Embarking on a journey into the finance industry is akin to stepping into a labyrinth of opportunities and challenges. For newcomers, deciphering this intricate landscape requires a blend of insight, strategy, and adaptability. This exploration delves into the depths of financial strategies and unveils the pathways to success for those venturing into the dynamic world of finance.

Key Takeaways

- Corporate finance encompasses a range of roles focused on securing funding, mergers and acquisitions, and capital market activities.

- A strong foundation in finance and accounting is crucial for career advancement in the finance industry.

- Networking, mentorship, and executive education are vital for professional growth and understanding the financial ecosystem.

- Innovative financial strategies include alternative investments, sustainable investing, and adapting to global business trends.

- Practical experience through internships, scholarships, and student jobs is essential for skill-building and career development.

The Landscape of Corporate Finance

Understanding the Financial Ecosystem

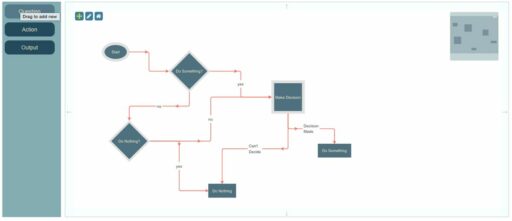

Before venturing further into the world of corporate finance, it’s crucial to grasp the intricate dynamics of the financial ecosystem. This ecosystem is a complex network that includes traditional banking institutions, investment firms, insurance companies, and a burgeoning sector of fintech startups. Each player within this network plays a pivotal role, and their interactions form the backbone of economic activity.

To truly understand this ecosystem, one must recognize the importance of financial concepts, planning, forecasting, and the various financing options available. These elements are vital for sustainable growth and informed decision-making within any business. Embracing technology and financial tools is also essential, as they significantly enhance efficiency and service quality in modern financial services.

In navigating the financial ecosystem, focusing on niche markets and specialized sectors can provide unique opportunities for growth and expertise development.

Key Roles and Responsibilities

In the realm of corporate finance, a myriad of roles contribute to the financial health and strategic direction of organizations. Financial Analysts play a pivotal role, analyzing data and preparing reports that inform critical decisions. Investment Analysts, on the other hand, focus on identifying lucrative investment opportunities and optimizing portfolio performance.

The synergy between various finance roles is essential for a company’s success, as each position brings a unique set of skills and perspectives to the table.

Risk Analysts are tasked with the crucial job of assessing financial risks and developing strategies to mitigate them, ensuring the company’s resilience against market fluctuations and regulatory changes. Similarly, those in consulting positions, such as Strategy Consultants and Financial Consultants, provide external expertise to drive growth and manage financial complexities.

Here is a snapshot of key roles within corporate finance:

- Investment Analyst: Research and portfolio optimization

- Financial Analyst: Financial data analysis and reporting

- Risk Analyst: Financial risk assessment and mitigation

- Strategy Consultant: Strategic growth initiatives

- Financial Consultant: Financial analysis and investment strategy

Each role is integral to the financial ecosystem, requiring a blend of analytical prowess, strategic thinking, and collaborative skills to navigate the ever-evolving landscape of corporate finance.

The Impact of Economic Development

Economic development plays a pivotal role in shaping the corporate finance landscape. The ability of firms to transition from stagnation to growth is crucial for economic progress. This transition is not uniform across all sectors, with some industries experiencing more rapid post-stagnation growth than others. The growth distribution within industries often reflects the broader economic aggregates such as GDP growth, which in turn influences corporate finance strategies.

Economic development influences corporate finance by dictating the pace and direction of industry growth, thereby affecting investment decisions and financial planning.

Understanding the dynamics of economic development can help treasurers and financial managers adapt their strategies to the evolving economic landscape. Challenges such as adapting to rising interest rates, risk management, and leveraging AI for innovative financial solutions are at the forefront of corporate finance today. The table below summarizes key factors that influence firm growth in the context of economic development:

| Factor | Description |

|---|---|

| GDP Growth | Reflects the broader economic environment and its impact on firm growth. |

| Industry Output | Indicates the share of growth within specific sectors. |

| Firm Size & Internationalization | Affects the pattern and intensity of firm growth. |

By recognizing these factors, financial professionals can better navigate the complexities of corporate finance, ensuring that their organizations remain competitive and resilient in the face of economic changes.

