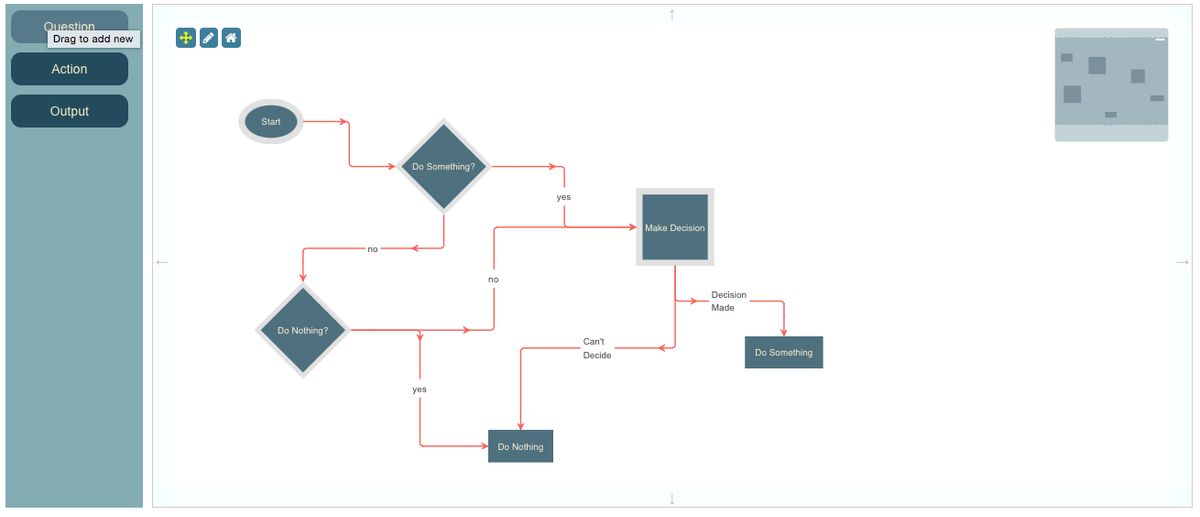

Navigating the complexities of personal finance can be daunting, but with the right guidance, anyone can become a master of their money. This article outlines a simple yet comprehensive personal finance flowchart in five essential steps, providing a clear path to financial literacy and empowerment. From understanding your financial statements to establishing a financial leadership pipeline, each step is designed to help you take control of your finances and achieve your financial goals.

Key Takeaways

- Learn to transform personal financial statements into powerful management tools for better financial oversight.

- Identify and manage key financial factors to achieve and maintain financial self-sufficiency.

- Understand the importance of key personal planning documents, such as HIPAA disclosures and living wills, for comprehensive financial planning.

- Discover how to craft effective goal statements that drive you towards financial success.

- Develop a financial leadership pipeline to ensure sustained financial health and adaptability in a changing employment environment.

1. Personal Financial Statements

Understanding and managing your personal financial statements is the cornerstone of financial literacy. Transforming personal financial statements into powerful management tools is essential for tracking your financial health and making informed decisions.

Personal financial statements typically include:

- Balance Sheet: Lists your assets and liabilities, providing a snapshot of your net worth.

- Income Statement: Shows your income and expenses, helping you understand your cash flow.

It’s crucial to regularly review and update these documents to reflect your current financial situation and to identify key financial factors that must be managed to achieve financial self-sufficiency.

By maintaining accurate and up-to-date financial statements, you can set realistic financial goals and measure your progress towards achieving them. This proactive approach is the first step in mastering your money and laying the foundation for a secure financial future.

2. Financial Self-Sufficiency

Achieving financial self-sufficiency is a pivotal step in mastering your money. It means having enough income to cover your living expenses without relying on external support. This stage is about creating a buffer between you and life’s uncertainties.

To reach financial self-sufficiency, consider the following:

- Assess your income sources: Ensure you have reliable streams of income that can cover your expenses.

- Control your spending: Track your expenses and cut back on non-essential items.

- Build an emergency fund: Aim for 3-6 months’ worth of living expenses saved.

- Eliminate high-interest debt: Prioritize paying off debts with the highest interest rates.

Remember, financial self-sufficiency isn’t an overnight achievement. It’s a gradual process that requires discipline, planning, and a commitment to making informed financial decisions.

