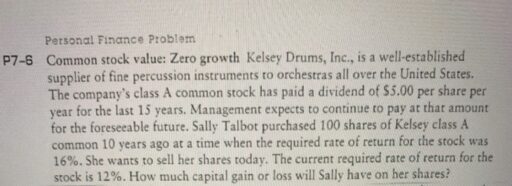

The New York City Department of Finance plays a crucial role in managing property taxes, a significant source of revenue for the city. This article offers an inside look at how the department assesses property taxes, the appraisal process, technological advancements, stakeholder engagement, and career opportunities within the field. By examining these aspects, we gain a comprehensive understanding of the complexities and nuances of property tax management in NYC.

Key Takeaways

- The NYC Department of Finance is responsible for the fair and accurate assessment of property taxes, utilizing varying methodologies for different property types.

- Certified general appraisers play a key role in the appraisal process, which involves meticulous data collection and market analysis to determine property values.

- Technological innovations are enhancing the efficiency and precision of property tax assessments, signaling a trend towards more data-driven approaches.

- Active collaboration with property owners, businesses, and community members is essential for transparency and effective property tax management.

- The NYC Dept of Finance offers robust training programs and career development opportunities for individuals interested in becoming commercial real estate appraisers.

Understanding Property Tax Assessment in NYC

The Role of the Department of Finance

The New York City Department of Finance plays a pivotal role in the fiscal health of the city by managing property tax assessments, a major source of revenue. The department ensures equitable tax distribution among property owners, based on the value of their real estate holdings. The responsibilities extend beyond mere assessment; they encompass a broad spectrum of financial activities crucial for urban development.

- Overseeing the property tax assessment process

- Administering tax exemptions and abatements

- Collecting property tax revenues

- Enforcing tax laws

The Department of Finance also engages in sophisticated financial strategies, such as Tax Increment Financing (TIF), to foster urban growth and development. While TIF can be a powerful tool for revitalizing communities, it requires strategic implementation to balance benefits and challenges.

The Department’s multifaceted approach to property tax management ensures the city’s development and service provision align with the community’s needs and expectations.

Assessment Methodologies for Different Property Types

In New York City, the Department of Finance employs a variety of assessment methodologies to determine the value of different types of properties. Residential properties, for instance, are often assessed based on comparable sales, while commercial properties require a more complex approach involving the collection and analysis of market data.

The valuation of commercial properties is particularly intricate. Appraisers must conduct property inspections, gather relevant information, and collaborate with senior appraisers to learn the nuances of appraisal methodologies and techniques. This process includes analyzing local market trends, property sales, and rental data to ensure accurate and equitable assessments.

The goal is to maintain assessment equity across the board, reflecting the market value as closely as possible without a statutory requirement to assess at 100 percent of market value.

Understanding these methodologies is crucial for property owners who wish to engage with the assessment process or question their property’s valuation. The NYC Department of Finance provides resources such as FAQs to assist property owners in navigating the complexities of property tax assessment.

Annual Assessment Cycle and Public Review Process

The New York City Department of Finance (DOF) operates on a meticulous annual assessment cycle to ensure the fair valuation of properties. This cycle is crucial for the accurate calculation of property taxes, which fund essential city services. The process begins with the DOF reviewing property data and applying assessment methodologies tailored to various property types.

Following the initial assessment, there is a period for public review, allowing property owners to examine and challenge their assessments if they believe them to be incorrect. This transparency is vital for maintaining public trust and allows for the correction of any potential errors.

- January: Tentative Assessment Roll released

- February to March: Period for public review and filing of challenges

- May: Final Assessment Roll published

- July: Property tax bills issued based on the final assessment

The DOF also coordinates with internal and external partners to streamline the assessment process. This includes working with certified appraisers and leveraging technology to improve accuracy and efficiency. The goal is to create a system that is both equitable and responsive to the needs of New York City’s diverse property owners.

The Appraisal Process: From Data Collection to Valuation

Gathering and Confirming Market Data

The initial phase in the appraisal process involves meticulous data collection. This step is crucial as it lays the groundwork for accurate property valuations. The NYC Department of Finance employs a variety of methods to gather market data, which includes analyzing recent sales transactions, reviewing leases, and examining third-party reports.

Professionals in this field are adept at identifying new business opportunities and are capable of conducting independent real estate market research. They collaborate closely with asset managers and utilize advanced technology to prepare valuation models and financial reports.

The process of confirming market data is as important as its collection. It ensures that the information used in the appraisal is current and reflective of the market’s characteristics.

Here is a simplified list of steps taken during this phase:

- Collect and review new client onboarding documents.

- Maintain and analyze lead databases for potential transactions.

- Request and scrutinize third-party reports for compliance.

- Conduct economic and demographic research to assess transaction feasibility.

- Attend site inspections to evaluate physical real estate assets.

Working with Certified General Appraisers

The collaboration with certified general appraisers is a cornerstone of the NYC Department of Finance’s appraisal process. These professionals bring a wealth of knowledge and expertise, ensuring that property valuations are based on the most current and accurate market data. Certified appraisers are instrumental in maintaining the integrity and fairness of property tax assessments.

