Snap Finance offers a unique financing solution for individuals with varying credit histories, promoting a ‘No Credit Needed’ option that has garnered attention among consumers and retailers alike. This article delves into the specifics of Snap Finance’s credit check process, application steps, financing options, and the overall customer experience, shedding light on how the company manages to support those who may be underserved by traditional financial institutions.

Key Takeaways

- Snap Finance provides ‘No Credit Needed’ financing options, welcoming customers with bad credit or no credit history.

- While Snap Finance does not perform hard credit inquiries, it obtains information from consumer reporting agencies during the lease-to-own application process.

- The application process is streamlined and quick, offering instant answers and up to $5,000 in financing with a 100-day interest-free payment option.

- Snap Finance has a strong customer service record, addressing complaints efficiently and maintaining high satisfaction rates as reflected in customer testimonials.

- Retail partners benefit from Snap Finance’s services, which can lead to increased sales and business growth through effective marketing services.

Understanding Snap Finance Credit Requirements

The ‘No Credit Needed’ Financing Option

Snap Finance offers a ‘No Credit Needed’ financing option, which is a beacon of hope for individuals who may not have the best credit history or any credit at all. This option provides a pathway to purchase without the stringent requirements of traditional credit checks.

With the ‘No Credit Needed’ program, customers can enjoy the flexibility of financing their purchases even if they have credit issues. The program is designed to be inclusive, allowing a wider range of consumers to access the products they need.

Here are some key features of the ‘No Credit Needed’ financing option:

- 100 days to pay with no interest.

- No hard credit check for approval.

- Instant application process with no obligation or cost.

- Average approval amount is typically around $3,000.

This financing solution caters to credit-challenged individuals across the US, providing them with the opportunity to make necessary purchases and manage payments over time. It’s a practical alternative for those who might be denied traditional financing options and are looking for a way to avoid delays in major purchases or the need to hunt for flexible payment options.

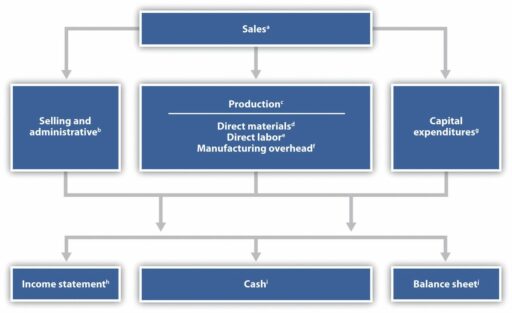

How Snap Finance Evaluates Applications

When evaluating applications, Snap Finance takes a unique approach that caters to a wide range of customers, including those with less-than-perfect credit histories. The company’s proprietary decisioning platform boasts an approval rate of up to 80%, demonstrating its inclusive financing solutions.

Snap Finance assesses each application by considering various factors beyond traditional credit scores. Here’s a brief overview of what they look at:

- Information from consumer reporting agencies

- Applicant’s income stability

- Employment history

- Overall financial behavior

Snap Finance’s evaluation process is designed to be transparent and fair, ensuring that customers understand the financing product before signing their agreement.

This approach not only helps individuals obtain the financing they need but also supports Snap Finance’s retail partners by generating significant incremental sales. In 2021 alone, the company contributed $1.5 billion in incremental sales for its partners.

Implications for Customers with Credit Issues

For customers with credit issues, Snap Finance presents a viable alternative to traditional financing. Approval up to $5,000 can be a significant aid for those who are often left unattended by banks with stringent lending criteria. With Snap Finance, the fear of denial is mitigated, allowing consumers to make necessary purchases without delay.

- Consumers with less than perfect credit find solace in Snap Finance’s flexible approach.

- Retailers offering Snap Finance can see increased average order values and repeat business.

- Life events impacting credit scores are considered, providing a lifeline during transitions.

Snap Finance’s lease-to-own option empowers consumers to improve their quality of life by affording major purchases, despite credit challenges.

The Application Process and Credit Checks

Step-by-Step Guide to Applying

Applying for financing through Snap Finance is designed to be a straightforward process. Complete a simple application online or in-store with basic personal information to receive a quick decision. If you prefer personal assistance, you can call and have a representative help you with the application.

