Preparing for a corporate finance interview requires a deep understanding of financial principles and the ability to apply them to real-world business scenarios. Whether you’re a recent graduate aiming to break into the industry or an experienced professional seeking to advance your career, mastering common interview questions can give you a competitive edge. This article outlines the essential topics and questions you should be familiar with before stepping into the interview room.

Key Takeaways

- Grasp the fundamental concepts of corporate finance, including financial statements, key ratios, and valuation techniques.

- Understand the strategic role of corporate finance in driving business decisions and value creation.

- Be prepared to discuss investment banking scenarios, including M&A, IPOs, and LBOs, and their financial implications.

- Demonstrate awareness of risk management practices, compliance regulations, and ethical considerations in finance.

- Stay informed about advanced topics such as derivatives, global financial markets, and economic trend forecasting.

Understanding the Basics of Corporate Finance

Defining Key Financial Concepts

In the realm of corporate finance, understanding the foundational concepts is crucial for analyzing a company’s financial health and making strategic investment decisions. Key financial concepts include the cost of debt, which is the interest paid on borrowed funds, and the cost of equity, which represents the returns required by shareholders. These are part of the broader concept of the Weighted Average Cost of Capital (WACC), a critical metric used to determine a company’s overall cost of capital.

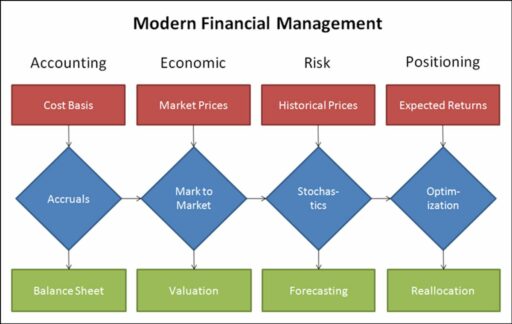

Financial management systems are essential for tracking income, expenses, and assets, ensuring accountability for a company’s profits.

Another fundamental concept is the time value of money, which underpins the importance of discounting future cash flows to ascertain their present value. This is because money available in the present is worth more than the same amount in the future due to its potential earning capacity.

Here is a list of some key financial concepts often discussed in corporate finance:

- Risk-free Rate

- Hurdle Rate

- Cost of Equity

- Weighted Average Cost of Capital (WACC)

- Cost of Debt

Explaining the Role of Corporate Finance in Business

Corporate finance serves as the backbone of a company’s financial health, focusing on optimizing shareholder value through long-term and short-term financial planning and the implementation of various strategies. Its role extends beyond mere bookkeeping and involves planning the most efficient capital structure, which includes a mix of debt and equity financing.

- Capital Raising: Securing funding for company initiatives and growth.

- Investment Decisions: Determining where to allocate resources for maximum return.

- Risk Management: Identifying and mitigating financial risks to ensure stability.

Corporate finance professionals are tasked with balancing risk and profitability, while striving to maximize an entity’s wealth and the value of its stock. A well-structured corporate finance department is integral for a company’s development and success, as it is responsible for making critical financial decisions that can shape the company’s future.

Corporate finance is the division of finance that deals with how corporations address funding sources, capital structuring, and investment decisions. This encompasses a wide range of activities from capital investment to tax considerations and financial reporting.

Distinguishing Between Different Types of Financial Statements

In the realm of corporate finance, understanding the different types of financial statements is crucial for analyzing a company’s financial health. The three core financial statements are the income statement, balance sheet, and cash flow statement. Each serves a unique purpose and provides valuable insights into various aspects of a company’s financial performance.

The income statement details a company’s profitability over a specific period, such as a quarter or a year. It starts with revenue and subtracts various expenses to arrive at the net income.

The balance sheet offers a snapshot of a company’s financial position at a particular point in time, detailing assets, liabilities, and shareholders’ equity.

Lastly, the cash flow statement focuses on the cash movements within the company, breaking down cash activities into operating, investing, and financing categories. It reconciles the cash balance from the beginning to the end of the period, highlighting the company’s liquidity and cash management.

Analyzing Financial Performance

Interpreting Key Financial Ratios

Financial ratios are crucial tools for assessing a company’s financial health and operational efficiency. Understanding these ratios is essential for making informed investment decisions. They provide insights into various aspects of a company’s performance, such as liquidity, profitability, and leverage.

Key financial ratios include:

- Debt-to-Capital Ratio

- Debt-to-Equity (D/E) Ratio

- Interest Coverage Ratio

- Degree of Combined Leverage (DCL)

Each ratio offers a unique perspective:

The Debt-to-Capital Ratio measures the proportion of a company’s capital that comes from debt, indicating financial leverage and risk.