The path to becoming a certified general appraiser involves rigorous training and mentorship. Aspiring appraisers work closely with seasoned experts to master appraisal techniques and industry standards. The job requirements for this role typically include:

- A bachelor’s degree in Real Estate, Finance, Economics, or a related field

- Strong analytical and critical thinking skills

- Excellent communication abilities

- Detail-oriented and organized work habits

- Proficiency in Microsoft Office Suite

- Willingness to travel for property evaluations

The Department of Finance values the meticulous work of certified appraisers, recognizing their role in upholding the city’s fiscal health through accurate property tax assessments.

The collaboration between the Department and certified appraisers is not just about data and numbers; it’s a partnership that ensures transparency and fairness in the property tax system, fostering trust among property owners and the broader community.

Challenges in Commercial Real Estate Appraisal

Appraising commercial real estate in NYC presents a unique set of challenges. Market volatility and regulatory changes often impact valuation, requiring appraisers to stay abreast of the latest trends and regulations. For instance, the anticipated trends for 2024, such as AI-driven opportunities and increased ESG regulations, will likely influence commercial property valuations.

The process of collecting and analyzing market data is intricate, involving multiple steps:

- Conducting thorough property inspections

- Gathering relevant property information

- Researching local market trends, property sales, and rental data

- Collaborating with senior appraisers

- Maintaining up-to-date appraisal records

Appraisers must navigate through a complex landscape of financial, legal, and market-driven factors to determine the true value of a property. This requires a deep understanding of both the micro and macroeconomic indicators that can affect property values.

The role of technology is becoming increasingly significant in addressing these challenges. Adoption of real estate tech, such as property analytics platforms, can enhance the accuracy and efficiency of appraisals. However, the human element remains crucial, as experienced appraisers bring invaluable insights into the valuation process.

Technology and Innovation in Property Tax Management

Adoption of Real Estate Tech by the NYC Dept of Finance

The New York City Department of Finance is at the forefront of integrating real estate technology to enhance property tax management. The adoption of big data and advanced technology has revolutionized the appraisal process, making it more efficient and accurate.

- Utilization of big data analytics for property valuation

- Implementation of machine learning algorithms to predict market trends

- Deployment of digital tools for data collection and analysis

This technological transformation has streamlined operations, reduced errors, and improved overall service delivery.

The Department’s commitment to innovation is evident in its collaboration with tech firms like Bowery, a pioneer in the commercial real estate appraisal space. With over $80 million in venture capital backing, Bowery’s model exemplifies the potential of tech-driven appraisal services. The NYC Dept of Finance’s embrace of such partnerships underscores its dedication to staying at the cutting edge of real estate appraisal and assessment.

Impact of Technology on Efficiency and Accuracy

The integration of advanced technology has significantly transformed the landscape of property tax management in NYC. The adoption of sophisticated software and data analytics tools has led to remarkable improvements in both efficiency and accuracy. For instance, the use of Geographic Information Systems (GIS) allows for precise property mapping and data analysis, which is crucial for fair assessments.

- Streamlined data processing and management

- Enhanced precision in property valuation

- Improved taxpayer services through online platforms

- Quicker response times to public inquiries

The strategic application of technology ensures that the Department of Finance can adapt to the evolving demands of property tax assessment and management.

The evidence from local governments in the developing world suggests that technology plays a pivotal role in enhancing tax collection capacity. This insight is mirrored in the NYC Department of Finance’s approach, where technology is leveraged to handle complex assessments and large volumes of data with greater ease.

Future Trends in Property Tax Appraisal and Assessment

The landscape of property tax appraisal and assessment is on the cusp of transformation. One potential future for property tax assessments is the implementation of artificial intelligence, which could more accurately determine the value of properties. This shift promises to enhance precision and streamline the appraisal process.

The integration of AI into property tax systems could lead to a significant reduction in manual errors and an increase in the speed of assessments.

Emerging technologies are not only about automation but also about the ability to analyze vast amounts of data. The NYC Department of Finance is poised to leverage these advancements to better understand market trends and property values. Below is a list of key areas where technology could impact the future of property tax assessments:

- Advanced data analytics for market trend analysis

- Machine learning algorithms for predictive valuation

- Blockchain for secure and transparent record-keeping

- Internet of Things (IoT) devices for real-time property data collection

As these technologies mature, they will likely become integral to the way the Department of Finance approaches property tax assessments, ensuring fairness and accuracy for all stakeholders.

Collaboration and Outreach: Engaging with Stakeholders

Partnerships with Property Owners and Businesses

The New York City Department of Finance places a strong emphasis on fostering partnerships with property owners and businesses to ensure a collaborative approach to property tax management. These partnerships are crucial for maintaining an open line of communication and for the development of mutually beneficial strategies.

- Develop and maintain business relationships with developers and landlords in NYC

- Conduct real estate market research and analysis

- Collaborate with event and marketing teams to promote community engagement

By actively collaborating with stakeholders, the Department of Finance is able to identify new business opportunities and streamline the property tax assessment process.