- SELECT YOUR PRODUCTS: Choose the items you wish to purchase.

- CHOOSE PAYMENT PLAN: Decide on your preferred payment duration, up to 12 months, with options like ‘Pay in 4’ installments.

- APPLICATION: Provide necessary details for a soft credit check, which won’t impact your credit score.

- FIRST PAYMENT: Make the initial payment to start your lease agreement.

Remember, while Snap Finance offers a ‘No Credit Needed’ option, they still perform a soft credit check to determine approval. A hard credit inquiry is only conducted when the loan is finalized. It’s important to stay active with your payments, as inactivity for six months may result in the forfeiture of all payments.

Does Snap Finance Perform Hard Credit Inquiries?

When considering Snap Finance for your purchase financing, it’s important to understand their approach to credit checks. Snap Finance does not perform hard credit inquiries when evaluating applications, which means applying with them should not affect your credit score. This is particularly beneficial for those who are credit-conscious or are working on rebuilding their credit.

- Snap Finance’s ‘No Credit Needed’ program allows for a broader range of customer approvals.

- Information from consumer reporting agencies is utilized, but not in the form of a hard credit pull.

- Approval decisions are based on multiple factors, not solely on credit history.

While Snap Finance does check credit, the process is designed to be less invasive and more accommodating than traditional credit evaluations. This can be a relief for customers who may have concerns about their creditworthiness.

Remember, the absence of a hard credit inquiry does not mean that Snap Finance disregards credit information entirely. They do obtain relevant data from consumer reporting agencies to make informed decisions on applications.

What Information Does Snap Finance Obtain from Consumer Reporting Agencies?

When considering a lease-to-own application, Snap Finance obtains information from consumer reporting agencies. This is a crucial step in their evaluation process, even though they welcome customers with various credit backgrounds. The information gathered helps Snap Finance make informed decisions on application approvals.

- Personal identification details

- Credit history

- Payment history

- Public records (if any)

While no credit history is required to apply, the information from reporting agencies plays a significant role in the application’s outcome. It’s important for applicants to understand that their credit information will be reviewed, albeit not being the sole factor in the decision-making process.

This practice enables Snap Finance to extend their services to a broader range of customers, including those who may not have access to traditional financing options due to credit issues.

Financing Options and Repayment Terms

Lease-to-Own Agreements Explained

Lease-to-own financing is a flexible solution for individuals who may not qualify for traditional credit options. It empowers customers to acquire desired items and pay over time, regardless of their credit history. This approach is particularly beneficial for those with poor or no credit, as it provides an alternative pathway to ownership.

Retailers offering lease-to-own options often witness a surge in average order value. Customers with newfound purchasing power are more likely to invest in higher-priced items, leading to increased revenue for businesses. The model fosters customer loyalty, with consumers returning for future needs, thus driving repeat business.

The simplicity of lease-to-own financing lies in its minimal upfront costs and straightforward qualification criteria. Customers can quickly enjoy their purchases without the burden of immediate full payment.

For consumers facing financial challenges or life transitions that affect their credit, lease-to-own financing is a beacon of hope. It provides a means to afford significant purchases and enhance their living standards, all while working within their financial constraints.

Understanding the 100-Day Payment Option

Snap Finance offers a 100-Day Payment Option that allows customers to minimize the total cost of their lease. By paying an amount equivalent to the cash price of the item, plus applicable taxes and fees, within the first 100 days of the lease agreement, customers can achieve early ownership and avoid additional lease charges.

This option is designed for those who wish to own their merchandise outright in a shorter timeframe and save on the overall cost.

To utilize this option effectively, customers should:

- Contact Snap Finance Customer Service or use the customer portal to schedule payments.

- Ensure that the full amount is paid within the 100-day period to qualify for early buyout benefits.

- Be aware that failure to pay the full amount within the allotted time will result in the continuation of the lease under the original terms.

It’s important to note that the 100-Day Payment Option may be subject to state regulations, and the discount on the remaining lease payment for early buyout after the 100 days can vary, typically around 30%.