Investment Banking and Private Equity

Securing Corporate Funding and M&A

In the dynamic realm of corporate finance, securing funding and navigating mergers and acquisitions (M&A) are pivotal for growth and sustainability. Professionals in this field are tasked with identifying and securing corporate funding, which includes a range of activities from private placements of capital to debt and equity advisory services. The process often involves rigorous due diligence, asset reviews, and risk assessments to ensure the financial health of the entities involved.

Key responsibilities in this area include:

- Participating in due diligence processes

- Preparing financial reports, forecasts, and budgets

- Assessing company performance through performance metrics

- Managing investment portfolios

It is crucial for companies to integrate ESG (Environmental, Social, and Governance) considerations into their M&A strategy to mitigate risks and align with global business trends.

The decision-making process is supported by thorough data analysis and trend identification, which helps in making informed financial decisions. As the market evolves, professionals must adapt to new challenges, such as the distinctive features of high-tech firms at various stages of evolution, to maintain competitiveness and capitalize on opportunities.

Navigating IPOs and Capital Markets

In the ever-evolving landscape of corporate finance, navigating IPOs and capital markets is a critical skill for finance professionals. The process of taking a company public or securing investment through capital markets is complex and requires a deep understanding of regulatory frameworks and market dynamics.

- Understanding the regulatory environment

- Preparing for market fluctuations

- Developing creative financing strategies

In the volatile world of finance, agility in navigating market volatility is essential for safeguarding investments and capitalizing on emerging trends.

Professionals must be adept at adapting to volatile capital markets and optimizing balance sheets to ensure successful outcomes. The ability to explore creative financing strategies can set a company apart in a competitive landscape.

Venture Capital and Startup Financing

Venture capital plays a pivotal role in the financial landscape, providing essential funding to startups and early-stage companies with high growth potential. Professionals in this field evaluate and manage investment risks, seeking to maximize returns through strategic asset allocation and portfolio management.

- Portfolio Management: Overseeing a collection of investments, venture capitalists aim to balance risk with potential rewards.

- Risk Assessment: Critical to venture capital, professionals must gauge the viability and growth prospects of startups.

- Strategic Growth: Supporting startups through funding and expertise, venture capitalists help navigate the path to success.

The journey of a startup from inception to market leader is fraught with challenges, yet venture capital offers the resources and guidance necessary to traverse this complex terrain.

Understanding the nuances of venture capital is crucial for anyone looking to enter the realm of corporate finance. It’s not just about the money; it’s about fostering relationships and nurturing the next wave of innovative businesses.

Career Development and Advancement

Building a Foundation in Finance & Accounting

The cornerstone of a successful career in corporate finance lies in a solid understanding of finance and accounting principles. Grasping the core concepts of finance is essential, as it encompasses making money, managing money, investment, saving money, and borrowing money. These fundamentals are the building blocks for more advanced topics such as budgeting, taxes, ETFs, real estate, stocks, credit cards, loans, and mortgages.

To begin this journey, one might consider pursuing relevant educational pathways, such as a Certificate in Accounting or participating in an Executive Education program like the Eastside Mini-MBA Executive Certificate. These programs provide a structured approach to learning and can significantly enhance one’s financial acumen.

The array of opportunities in finance and accounting education is vast, offering various courses and specializations that cater to the diverse interests within the field.

It’s also important to recognize the role of practical experience. Engaging in internships, mentorship programs, and independent study projects can bridge the gap between theoretical knowledge and real-world application. Scholarships, such as the Ron Tilden Accounting Scholarship or the Don Whitney Scholarship for Graduate Students, can provide financial support to those aspiring to excel in this domain.

Leveraging Executive Education for Career Growth

In the pursuit of career advancement within corporate finance, executive education plays a pivotal role. Programs like the Eastside Mini-MBA Executive Certificate offer a blend of theoretical knowledge and practical skills, tailored to mid-career professionals seeking to elevate their leadership capabilities.

Executive education is not just about learning; it’s about transforming your career trajectory and opening doors to new opportunities.

The following list highlights key benefits of engaging in executive education:

- Enhanced leadership skills and business acumen

- Access to a network of peers and industry leaders

- Exposure to the latest trends and strategies in finance

- Opportunities for mentorship and professional coaching

Participation in programs such as Wharton@Work can significantly enhance one’s leadership skills and advance business acumen, setting a strong foundation for future success.

