distinguishing between constructive and destructive debt is crucial. This strategy not only helps in clearing debt but also in building a solid financial foundation for the future.

Creating and Maintaining an Emergency Fund

An emergency fund is not just a financial buffer, but the cornerstone of your financial tranquility. It’s the safety net that catches you during life’s unforeseen events, from medical emergencies to sudden job loss. Starting with a modest goal and gradually increasing your savings to cover several months of expenses is a practical approach to building this fund.

- Determine your monthly living expenses

- Set a realistic initial savings goal

- Gradually increase your goal to cover 3-6 months of expenses

- Regularly contribute to your emergency fund

- Keep the fund in an easily accessible, high-yield savings account

Building an emergency fund should be a top priority. It’s about creating a buffer that ensures you’re not derailed by life’s unexpected turns. Consistency is key; even small, regular contributions can grow into a substantial safety net over time. Remember, it’s not about the amount you start with, but the habit of saving that counts.

Investing Insights for Wealth Accumulation

Understanding the Stock Market

The stock market can be a powerful engine for wealth creation, but it requires knowledge and strategy to navigate effectively. Understanding the intricacies of the market is crucial for any investor looking to build a robust portfolio.

For those seeking guidance, several books stand out for their ability to demystify the stock market. ‘The Little Book of Common Sense Investing’ introduces the concept of index fund investing, highlighting the importance of a long-term approach over attempting to pick individual winners. Similarly, ‘A Random Walk Down Wall Street’ provides timeless advice for building a solid investment foundation, now updated with contemporary insights such as factor investing and the implications of automated advisers.

- ‘The Big Short: Inside the Doomsday Machine’ by Michael Lewis

- ‘Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies’ by Jeremy Siegel

- ‘The Naked Trader’ by Robbie Burns

Embracing a long-term perspective and a well-informed strategy is the key to success in the stock market. It’s not about quick wins but about consistent, informed decision-making that stands the test of time.

Whether you’re a seasoned investor or just starting out, these books offer valuable insights into the ever-evolving landscape of the stock market, providing the tools needed to make informed decisions and potentially secure your financial future.

Real Estate as an Investment Vehicle

Real estate investment stands as a cornerstone for those seeking to build long-term wealth and generate passive income. Investing in property can diversify your portfolio and act as a hedge against inflation. However, it’s crucial to understand the various types of real estate investments and the associated risks.

- Residential properties

- Commercial real estate

- Real estate investment trusts (REITs)

- Land development

Real estate investing requires due diligence and a clear understanding of the market dynamics. It’s not just about buying property; it’s about strategic asset allocation and management.

While some investors prefer direct ownership, others may opt for REITs which offer liquidity and ease of entry. Remember, every investment involves substantial risks, including the complete loss of capital. It’s advisable to perform independent research and consult a licensed professional before making any investment decisions.

Retirement Planning Essentials

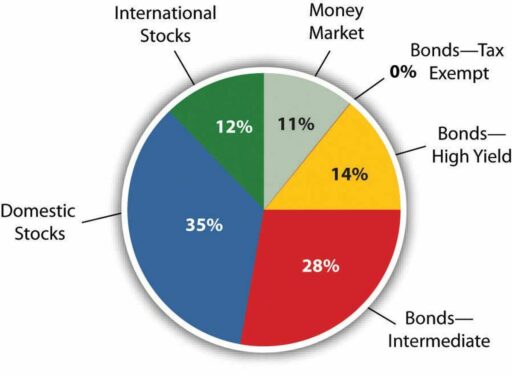

Retirement planning is not just about the present, but about securing a future free from financial stress. Robbins highlights the significance of asset allocation, which is crucial for balancing the potential for returns against the risk of losses.

Starting early is key, as the Barber’s advice suggests. The power of compound interest is maximized with early and consistent contributions to retirement accounts. This approach is echoed by Ramsey, who combines practical steps with motivational guidance to ensure a comfortable retirement.

To avoid common pitfalls, consider the following expenses that can impact your retirement savings:

- Management fees (minimized with low-cost index funds)

- Record keeping costs (avoided by rolling over to a rollover account)

- Advisory fees (avoided)

- Turnover or trading costs (controlled through occasional rebalancing)

- Capital gains taxes (reduced with tax-efficient funds)

By focusing on these areas, you can enhance your retirement plan’s efficiency and ensure that more of your savings go towards your golden years rather than unnecessary expenses.

In addition to these strategies, it’s important to select advisors who offer valuable service at a fair price and to utilize tax-advantaged accounts like the "Backdoor Roth IRA" to optimize your retirement funds.

The Behavioral Aspect of Personal Finance

Overcoming Psychological Barriers to Saving

Understanding the psychological hurdles in saving is crucial for financial growth. Habit stacking is a transformative approach where small, manageable changes lead to significant results. Begin with an automatic transfer from checking to savings, then review expenses weekly to stay on course.