The Debt-to-Equity Ratio compares a company’s total liabilities to its shareholder equity, providing a snapshot of its financial structure and ability to meet long-term obligations.

Interest Coverage Ratio assesses a company’s ability to pay interest on its outstanding debt, a critical indicator of financial stability.

Lastly, the Degree of Combined Leverage combines the effects of operating and financial leverage, reflecting the company’s sensitivity to changes in sales on its earnings before interest and taxes (EBIT).

Assessing Company Valuation Techniques

Valuation is a cornerstone in corporate finance, pivotal for investment analysis, capital budgeting, and merger and acquisition decisions. Understanding the nuances of different valuation methods is crucial for anyone looking to excel in corporate finance roles.

The three primary valuation methodologies include:

- The multiples valuation method, often referred to as the "comps" method, which utilizes sector-specific ratios such as the P/E ratio.

- The transactional valuation method, also known as the "precedents" strategy, compares the company to similar entities that have been recently acquired or sold.

- The discounted cash flow (DCF) method, which estimates the present value of expected future cash flows.

Each technique has its own set of assumptions and suitability depending on the context of the valuation. For instance, the comps method is widely used for its simplicity and the availability of market data, while the DCF method is favored for its consideration of future performance.

It’s essential to recognize that valuation is more of an art than a science, with various factors influencing the final figure. Analysts must exercise judgment and consider the unique aspects of each company and situation.

Evaluating Capital Budgeting Decisions

Capital budgeting decisions are pivotal for a company’s long-term financial health. They involve the evaluation of potential investments or projects and their expected returns. Understanding the time value of money is essential, as it affects the present value of future cash flows. Discounting these cash flows is a critical step in capital budgeting.

When evaluating projects, several factors come into play:

- The risk-free rate and the hurdle rate are used to assess the minimum acceptable return.

- The Cost of Equity and the Weighted Average Cost of Capital (WACC) help determine the project’s required rate of return.

- The Cost of Debt is also considered, especially in relation to the company’s capital structure.

It’s important to incorporate risk and uncertainty into the analysis, as well as accounting for inflation, taxes, depreciation, and salvage value. These elements can significantly alter the projected outcomes of an investment.

The WACC formula, which includes the cost of equity and the cost of debt adjusted for taxes, is a common tool used in this process:

| Component | Formula |

|---|---|

| WACC | (E/V * Re) + (D/V * Rd * (1-T)) |

In summary, capital budgeting is a complex process that requires a thorough understanding of financial concepts and the ability to apply them to real-world scenarios.

Navigating Investment Banking Scenarios

Discussing Mergers and Acquisitions Strategies

Mergers and acquisitions (M&A) are pivotal strategies for corporate growth and restructuring. Understanding the distinction between a merger and an acquisition is fundamental to grasping M&A strategies. A merger typically involves the combination of two companies to form a new entity, often aiming for synergies and competitive advantages. In contrast, an acquisition occurs when one company takes over another, which may not necessarily result in a new company name or structure.

For example, consider a scenario where a company like Amazon seeks to expand its market share in a competitive landscape such as India. Acquiring a smaller, local company could provide immediate infrastructure benefits and a stronger market presence. This was the case with Amazon’s interest in Jabong, an online clothing retailer, which would have allowed Amazon to penetrate the Indian market more effectively.

M&A strategies are not just about the transfer of ownership; they’re about creating value and strategic advantage. The role of investment bankers (IBs) is crucial in facilitating these transactions, ensuring that both the acquiring and the target company benefit from the deal.

The capital structure of a company can also hint at its M&A activities, revealing investments and acquisitions that could affect the company’s financial health. It’s essential for acquisition managers to articulate their experience with M&A during interviews, as their insights can be indicative of their ability to manage complex financial transactions.

Understanding Initial Public Offerings (IPOs)

An Initial Public Offering (IPO) is a pivotal event for a company, marking the transition from private to public and inviting shareholders to participate in its future. The process involves intricate planning and strategic timing to ensure the maximum benefit for the company. Investment banks (IBs) play a crucial role, not only in finding potential investors but also in convincing them of the company’s value and stability. They must articulate why the earnings and returns will be high, especially when issuing stock, to attract capital for the company in question.

The IB’s responsibilities extend beyond persuasion. They are tasked with determining the ideal moment and market for the issuance of bonds or stocks, and they are responsible for preparing the necessary legal documentation. This phase is critical as it sets the stage for the public offering and can significantly impact the company’s financial trajectory.

When a company decides to raise equity capital, it is essentially inviting the public to invest and become partners. Unlike bonds, there is no fixed ‘interest’ to be paid; instead, investors share in the profits or losses. This method of raising capital can be more advantageous for the company, as it does not incur debt, but it also introduces the risk of diluting existing shareholders’ stakes.