Networking and Mentorship Opportunities

In the dynamic realm of corporate finance, building a strong professional network is crucial for career advancement. Networking in the workplace benefits everybody involved, fostering professional relationships and unlocking new opportunities. Engaging with financial representatives through events and platforms like LinkedIn can lead to valuable advice and potential job prospects.

Mentorship, on the other hand, provides personalized guidance, helping to navigate the industry’s real-world demands. Seasoned professionals offer insights that are often not found in textbooks, equipping mentees with the tools to manage market volatility and advance their careers.

The synergy between mentorship and networking cultivates a fertile ground for professional growth, enabling individuals to learn from the best while expanding their industry footprint.

Here are some steps to enhance your networking and mentorship endeavors:

- Attend industry-specific events and conferences.

- Join professional associations and groups.

- Utilize online platforms like LinkedIn to connect with industry leaders.

- Seek out formal mentorship programs or informal mentor-mentee relationships.

Innovative Financial Strategies

Alternative and Sustainable Investing

In the realm of corporate finance, sustainable investing is gaining traction as a method to achieve financial returns while also promoting environmental, social, and governance (ESG) goals. This approach aligns investor values with their investment strategies, creating a positive impact on society and the environment.

Alternative investment strategies extend beyond the conventional market securities. They encompass a variety of assets, including real estate, commodities, and private equity. These options not only diversify an investor’s portfolio but also offer the potential for significant profitability. Among these, certain structures stand out for their focus on sustainability:

- Blended Finance

- Impact Investing

- Philanthropy

Each of these sustainable investment structures offers a unique blend of financial and social returns. Blended Finance combines private sector capital with philanthropic funds or public financial support to achieve greater impact. Impact Investing specifically targets investments that can generate measurable social or environmental benefits alongside financial returns. Philanthropy, while not always focused on financial returns, plays a crucial role in funding initiatives that drive positive change.

Embracing these alternative and sustainable investing strategies can lead to a more resilient and socially responsible portfolio, reflecting a commitment to long-term value creation that transcends mere financial gain.

Adapting to Global Business Trends

In the face of the dynamic nature of global economic trends, businesses are compelled to continuously innovate and adapt. The agility to pivot strategies in response to market fluctuations is not just a competitive advantage but a survival imperative. This is particularly true for younger, agile firms that often lead the charge in innovation and growth, especially in Western economies.

The universal principle of strategic adaptation is affirmed across diverse economic landscapes. Companies that embrace change and seek to design and implement transformative strategies are better positioned to deliver real value and stay relevant. This pathway requires a blend of analytical, visionary, and management skills to effectively plan and execute major organizational transformations.

The journey towards excellence is fueled by experience that simulates real business environments, exposing professionals to real-life scenarios and practical challenges.

Adapting to global trends is not just about survival; it’s about seizing opportunities for growth by integrating practices such as sustainability into international business strategies. The table below illustrates how businesses are adapting to these trends by sector:

Ethics and Corporate Accountability

In the realm of corporate finance, ethics and corporate accountability are paramount for maintaining trust and credibility with stakeholders. Companies are increasingly held to high standards of conduct, and the integration of ethical practices into business operations is not just a moral imperative but a strategic one as well.

- Ethical guidelines and compliance frameworks

- Transparency in financial reporting

- Sustainable business practices

- Stakeholder engagement and management

The pursuit of financial success must be balanced with a commitment to ethical behavior and accountability. This balance is critical for long-term sustainability and reputation management.

With the rise of environmental, social, and governance (ESG) criteria, companies are now more than ever scrutinized for their impact on society and the environment. It is essential for businesses to adopt comprehensive reporting systems that reflect their performance in these areas, driving decision-making and transparency.

Practical Experience and Skill Building

The Role of Internships and Student Jobs

Internships and student jobs are a crucial stepping stone in the journey of a finance professional. They offer a unique opportunity to apply theoretical knowledge in a real-world setting, providing invaluable insights into the workings of the corporate finance sector. Internships can be the gateway to a successful career, offering exposure to various financial roles and responsibilities.

- Why hire an intern

- Gain fresh perspectives

- Foster talent for future hiring

- Professional Coaching

- Enhance practical skills

- Bridge the gap between theory and practice

- Independent Study Projects

- Tackle real-world problems

- Develop specialized expertise

Internships not only equip students with practical skills but also allow them to build a professional network that can be pivotal in securing future employment opportunities. They are a testament to a candidate’s commitment and can often lead to full-time offers post-graduation.