3. Key Personal Planning Documents

Having the right personal planning documents in place is a cornerstone of sound financial management. Key documents include the HIPAA Medical Disclosure Document, Living Will, Medical Durable Power of Attorney, and Letter of Instruction at Death. These documents ensure that your wishes are respected and your affairs are in order, even in unforeseen circumstances.

It’s essential to not only have these documents but to keep them updated as your life circumstances change.

Here’s a quick checklist of the documents you should have:

- HIPAA Medical Disclosure Document

- Living Will

- Medical Durable Power of Attorney

- Letter of Instruction at Death

Each document serves a unique purpose, from managing your medical information privacy to outlining your healthcare preferences and delegating decision-making power in case you’re unable to do so yourself. Remember, these are living documents that should evolve as your life does.

4. Goal Statements

Creating goal statements is a pivotal step in mastering your money. These statements serve as a compass, guiding your financial decisions and keeping you on track towards your aspirations. To ensure your goals are actionable and achievable, consider the SMART criteria: Specific, Measurable, Achievable, Relevant, and Time-bound.

- Specific: Clearly define what you want to accomplish.

- Measurable: Determine how you will track your progress.

- Achievable: Set goals that are within your reach.

- Relevant: Ensure your goals align with your values and long-term objectives.

- Time-bound: Assign a deadline to create a sense of urgency.

Crafting goal statements that resonate with your personal ambitions will not only motivate you but also provide a clear roadmap for your financial journey. Remember, the power of a well-articulated goal lies in its ability to inspire action and foster progress.

5. Financial Leadership Pipeline

The Financial Leadership Pipeline is a strategic framework for developing the financial acumen and leadership skills necessary to navigate the complexities of modern business finance. It’s about cultivating a deep understanding of the financial landscape and honing the soft skills that make a great leader.

- Budgeting: Establish a solid foundation for financial planning.

- Investing: Make informed decisions to grow wealth over time.

- Tax Planning: Optimize financial outcomes by understanding tax implications.

Developing a Financial Leadership Pipeline involves more than just technical skills; it requires a commitment to continuous learning and personal growth.

To truly master personal finance, one must not only grasp the technical aspects but also embrace the leadership qualities that inspire trust and credibility. This includes being able to manage risk, communicate effectively, and adapt to the ever-changing employment environment. By focusing on these areas, individuals can become more valuable as business leaders and contribute to the overall success of their organizations.

Conclusion

Mastering personal finance is a journey that requires dedication, strategic planning, and continuous learning. By following the five steps outlined in this article and utilizing the flowchart as a guide, you can transform your personal financial statements into powerful tools for achieving financial self-sufficiency. Remember to keep your key documents updated, including your HIPAA Medical Disclosure Document, Living Will, and Medical Durable Power of Attorney. Set clear and actionable ‘goal’ statements to drive your financial decisions. As you implement these strategies, you’ll be better equipped to manage risks, plan for the future, and ultimately climb your own financial mountain to success. Keep refining your approach, stay informed on financial trends, and don’t hesitate to seek advice when needed. Your financial well-being is a critical aspect of your overall success, and with the right mindset and tools, you can enjoy the journey to mastering your money.

Frequently Asked Questions

What are personal financial statements and why are they important?

Personal financial statements are records that provide an overview of your financial situation, including assets, liabilities, income, and expenses. They are important as they serve as powerful management tools to help you identify key financial factors and track progress towards achieving financial self-sufficiency.

What documents are considered key personal planning documents?

Key personal planning documents include the HIPAA Medical Disclosure Document, Living Will, Medical Durable Power of Attorneys, and Letter of Instruction at Death. These documents ensure that your personal and medical wishes are respected and followed in various circumstances.

How can I create effective goal statements?

To create effective goal statements, you should focus on clarity, measurability, and achievability. They should be specific enough to guide your actions and provide a clear direction for what you want to achieve.

What is the Financial Leadership Pipeline?

The Financial Leadership Pipeline refers to the process of developing and nurturing financial professionals within an organization to ensure that there is a steady flow of qualified individuals ready to take on leadership roles as needed.

How does risk management play into personal finance?

Risk management in personal finance involves identifying potential risks that could negatively impact your financial well-being and taking steps to mitigate them. This includes having an emergency fund, insurance policies, and a diversified investment portfolio.

What is the role of a financial professional in strategic planning?

A financial professional plays a critical role in strategic planning by providing insights into the financial implications of business decisions, helping to develop strategies, measure performance, and manage risks to ensure the long-term financial health of the organization.