In a world where financial complexity is ever-growing, the importance of personal finance education cannot be overstated. A personal finance class offers a wealth of benefits that can lead to a life of financial freedom and independence. Through such courses, individuals learn to navigate the maze of budgeting, investing, and debt management, equipping themselves with the necessary tools to make sound financial decisions. This article explores the transformative power of personal finance education and its pivotal role in unlocking financial freedom.

Key Takeaways

- Personal finance education is key to gaining financial literacy, empowering individuals to make informed decisions and achieve financial stability.

- Mastering budgeting, saving, and investing principles in a personal finance class can lead to long-term wealth accumulation and financial security.

- Financial education helps individuals break free from the paycheck-to-paycheck cycle, fostering a culture of financial responsibility and independence.

- Taking a personal finance class can pave the way for financial independence, allowing for life choices that align with personal values and goals.

- Incorporating financial education into everyday learning through various platforms enhances accessibility and prepares individuals for future financial challenges.

Laying the Foundation: The Importance of Financial Literacy

Empowering Individuals with Knowledge

Financial knowledge serves as the cornerstone of personal empowerment. With the right information and skills, individuals can take control of their financial destiny. This empowerment is not just about understanding money, but also about making informed decisions that pave the way for a secure financial future.

- From budgeting and saving to investing and retirement planning, financial literacy equips individuals with the necessary tools to make prudent financial decisions.

- It enables people to navigate the complexities of the financial world with confidence.

- Continuous education in personal finance is crucial for adapting to new financial challenges and opportunities.

Financial knowledge is a powerful tool for achieving financial empowerment. It equips individuals with the information and skills they need to make informed decisions and take control of their financial well-being.

Building a Strong Financial Future

A strong financial future is not just a goal; it’s a necessity for a life of stability and prosperity. Understanding the basics of personal finance is the first step towards this future. It’s about more than just balancing a checkbook or saving a portion of your paycheck; it’s about creating a comprehensive plan that encompasses all aspects of your financial life.

- Assess your income and expenses to understand your financial position.

- Differentiate between good debt (like a mortgage) and bad debt (like high-interest credit cards).

- Prioritize saving and investing to build wealth over time.

- Ensure adequate insurance coverage to protect your assets.

- Plan for major life events to avoid financial surprises.

By laying the groundwork for a secure and prosperous financial future, individuals can enjoy the fruits of their labor without the constant worry of financial instability.

Building savings and achieving financial goals requires discipline and a strategic approach. Regularly reviewing your finances, as suggested by Forbes, can help identify areas for improvement and opportunities for growth. The journey to a strong financial future is ongoing, and with the right knowledge and tools, it is certainly within reach.

The Role of Financial Education in Decision-Making

Financial education serves as a pivotal tool in shaping the way individuals approach their financial landscape. It empowers them to make choices that are informed, strategic, and aligned with their long-term objectives. By understanding the intricacies of financial products and the implications of various financial strategies, people can navigate their economic lives with greater confidence and control.

- Financial security enhancement

- Informed financial decision-making

- Debt management and reduction

Financial education is not just about learning to manage money—it’s about achieving a sense of financial well-being and independence that permeates all aspects of life.

The benefits of financial education extend beyond personal gain; they contribute to a more financially literate society where individuals can actively participate in the economy. This participation is not just about personal wealth—it’s about contributing to the economic health of the community and the nation at large.

Navigating Your Finances: Key Concepts in Personal Finance

Budgeting and Saving Strategies

Mastering the art of budgeting and saving is a cornerstone of personal finance. It involves creating a plan for how you will allocate your income to cover expenses, savings, and investments. Effective budgeting helps you track your spending and identify areas where you can save money, ensuring that you’re living within your means.

Budgeting is not just about limiting expenses; it’s about making informed choices that align with your financial goals.

Consider starting with a small amount and gradually increasing your contributions over time. Even saving a few dollars each week can add up, building savings and achieving financial goals. Look for opportunities to save, such as reducing discretionary spending or negotiating lower bills.