Developing a robust savings plan is essential for long-term goals. Starting early and making informed investment choices, as advised by financial experts, can pave the way to a comfortable future. It’s about setting realistic procedures and being inspired to maintain them.

Investors often fall prey to cognitive biases and shortcuts, impacting their savings growth. Overcoming these mental traps requires diligence and a willingness to engage with the investment process. Learning from past performance and avoiding the allure of smooth-sailing funds can lead to more profitable outcomes.

By recognizing and adjusting our financial behaviors, we can steer clear of past errors and foster a healthier relationship with money. This self-awareness is a powerful tool in achieving financial independence and success.

The Impact of Emotions on Financial Decisions

Our financial decisions are often at the mercy of our emotions, which can cloud our judgment and lead to less-than-optimal outcomes. Understanding the emotional triggers that influence spending and investing can be the key to better financial health.

- Fear and greed, for instance, are powerful emotions that can cause us to make hasty decisions or hold onto investments longer than we should.

- Recognizing these patterns is the first step towards taking control and making more informed choices.

By becoming aware of our emotional biases, we can set ourselves on a path to more rational and effective financial decision-making.

It’s not just about the numbers; our hopes, dreams, and fears are all intertwined with our financial choices. Learning to manage these emotions can help us confidently navigate future financial decisions, avoiding the repetition of past mistakes and transforming our relationship with money.

Cultivating a Mindset for Financial Success

Achieving financial prosperity often begins with a shift in mindset. Your thoughts can greatly influence your financial destiny, and by adopting a success-oriented mindset, you’re laying the groundwork for wealth creation. It’s not just about positive thinking; it’s about setting the stage for strategic planning and opening yourself to innovative income streams.

- Reflect on your financial affirmations.

- Embrace the philosophy that your mindset shapes your financial future.

- Recognize the power of a positive money mindset in earning, spending, saving, and investing.

By cultivating a success mindset, you’re taking the first step towards wealth creation.

Understanding that your beliefs, attitudes, and habits around money play a crucial role in your financial success is essential. Surprising habits and characteristics often underpin the success stories of those who have achieved financial freedom. Discipline, frugality, and diligence are key traits that, when combined with a growth mindset, can help you confidently navigate future financial decisions and transform your relationship with money.

Innovative Income Streams

Exploring Passive Income Opportunities

The allure of earning money while you sleep is a powerful motivator in the quest for financial freedom. Passive income streams can provide the stability and security that come with having multiple sources of income. While the idea of passive income may seem reserved for the wealthy, there are numerous strategies accessible to the average person.

One such strategy is to leverage your skills and interests to create a side business that requires minimal ongoing effort. For example, writing an e-book or creating an online course can generate sales long after the initial work is done. Additionally, investing in dividend-paying stocks or rental properties can provide a steady flow of income.

It’s important to remember that passive income isn’t entirely hands-off; it often requires a significant upfront investment of time or money. However, with careful planning and execution, these investments can pay off handsomely over time.

To get started, consider the following passive income ideas:

- Dividend-paying stocks

- Rental real estate

- Peer-to-peer lending

- Creating digital products

Each option comes with its own set of risks and rewards, and it’s crucial to do thorough research before diving in. The journey to building wealth through passive income is a marathon, not a sprint, and the best time to start is now.

Side Hustles for Financial Flexibility

The allure of side hustles lies in their potential to provide financial flexibility without the need to abandon your primary source of income. Freelancing stands out as a particularly effective method for generating additional revenue, as it allows individuals to capitalize on their existing skills and expertise. The book ‘Side Hustle: Build a Side Business and Make Extra Money

- Without Quitting Your Day Job’ by Chris Guillebeau delves into the practicalities of maintaining a side gig alongside a full-time job, offering a wealth of actionable advice.

The journey to establishing a successful side hustle is often marked by the strategic utilization of one’s personal talents and the efficient management of time. It’s about finding the right balance that complements your lifestyle and financial goals.

For those just starting out, the process may seem daunting. However, the book ‘Money: A User’s Guide’ by Laura Whateley provides a clear framework for beginners, ensuring that the pursuit of a side hustle remains accessible and manageable.

Leveraging Skills for Freelance Income

In the realm of personal finance, leveraging your existing skills to create a freelance income can be a transformative step. Freelancing allows for flexibility and the potential for increased earnings. It’s essential to identify your marketable skills and understand how to position them to potential clients.

- Identify your skills and strengths

- Research the market demand

- Create a compelling portfolio

- Set competitive pricing

- Network and market your services

Popular side hustles to supplement income include freelancing, selling online, tutoring, and renting. Investing in financial education is crucial for informed decisions and lifelong financial security.

The journey to successful freelancing begins with a clear understanding of your value proposition and a strategic approach to market yourself.

Remember, the key to a sustainable freelance career is not just in the quality of work but also in the consistency of income and client satisfaction. Diversify your client base to ensure a steady stream of projects and income.