The success of an IPO can hinge on the public’s perception and the company’s ability to communicate its potential. A well-executed IPO can provide a company with the necessary funds to expand and innovate, while a poorly managed one can lead to financial and reputational damage.

However, IPOs are not without risks. New share issues can lead to potential insider abuse, where management might issue shares at a discount during financial distress, diluting the value for existing shareholders. Additionally, there can be unfavorable tax implications for both the company and its shareholders, sometimes triggering taxable events and alternative minimum taxes.

Exploring Leveraged Buyouts (LBOs) and Their Impact

Leveraged Buyouts (LBOs) are a significant financial strategy where a company is acquired primarily through borrowed funds. The goal is to enhance the company’s value and generate high returns on the investment by using the acquired company’s cash flows to service the debt. LBOs can lead to substantial changes in a company’s capital structure, often involving a mix of operating leases, redeemable preferred stock, and various forms of debt.

LBOs are complex transactions that require careful analysis of the target company’s financial health and potential for growth. They can dramatically alter the financial landscape of the acquired entity, sometimes resulting in improved performance.

The impact of LBOs extends beyond the immediate financial restructuring. They can influence the market by setting precedents for valuations and investment strategies. For instance, investment bankers (IBs) play a crucial role in identifying acquisition targets and structuring deals that can lead to a significant transfer of shares and control of the company.

Risk Management and Compliance

Identifying and Mitigating Financial Risks

Understanding, evaluating, and mitigating financial risk is essential for safeguarding a company’s assets and ensuring its longevity. Financial risks can manifest in various forms, such as market volatility, credit issues, liquidity constraints, and operational failures. To effectively manage these risks, companies often employ a combination of strategies and financial instruments.

The process of risk identification involves a thorough analysis of all potential threats that could negatively impact the organization’s financial health. Once identified, the next step is to assess the magnitude and likelihood of these risks.

Mitigation strategies may include diversification of investments, hedging against market movements, maintaining adequate liquidity reserves, and implementing robust internal controls. It is also vital to continuously monitor the risk environment as it evolves over time, adjusting strategies accordingly.

- Assess the risk’s magnitude and likelihood

- Diversify investments to spread risk

- Employ hedging strategies to protect against market volatility

- Ensure sufficient liquidity to meet short-term obligations

- Strengthen internal controls to prevent operational risks

Comprehending Regulatory Compliance in Finance

In the realm of corporate finance, regulatory compliance is a critical aspect that ensures companies adhere to laws, regulations, and guidelines relevant to their business operations. The consequences of non-compliance can be severe, ranging from financial penalties to reputational damage.

Financial institutions are often required to comply with a variety of regulatory frameworks, such as the Basel Norms, which set international standards for banking regulation and risk management. Understanding these norms is essential for any finance professional.

Effective compliance hinges on a robust system that can manage various financial processes. Key components of such a system include a financial management system, credit management system, and investment management system.

To prepare for interviews in corporate finance, candidates should familiarize themselves with the main regulatory bodies and the specific regulations that impact their sector. This knowledge not only demonstrates awareness but also shows a commitment to ethical practices and risk mitigation.

Exploring Ethical Considerations in Financial Decisions

In the realm of corporate finance, ethical considerations play a pivotal role in maintaining the integrity of financial decisions. Ethical dilemmas can arise in various contexts, such as conflicts of interest, insider trading, and the manipulation of financial statements. It is crucial for professionals to adhere to a strict ethical code to foster trust and credibility.

The ethical landscape of finance is continually evolving, especially with the advent of new technologies. For instance, the ethical considerations of AI in finance include issues related to bias, privacy, and regulatory compliance.

Financial ethics also extend to the responsibility of investment bankers and advisors in ensuring that their recommendations align with the client’s best interests. Here are some key inquiries to consider:

- Am I comfortable with the level of risk associated with this investment?

- Do I understand the investment, and is it possible to liquidate quickly if needed?

- Is the investment regulated, and what protections are in place?

- What happens if my advisor or the investment provider goes bankrupt?

- Should I consult a financial advisor for guidance on ethical practices?

Advanced Topics in Corporate Finance

Delving into Derivatives and Complex Financial Instruments

In the realm of corporate finance, derivatives and complex financial instruments play a pivotal role in risk management and investment strategies. These tools, including futures, options, swaps, and structured products, allow companies to hedge against market volatility, speculate on future price movements, and enhance portfolio diversification.

Understanding these instruments requires a grasp of their underlying assets, valuation methods, and the implications of their use. For instance, the valuation of options can be explored through the Black-Scholes model, which considers factors such as the underlying asset’s price, strike price, and time to expiration.