Here are some tips for effective budget management:

- Track your expenses to understand where your money goes.

- Prioritize your spending by distinguishing between needs and wants.

- Set clear goals for savings, like building an emergency fund or saving for a significant expense.

- Adjust your budget as your financial situation changes.

Remember, a budget is a tool for empowerment, providing control over your finances and peace of mind knowing every dollar you spend is moving you closer to where you want to be.

Investing Basics for Long-Term Growth

Understanding the basics of investing is crucial for anyone looking to achieve long-term financial growth. By harnessing the power of compound interest, you can turn modest savings into substantial wealth over time. It’s essential to familiarize yourself with different investment options and strategies that align with your financial goals.

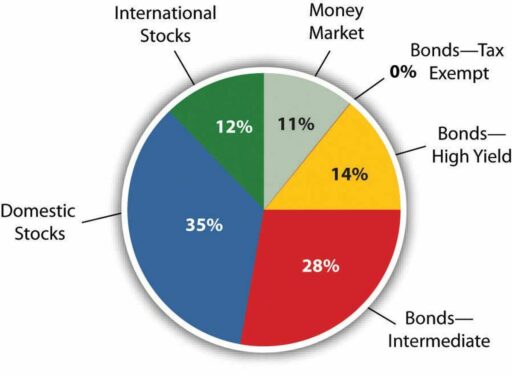

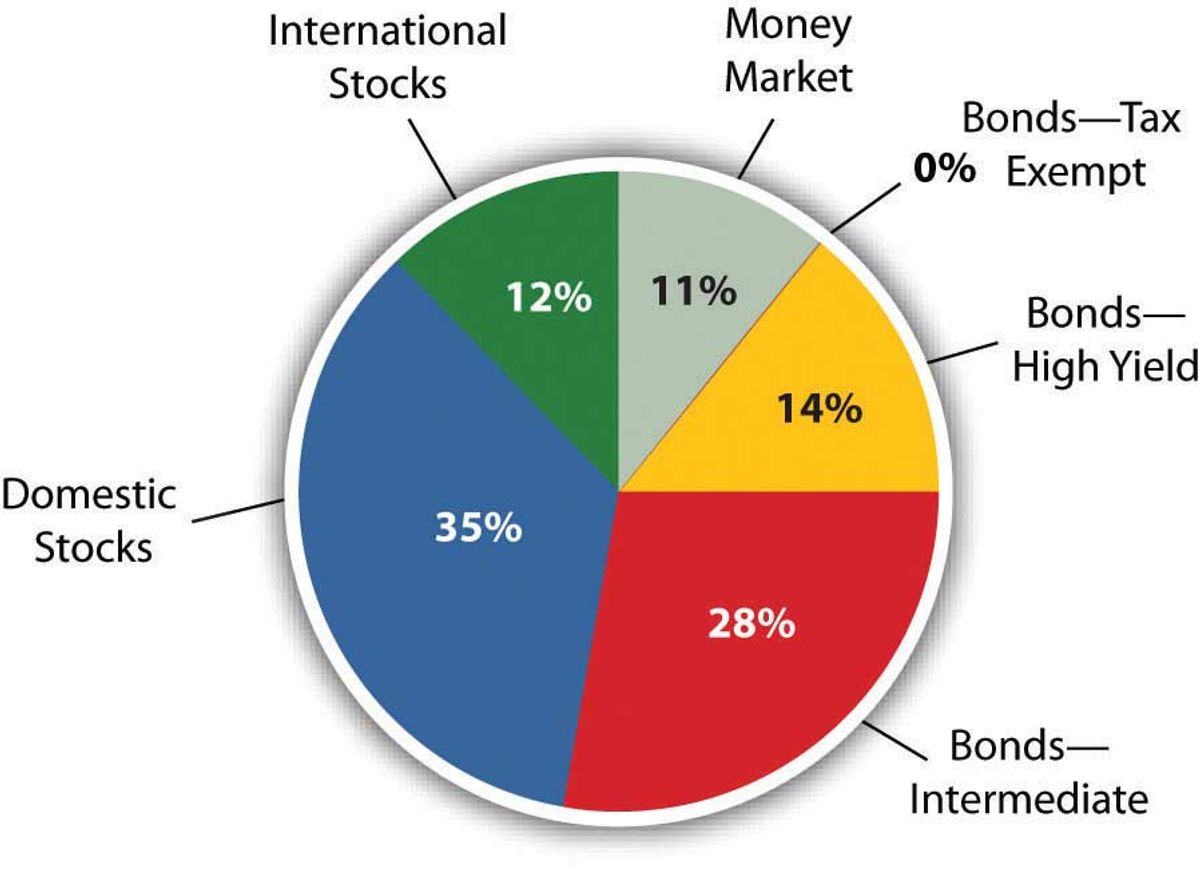

Diversifying your investment portfolio is key to mitigating risk and maximizing growth. Spreading your investments across various asset classes and sectors can help cushion the blow of market fluctuations.

Here are some foundational investment concepts for beginners:

- The importance of starting early to take advantage of compound interest

- Low-risk investment options like bonds or index funds

- The role of unitized funds in long-term growth

- The impact of reinvesting dividends on your investment’s growth potential

The Mastering Money Management course empowers individuals with essential personal finance knowledge and skills for budgeting, banking, credit, investments, and financial security.

Debt Management and Credit Health

Effective debt management is a cornerstone of financial stability. Creating a debt repayment plan and negotiating better terms with creditors can prevent the damaging effects of defaulting on payments. It’s crucial to differentiate between good debt, like student loans or mortgages, and bad debt, which can quickly become unmanageable.

Understanding and managing your credit is equally important. A healthy credit score opens doors to better loan conditions and is a reflection of your financial responsibility. Here are some steps to improve your credit health:

- Review your credit reports regularly.

- Keep bill payments on time.

- Utilize less than 30% of your available credit.

- Limit requests for new credit.