Consequences of Extended Payment Periods

Choosing an extended payment period with Snap Finance may seem like a convenient option for those who need more time to pay off their purchases. However, it’s important to be aware of the potential financial implications. Extended payment periods can significantly increase the overall cost due to the accumulation of interest and fees over time.

For instance, customers who miss the 100-day payment option deadline may find themselves paying much more than the original purchase price. The lease-to-own agreement allows for early buyout, which can offer savings, but failing to utilize this option can lead to extended payments and higher costs.

It is crucial for customers to carefully consider their ability to meet payment deadlines to avoid additional charges and a prolonged repayment schedule.

Here’s a breakdown of potential consequences:

- Increased total cost due to added interest and fees

- Risk of damaging credit score if payments are missed

- Stress and financial strain from managing long-term debt

- Potential for disputes with the lender over payment terms and amounts

Customer Experiences with Snap Finance

Positive Reviews and Testimonials

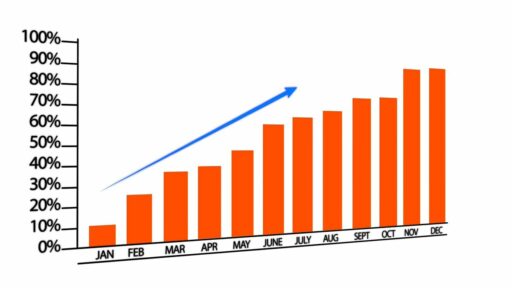

Snap Finance has garnered a significant number of positive reviews from customers, reflecting their satisfaction with the company’s services. On platforms like Trustpilot, Snap Finance boasts a high rating, with many customers praising the company for its inclusive approach, welcoming those with credit challenges such as bad credit or bankruptcy.

The Trustpilot platform emphasizes the authenticity of reviews, ensuring that all feedback comes from genuine experiences. Snap Finance’s commitment to addressing customer needs is evident in their response rate to negative reviews, replying to 98% of them within two days, which demonstrates their dedication to customer service.

The positive feedback from customers serves as a testament to Snap Finance’s efforts to provide flexible financing options and attentive customer support.

The table below summarizes the customer ratings on Trustpilot:

| Rating | Percentage |

|---|---|

| 5-star | 81% |

| 4-star | 4% |

| 3-star | 2% |

| 2-star | 1% |

| 1-star | 12% |

Handling Customer Complaints and Issues

Snap Finance has a structured approach to addressing customer complaints and issues, which is reflected in their interaction with the Better Business Bureau (BBB). Customers can view and file complaints directly through the BBB’s platform, which categorizes issues for clarity and resolution tracking. The types of complaints reported include billing/collection issues, problems with products/services, and more.

The company’s commitment to resolving disputes is evident from the data available on the BBB profile. Here’s a summary of the complaints made in the last 3 years:

- 474 total complaints

- 173 complaints closed in the last 12 months

Snap Finance’s response to complaints often involves direct communication with the customer to find a resolution. This process is designed to be transparent and efficient, ensuring that all parties are heard and that a fair outcome is achieved.

It is important for customers to follow up on their complaints to confirm satisfaction with the resolutions provided. This step is crucial in maintaining a positive relationship between the consumer and the company.

Communication and Customer Support Services

Snap Finance places a strong emphasis on customer support services to ensure a positive experience for all users. With options like in-house tech support and a dedicated team ready to address any concerns, customers can expect assistance throughout their financing journey. The support extends beyond just addressing issues; it includes guidance on product fitment, pricing, and compatibility questions.

- Call or email the support team for professional assistance

- Benefit from a 60-day return policy and a low price match guarantee

- Access to a variety of financing options to suit different needs

Snap Finance’s commitment to customer service is evident in the resources they provide, aiming to foster trust and satisfaction.

The company’s website also serves as a resource hub, offering insights into finance-related categories such as credit cards, loans, and financial literacy. This educational approach helps customers make informed decisions and understand the potential reasons for a credit score drop.

Businesses and Snap Finance: A Partnership for Growth

How Snap Finance Benefits Retail Partners

Retailers partnering with Snap Finance gain a competitive edge by offering their customers a flexible lease-to-own financing solution. This not only caters to a broader customer base but also enhances the shopping experience, leading to increased sales and customer loyalty.