It’s essential to recognize the potential for significant gains or losses with these instruments, and the importance of a robust risk management framework to mitigate adverse outcomes.

Here’s a brief overview of some key derivatives:

- Futures: Contracts to buy or sell an asset at a predetermined future date and price.

- Options: Contracts that give the holder the right, but not the obligation, to buy or sell an asset at a specified price within a certain time frame.

- Swaps: Agreements to exchange cash flows or other financial instruments between parties.

- Structured Products: Customized combinations of derivatives and other financial instruments tailored to specific investment goals.

Discussing Global Financial Markets and Strategies

In the realm of corporate finance, global financial markets present both opportunities and challenges. Corporate finance adapts to evolving financial landscapes with strategies that span across borders. Investment banks play a pivotal role in this adaptation, often innovating strategies to mitigate risks and reduce costs.

- Understanding the dynamics of different markets

- Adapting to regulatory changes across jurisdictions

- Leveraging international capital markets for funding

- Implementing robust hedging programs to manage currency risk

The interconnectivity of global markets means that strategies must be both dynamic and resilient, taking into account not just the potential for growth, but also the lessons from past financial crises.

Financial professionals must remain vigilant, constantly updating their knowledge and approaches to stay ahead in a competitive and fast-paced environment.

Forecasting Economic Trends and Their Effects on Corporate Finance

Understanding and predicting economic trends is a cornerstone of corporate finance, as it influences investment strategies and financial planning. Forecasting economic trends allows businesses to prepare for potential changes in the market and adjust their financial strategies accordingly.

Economic indicators such as GDP growth rates, unemployment figures, and inflation rates are critical for forecasting. These indicators help finance professionals anticipate shifts in economic conditions that could impact corporate performance and investment returns.

- GDP Growth Rate

- Unemployment Rate

- Inflation Rate

- Interest Rates

- Consumer Confidence Index

Forecasting is not about predicting the future with certainty, but about having a well-informed outlook that enables proactive decision-making.

The ability to forecast effectively can lead to optimized capital allocation, better risk management, and a competitive edge in the marketplace. It’s essential for corporate finance professionals to continuously hone their forecasting skills and stay abreast of global economic developments.

Conclusion

As you prepare for your corporate finance interview, remember that the key to success lies in understanding the fundamental concepts and being able to articulate your thoughts clearly. The questions we’ve outlined in this article are designed to give you a glimpse into the variety of inquiries you might face, ranging from general banking to investment-specific scenarios. Whether you’re a recent graduate or an experienced professional, thorough preparation using these questions will help you demonstrate your expertise and confidence. Keep in mind that interviews are not just about technical knowledge but also about showcasing your analytical skills and cultural fit for the organization. Good luck, and we hope this guide serves as a valuable tool in your interview preparation journey.

Frequently Asked Questions

What are the fundamental financial concepts I should understand for a corporate finance interview?

You should be familiar with concepts such as net present value (NPV), internal rate of return (IRR), discounted cash flow (DCF), payback period, and financial ratios like debt-to-equity, return on equity (ROE), and earnings per share (EPS).

How does corporate finance contribute to the overall success of a business?

Corporate finance is crucial for making investment decisions, managing capital structure, optimizing a company’s financial performance, and ensuring that sufficient funding is available for operations and growth initiatives.

What is the difference between an income statement, a balance sheet, and a cash flow statement?

An income statement shows a company’s revenues and expenses over a period, indicating profit or loss. A balance sheet provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. A cash flow statement shows the cash generated and used during a period, reflecting the company’s liquidity.

What are some common financial ratios used in analyzing a company’s financial performance?

Key financial ratios include the current ratio, quick ratio, debt-to-equity ratio, return on assets (ROA), and profit margin. These ratios help assess a company’s liquidity, solvency, and profitability.

What should I know about mergers and acquisitions when preparing for an investment banking interview?

Understand the strategic rationale behind M&As, the difference between a merger and an acquisition, the various stages of an M&A deal, valuation techniques, and the potential impact on the companies involved, including synergies and integration challenges.

Can you explain the importance of risk management in corporate finance?

Risk management in corporate finance involves identifying, assessing, and mitigating financial risks to ensure the company’s assets and earnings are protected. This includes market risk, credit risk, liquidity risk, and operational risk, among others.

![How to Strategically Manage Your Personal Finances Like a Mar [[MANAGE YOUR PERSONAL FINANCES LIKE A BUSINESS ] to make it a uniform lengthi 10 c50b2697thumbnail](https://financemeaning.com/wp-content/uploads/2024/04/c50b2697thumbnail-512x341.jpeg)