By adhering to these practices, you can maintain a robust financial profile and navigate the complexities of credit with confidence.

Transforming Lives: The Personal Impact of Financial Education

Achieving Financial Goals and Dreams

Personal finance classes serve as a beacon, guiding individuals towards the realization of their financial aspirations. Setting clear, achievable goals is the cornerstone of this journey. Whether it’s paying off debt, establishing an emergency fund, or saving for retirement, having a defined target is crucial.

- Identify your financial goals

- Break down goals into actionable steps

- Celebrate each milestone

- Stay focused and embrace the journey

The path to financial success is not just about reaching a destination; it’s about the growth and empowerment that comes with each step forward. Discipline, patience, and perseverance are your allies in this endeavor. By internalizing the lessons from a personal finance class, you can transform your financial dreams into tangible realities.

Overcoming the Paycheck-to-Paycheck Cycle

Breaking free from the paycheck-to-paycheck cycle is a transformative step towards financial independence. It requires a strategic approach to managing money and a commitment to change. For many, this cycle is a reality that consumes their entire income, leaving little to no room for savings or investments.

- Identify and cut unnecessary expenses: Start by scrutinizing your spending and finding areas where you can reduce costs.

- Create a bare bones budget: Focus on essential expenses and allocate funds accordingly.

- Build an emergency fund: Aim to save a small portion of your income regularly to cushion against unexpected expenses.

- Prioritize debt repayment: Tackle high-interest debts first to reduce the overall burden.

By adopting these practices, individuals can gradually shift from surviving to thriving, paving the way for a more secure financial future. The journey to financial wellness becomes less daunting as one gains control over their finances and starts making intentional decisions about money management.

Creating a Culture of Financial Responsibility

Financial responsibility is not just an individual goal; it’s a societal aim that benefits everyone. Empowering individuals with financial education is a critical step in cultivating a culture where financial responsibility is the norm. By integrating financial literacy into the fabric of our society, we can lay the groundwork for a future where economic resilience and sustainability are within everyone’s reach.