The Corporate Finance Institute (CFI) provides a beginner’s guide that covers the basics of financial analysis, investment strategies, and career preparation. Aspiring professionals are encouraged to utilize these resources for optimal learning and to navigate the CFI platform effectively.

Professional Coaching and Independent Studies

In the pursuit of a successful career in corporate finance, professional coaching and independent studies play a pivotal role. Professional coaching offers one-on-one career guidance, helping individuals to craft a robust career strategy and polish their personal marketing tools, such as CVs and LinkedIn profiles. It also provides functional, sectorial, and geographical advising to support a tailored go-to-market plan.

Independent study projects allow for a deep dive into specific areas of interest, fostering a hands-on approach to learning and problem-solving. These projects can be an extension of coursework or entirely self-directed, offering flexibility and the opportunity to tackle real-world issues.

The integration of professional coaching and independent studies into one’s academic journey equips aspiring finance professionals with the structure and training necessary to excel in the competitive landscape of corporate finance.

For those looking to further their knowledge independently, online courses and certifications offer a convenient way to develop key skills at one’s own pace. The title ‘10 Best Corporate Finance Certification Courses Online 2024‘ suggests a wealth of resources available for self-motivated learners.

Scholarships and Financial Support for Aspiring Professionals

For many aspiring finance professionals, scholarships and financial support can be the key to unlocking educational opportunities and career advancement. Securing financial aid is not only about easing the burden of tuition costs but also about gaining access to exclusive networks and resources.

Financial support comes in various forms, from merit-based scholarships like the Donor Excellence Scholarship to need-based grants. Each scholarship has its own set of criteria and benefits, often reflecting the values and priorities of the donors or institutions offering them.

- Ron Tilden Accounting Scholarship

- Don Whitney Scholarship for Graduate Students

- Donor Excellence Scholarship

The journey through corporate finance education is rigorous, and financial support programs are designed to ensure that the most talented individuals are not hindered by financial barriers.

It’s essential for students to research and apply for these opportunities early, as competition can be fierce and deadlines are often strict. By leveraging scholarships and financial support, students can focus more on their studies and professional development, rather than the financial stress that comes with higher education.

Conclusion

As we conclude our exploration of the multifaceted world of corporate finance, it’s clear that the opportunities within this dynamic field are as diverse as they are rewarding. From the high-stakes environment of investment banking to the innovative realms of private equity and venture capital, finance professionals have the chance to make a significant impact on businesses and economies. The pathways to success in finance are numerous, each requiring a unique blend of analytical acumen, strategic thinking, and interpersonal skills. Whether through formal education, professional certifications, or hands-on internships, aspiring financiers can build a robust foundation for a thriving career. As the financial landscape continues to evolve, those equipped with the knowledge and adaptability to navigate its complexities will find themselves well-positioned to seize the myriad opportunities that lie ahead.

Frequently Asked Questions

What are the primary areas of focus in corporate finance and investment banking?

Roles in corporate finance and investment banking focus on securing corporate funding, managing privatization, mergers and acquisitions, IPOs, raising and allocating capital through equity or debt, corporate restructurings, private placements of capital, and providing advisory services for debt and equity.

Why are finance and investments considered a challenging and rewarding career pathway?

Careers in finance and investments are considered challenging due to their fast-paced, intellectually demanding nature, and the need for quantitative and analytical skills. They are rewarding because of the high stakes, the potential for significant financial rewards, and the impact on business and economic development.

How can executive education contribute to career growth in finance?

Executive education, such as the Eastside Mini-MBA Executive Certificate, provides professionals with advanced knowledge and skills, which can enhance their leadership capabilities, strategic thinking, and understanding of the latest trends and ethical practices in finance.

What opportunities exist for students and newcomers in the finance industry?

Students and newcomers can take advantage of internships, student jobs, professional coaching, mentorship programs like Mentorship EDGE, and scholarships such as the Ron Tilden Accounting Scholarship to gain practical experience, build skills, and establish a network in the finance industry.

How does sustainable and alternative investing fit into the landscape of corporate finance?

Sustainable and alternative investing are innovative financial strategies that align investment decisions with ethical, environmental, and social governance criteria. These approaches are increasingly important in corporate finance as they address global business trends and the demand for corporate accountability.

What is the role of financial accounting in the finance industry?

Financial accounting is fundamental to the finance industry as it provides the necessary framework for recording, summarizing, and reporting financial transactions. This information is crucial for decision-making, securing funding, and strategic planning in corporate finance and investment banking.