Financial Literacy for All Ages

Teaching Kids About Money

Instilling financial literacy in children is a cornerstone for future monetary success. Early education on money matters can shape positive financial habits that last a lifetime. It’s crucial to start with the basics, such as the value of money, saving, and the concept of earning.

To make the learning process engaging, consider using storybooks that introduce financial concepts in a relatable way. For instance, Money Ninja by Mary Nhin is a popular choice among parents and educators. It’s part of a series that tackles various life skills through the adventures of a young ninja.

Encouraging kids to practice what they learn is as important as the learning itself. Setting up a small allowance and guiding them through budgeting their spending can be a practical start.

Remember, the goal is not just to teach kids about money, but to help them develop a healthy relationship with it. This includes understanding the importance of giving and the impact of their financial decisions on the wider world.

Financial Planning for Young Adults

As young adults stand on the precipice of financial independence, the choices made during this time can set the stage for a lifetime of financial health. Navigating the complexities of personal finance is crucial, and there’s no shortage of resources tailored to this demographic. For instance, books like "Spare Change" by Iona Bain provide not only practical advice on saving and budgeting but also delve into the psychological aspects of money management, a wake-up call for the financially savvy.

Creating a solid financial foundation involves more than just understanding money; it requires actionable strategies. Here’s a simple roadmap to get started:

- Assess your current financial situation.

- Set clear, achievable financial goals.

- Develop a budget that accommodates your lifestyle and savings.

- Prioritize paying down debts, especially high-interest ones.

- Explore investment options and understand the basics of asset allocation.

Remember, the key to financial planning is starting early and staying consistent. It’s about making informed decisions that align with your long-term objectives, ensuring that you’re not just living for today but also preparing for a financially secure future.

For those eager to dive deeper, exploring chapters on investment strategies, like understanding when to purchase a home or how to allocate assets, can provide invaluable guidance. The journey to financial independence is a marathon, not a sprint, and young adults are encouraged to live modestly, pay down debts with determination, and invest time in learning about financial tools and goals.

Money Wisdom for Pre-Retirees

As pre-retirees stand on the cusp of a significant life transition, financial wisdom becomes paramount. Navigating the complexities of retirement planning requires a strategic approach to ensure a secure and comfortable future. It’s not just about how much you have saved; it’s about making informed decisions that will stretch your retirement funds and maintain your lifestyle.

Retirement planning takes center stage, ensuring you’re not just living for today but preparing for a future where financial worries are a thing of the past.

The following points are crucial for pre-retirees to consider:

- Select advisors who give great service and advice at a fair price.

- Become a millionaire within five to ten years of residency graduation.

- Use a "Backdoor Roth IRA" and "Stealth IRA" to boost your retirement funds and decrease your taxes.

- Protect your hard-won assets from professional and personal lawsuits.

- Avoid estate taxes, avoid probate, and ensure your children and your money go where you want when you die.

- Minimize your tax burden, keeping more of your hard-earned money.

Each of these steps is a building block towards achieving a financially stable retirement. By focusing on saving a significant portion of your income and investing it wisely, you’re set on a journey towards securing your financial future. The importance of living below your means to free up more money for investment is a concept that might seem challenging at first but is vital for long-term wealth building.

Conclusion

In summing up, the personal finance books highlighted in this article are more than just reading material; they are tools for empowerment and change. Each book offers a unique perspective on managing finances, from overcoming debt to building wealth, and from understanding the psychology of money to creating sustainable income streams. As we navigate the complexities of our financial lives, these books serve as beacons, guiding us towards a future of financial literacy and independence. Embrace the knowledge they offer, and let it be the catalyst for your journey to financial success. Remember, the transformation of your financial future begins with the turn of a page.

Frequently Asked Questions

What are some must-read personal finance books to transform my finances in 2024?

In 2024, consider reading ‘Finance for the People’ by Paco De Leon and ‘The Psychology of Money’ by Morgan Housel for insightful strategies and practical advice on managing your finances.

How can personal finance books help me with my financial future?

Personal finance books offer guidance on budgeting, debt management, investing, and understanding the psychological aspects of money, empowering you to make informed decisions and take control of your financial destiny.

Can reading finance books actually improve my financial literacy?

Absolutely, finance books are a valuable resource for learning money management techniques, investment strategies, and the principles of financial planning, which can enhance your financial literacy and help protect your assets.

Are there personal finance books suitable for beginners?

Yes, there are many accessible personal finance books aimed at beginners that cover various topics such as debt management, saving, investing, living frugally, and creating multiple income streams.

What topics do the top personal finance books cover?

Top personal finance books typically cover budgeting, debt defeat strategies, investing in the stock market or real estate, retirement planning, the impact of emotions on financial decisions, and creating passive income.

Where can I find recommendations for personal finance books that cater to different financial goals?

You can find book recommendations in articles that discuss the top personal finance books, such as those by authors like Choon Leo Wang, CarolinaM, and Michael Jason, which cater to goals like wealth accumulation, debt management, and financial independence.