Financial education is the cornerstone of a financially savvy society, where each individual’s decisions contribute to the collective economic well-being.

The impact of financial education extends beyond personal gain; it fosters a community where informed decision-making is commonplace. Next Gen Personal Finance resources are a testament to this, providing education, technology, and advocacy tools that have been shown to lead to a significant lifetime benefit for students. Here’s how a culture of financial responsibility can manifest:

- Nurturing the ability to navigate the complexities of adulthood

- Breaking the cycle of financial illiteracy

- Building a foundation for a prosperous future for all

The Road to Independence: How Personal Finance Leads to Freedom

Breaking Free from Financial Constraints

Financial constraints often act as invisible chains that limit our choices and aspirations. Taking a personal finance class can be a transformative experience, providing the tools and knowledge necessary to break these chains. By understanding how to manage money effectively, individuals can move from a state of financial survival to one of financial stability and growth.

- Recognize and prioritize financial goals

- Develop a personalized budget

- Build an emergency fund

- Strategize to pay off debt

- Plan for retirement and other long-term objectives

One recent report found a lifetime benefit of roughly $100,000 per student from taking a one-semester course in personal finance during high school. This staggering figure underscores the profound impact that financial education can have on an individual’s life trajectory.

Embracing financial education is not just about numbers and budgets; it’s about gaining the confidence to make informed decisions that align with one’s personal values and goals. It’s about creating a life where financial stress does not dictate one’s choices, allowing for a more fulfilling and autonomous existence.

Making Life Choices Aligned with Personal Values

Understanding personal finance is more than just numbers; it’s about aligning your financial decisions with your deepest values and aspirations. Financial literacy enables individuals to make choices that resonate with their personal beliefs and life goals. It’s about creating a life that feels authentic and fulfilling.

- Weighing the pros and cons of various financial options

- Considering the long-term impact of financial decisions

- Prioritizing needs and aligning spending with values

By mastering personal finance, you gain the clarity to distinguish between what you need and what you want, ensuring that every dollar spent is a step towards your ideal life.

The top 10 personal finance books are a testament to the power of financial education. They offer actionable insights that can transform your financial habits, leading to a life of independence and alignment with your values.

The Flexibility to Pursue Passions

Embracing personal finance education can lead to a profound transformation in how individuals approach their careers and passions. The mastery of financial skills provides the freedom to make choices that align with one’s deepest interests and values. For many, this means the opportunity to engage in freelance entrepreneurship, which offers unparalleled flexibility compared to traditional employment.

- Freelancers can choose when, where, and how they work, crafting a lifestyle that fits their personal preferences.

- The ability to select projects that resonate with personal passions leads to greater job satisfaction and a sense of fulfillment.

- Setting one’s own rates and taking control of financial destiny is a direct result of financial literacy and confidence.

The journey towards financial independence is not just about the numbers; it’s about gaining the freedom to live life on your own terms, to pursue the things that bring joy and meaning.

For example, a web developer might leave a full-time job to travel and work remotely, or a writer could spend mornings in a coffee shop and afternoons on a hiking trail. This level of autonomy is a testament to the power of financial education in unlocking the doors to a life rich with personal choice and exploration.

Integrating Financial Education into Everyday Learning

The Benefits of Including Finance in Curriculums

Incorporating financial education into school curriculums is a transformative step towards empowering young individuals with the tools they need for financial success. It’s not just about learning to balance a checkbook or understanding interest rates; it’s about cultivating a mindset equipped to handle the complexities of the modern economic environment.

- Empowers students to make informed financial decisions

- Develops essential money management skills

- Prepares students for financial challenges and opportunities

- Fosters a culture of financial responsibility

- Increases financial security and well-being

By embedding financial literacy into the educational journey, we lay the groundwork for a future where individuals are not just surviving, but thriving. Financial education is the cornerstone of a life where choices are informed, risks are calculated, and opportunities are seized.