- Boost in omni-channel sales: Snap Finance’s solutions allow customers to apply directly from their smartphones, whether they are in-store or navigating a retailer’s website.

- Higher average order value: Retailers often see an increase in the average transaction size due to the accessible financing options provided by Snap Finance.

Snap Finance’s proprietary decisioning platform boasts an impressive application approval rate, which translates to significant incremental sales for retail partners.

Retailers also benefit from Snap Finance’s commitment to transparency and education, ensuring that both partners and customers are well-informed about the financing terms. The company’s free marketing program, EDGE, further supports retailers by delivering pre-approved customers ready to make purchases, thus driving traffic and sales with minimal investment.

Marketing Services to Increase Sales

Snap Finance offers a comprehensive suite of marketing services designed to help businesses increase sales and enhance customer engagement. Retail partners can leverage Snap’s marketing expertise to attract more customers and improve conversion rates. The company’s marketing program, EDGE, is a standout feature, providing retailers with pre-approved customers who are ready to make purchases, thereby streamlining the sales process.

Retailers can also take advantage of Snap’s omni-channel presence, which allows customers to apply for lease-to-own financing solutions directly from their smartphones, whether they are in-store or navigating a retailer’s website. This seamless integration can lead to a higher average order value and a more satisfying shopping experience for customers.

- Marketing Cookies: Utilized to build a profile of customer interests and deliver targeted content.

- Omni-channel Sales Boost: Enhances customer reach across multiple platforms.

- Higher Average Order Value: Encourages larger purchases through convenient financing options.

By adopting Snap Finance’s marketing services, businesses can expect to see a notable uptick in sales volume and customer loyalty, without the need for significant upfront investment.

Case Studies: Business Growth with Snap Finance

Snap Finance has proven to be a catalyst for business growth, particularly for retailers catering to customers with diverse credit backgrounds. Retail partners have seen sales increases of up to 30 percent, thanks to Snap’s comprehensive financing solutions. The company’s proprietary decisioning platform boasts an impressive application approval rate, which in turn, translates to higher sales volumes for partnered businesses.

| Year | Incremental Sales Generated |

|---|---|

| 2021 | $1.5 billion |

Snap Finance’s commitment to educating its partners on lease-to-own best practices ensures that businesses are well-equipped to offer these financing options responsibly. This education includes:

- Disclosing terms, fees, and costs upfront

- Ensuring customers understand the financing product

- Certifying partners in lease-to-own policies

By providing accessible financing alternatives, Snap Finance bridges the gap for consumers who might otherwise be left unattended due to stringent bank lending requirements.

Conclusion

In summary, Snap Finance offers a flexible and accessible financing option for individuals with varying credit histories, including those with bad credit or no credit at all. Their ‘No Credit Needed’ financing approach allows customers to make purchases without undergoing a hard credit check, providing a 100-day interest-free payment period. While Snap does obtain information from consumer reporting agencies, this does not equate to the stringent credit checks performed by traditional financial institutions. Snap Finance’s lease-to-own agreements and easy online application process make it an attractive alternative for consumers seeking immediate approval for their financing needs. With high customer satisfaction ratings and a commitment to addressing any issues promptly, Snap Finance stands out as a viable solution for those who might otherwise be excluded from traditional financing options.

Frequently Asked Questions

Does Snap Finance require a credit history for financing?

No, Snap Finance offers ‘No Credit Needed’ financing options. They welcome customers with bad credit, bankruptcy, or no credit history at all.

Will applying for Snap Finance affect my credit score?

Snap Finance does not perform hard credit checks, so applying will not affect your credit score.

What kind of purchases can I make with Snap Finance?

You can use Snap Finance for a variety of purchases including furniture, tires, electronics, appliances, and more.

How quickly can I get approved for financing with Snap Finance?

The online application process is simple and quick, and you can find out if you’re approved in seconds.

What are the repayment terms for Snap Finance?

Snap Finance offers a 100-day payment option with no interest. Extended payment periods may have different terms, which will be known upfront.

How does Snap Finance handle customer complaints and issues?

Snap Finance takes customer complaints seriously and often responds to negative reviews within 2 days. They have a dedicated Fraud department for investigating claims and provide various ways for customers to get assistance.