The evidence is clear: students who receive financial instruction in school demonstrate a marked improvement in their financial behaviors. They are more adept at managing their personal finances, from budgeting to investing, and are less likely to fall prey to financial pitfalls.

Online Learning Platforms and Accessibility

The integration of technology in personal finance education enhances learning through interactive platforms, gamification, and online resources. Financial literacy is promoted through age-appropriate games and policy initiatives, aiming for widespread accessibility.

Online learning platforms provide self-paced courses that utilize interactive learning techniques, such as videos, quizzes, and discussion forums. They also offer a wealth of educational resources, including fillable worksheets, virtual badges, and certificates of completion.

As you can see from the table below, there is a wide range of online learning platforms available, each with its own unique features and course offerings. Whether you prefer a platform that offers self-paced courses, community support, or university-certified programs, you can find the perfect fit for your financial learning journey.

One of the key advantages of online learning is the flexibility it offers. Self-paced courses allow you to learn at your own convenience, fitting your studies into your busy schedule. You can access the materials whenever and wherever you want, making it ideal for those juggling work, family, and other commitments. The interactive nature of online courses also enhances the learning experience. Videos, quizzes, and discussion forums engage learners, making the topics more relatable and enjoyable.

Additionally, popular online learning platforms like Udemy, Skillshare, Alison, and Coursera offer a wide range of financial planning workshops and budgeting workshops that cater to diverse learning preferences.

Preparing for Future Financial Challenges and Opportunities

In the journey of life, financial challenges and opportunities come hand in hand. Being prepared for these eventualities is not just about having funds available; it’s about understanding how to manage those funds effectively. Personal finance education equips individuals with the foresight to anticipate future needs and the skills to plan accordingly.

- Evaluating investment opportunities

- Optimizing tax strategies

- Protecting assets through insurance

- Planning for life events like education, marriage, and retirement

The true value of financial education lies in its ability to provide a framework for adapting to change. It’s about creating a financial plan that evolves with your life, ensuring that you’re always prepared for what’s next.

Regularly reviewing and updating financial plans is essential to stay aligned with changing circumstances and goals. By embracing a long-term vision, individuals can navigate the complexities of personal finance, ensuring they are well-positioned to seize opportunities and overcome obstacles.

Conclusion

In summary, the journey to financial freedom is paved with the knowledge and skills acquired through personal finance education. By engaging in personal finance classes and resources, individuals can unlock the potential to manage their finances with confidence, make strategic decisions, and build a secure financial future. Whether it’s through online courses, community programs, or self-guided learning, the investment in financial literacy pays dividends in the form of debt management, wealth accumulation, and the ultimate prize—financial independence. Embrace the empowerment that comes with understanding personal finance, and take the first step towards a life of financial autonomy and prosperity.

Frequently Asked Questions

Why is financial literacy important for achieving financial freedom?

Financial literacy empowers individuals with the knowledge to make informed financial decisions, manage debt effectively, and build wealth, which are crucial steps towards achieving financial freedom.

How can personal finance classes help break the paycheck-to-paycheck cycle?

Personal finance classes teach budgeting and saving strategies, helping individuals to manage their money more effectively, save for emergencies, and reduce reliance on living paycheck to paycheck.

What are some key concepts covered in personal finance classes?

Personal finance classes typically cover budgeting, saving, investing, debt management, credit health, and planning for retirement, among other topics.

Can online learning platforms be effective for financial education?

Yes, online learning platforms offer convenience and accessibility, making it possible for individuals to enhance their financial knowledge and skills at their own pace.

How does mastering personal finance contribute to making life choices aligned with personal values?

By achieving financial independence through personal finance mastery, individuals can make choices based on their values rather than financial constraints, leading to a more fulfilling life.

What are the benefits of including financial education in school curriculums?

Including financial education in school curriculums empowers students to make informed decisions, develops essential money management skills, and prepares them for future financial challenges and opportunities.