The Department’s responsibilities include coordinating with other Realty Specialists to manage real property interests effectively. This involves research, analysis, and making recommendations on leases, licenses, permits, and property utilization.

Coordination with Event and Marketing Teams

The NYC Department of Finance recognizes the importance of collaboration with event and marketing teams to enhance brand visibility and stakeholder engagement. By working closely with these teams, the department ensures that its initiatives and services are effectively communicated to the public.

- Coordinate reviews with internal partners to ensure alignment of messaging.

- Prepare and distribute materials for committee reviews and public events.

- Collect and manage data on business partners and clients, maintaining strong relationships.

The synergy between the Department of Finance and marketing professionals is crucial for the successful promotion of tax-related information and services.

Efficient coordination with event and marketing teams is not only about promoting the department’s brand but also about fostering community involvement and ensuring transparency in operations. The department’s outreach efforts are designed to keep stakeholders informed and engaged, which is essential for the smooth functioning of property tax management in NYC.

Community Involvement and Transparency Initiatives

The NYC Department of Finance has recognized the importance of community involvement and transparency in managing property tax. By engaging with various stakeholders, the department ensures that the process is not only efficient but also inclusive.

- Knowledge of applicable regulations and tax law is crucial for community development.

- The ability to communicate organizational strategies and goals is essential for fostering public trust.

- Managing public/private partnerships requires excellent project management skills and the ability to build relationships across sectors.

The department’s commitment to transparency is reflected in its efforts to provide clear and accessible information to the public. This includes detailed explanations of tax assessments and the availability of resources for those seeking to understand or challenge their property tax bills.

In addition to these efforts, the department conducts due diligence analysis on potential community development loans and investments, ensuring adherence to credit policies and legal agreements. This meticulous approach to financial management underpins the trust placed in the department by the community.

Career Opportunities and Professional Development

Training Programs for Aspiring Appraisers

The journey to becoming a certified general appraiser is a structured process that involves comprehensive training and mentorship. Aspiring appraisers are required to work under the supervision of seasoned professionals, gaining hands-on experience in various appraisal techniques and methodologies. This practical approach ensures that trainees develop a robust understanding of industry standards and best practices.

Job requirements for trainees typically include a Bachelor’s degree in fields such as Real Estate, Finance, Economics, or a related area. While not always mandatory, this educational background provides a solid foundation for the analytical and critical thinking skills essential in this profession. Additionally, strong communication abilities and attention to detail are highly valued, along with proficiency in tools like the Microsoft Office Suite.

The training program emphasizes the importance of both theoretical knowledge and practical skills, preparing candidates for the diverse challenges they will face in the field of property appraisal.

Willingness to travel is often a part of the job, as appraisers need to visit various properties to conduct their assessments. The NYC Department of Finance offers a supportive environment where trainees can grow and thrive, setting the stage for a rewarding career in property tax management.

Career Growth and Longevity at the NYC Dept of Finance

The NYC Department of Finance is not just a place of employment; it’s a venue for professional evolution. Employees are encouraged to grow within the organization, fostering a culture where longevity is a testament to the department’s commitment to its staff. The journey from an entry-level appraiser to a certified general appraiser is paved with continuous learning and mentorship.

- Day-to-day responsibilities include completing appraisals, updating clients, and supporting senior appraisers.

- A clear path is provided for those aiming to become certified general appraisers, with hands-on experience under the guidance of industry veterans.

- The department values gratitude and integrity, which contributes to a fulfilling and lasting career.

The NYC Dept of Finance offers a dynamic environment where dedication and hard work are recognized and rewarded. Employees are given the tools and opportunities to advance their careers, ensuring that their professional journey is not only successful but also enriching.

How to Start a Career in Property Tax Management

Starting a career in property tax management with the NYC Department of Finance can be a rewarding path for those interested in real estate and finance. The first step is to gain a solid understanding of the property tax system and the various roles within the department.

To begin, familiarize yourself with the job responsibilities that may include assisting in the valuation of commercial properties, conducting property inspections, and collaborating with senior appraisers. It’s essential to learn appraisal methodologies and techniques, as well as to maintain accurate and up-to-date appraisal records.

A career in property tax management offers the opportunity to work on diverse property sites and engage in significant financial analysis and market research.

Here are some steps to consider when pursuing a career in this field:

- Obtain relevant education, such as a degree in finance, real estate, or a related field.

- Gain experience through internships or entry-level positions in property appraisal or tax assessment.

- Acquire certifications or licenses as required for advancement in property tax management.

- Stay informed about local market trends, property sales, and rental data to make informed assessments.

- Continuously seek professional development opportunities to keep skills sharp and knowledge current.

Conclusion

In summary, the NYC Department of Finance plays a pivotal role in managing property taxes, a task that requires meticulous attention to detail and a deep understanding of the real estate market. Through the insights provided in this article, we’ve seen how the department conducts market research, collaborates with various teams, and ensures that appraisals are completed accurately. The dedication to doing things the right way not only fosters trust within the community but also provides a foundation for associates to build rewarding careers. As the real estate landscape continues to evolve, the department’s commitment to innovation and collaboration remains crucial in navigating the complexities of property tax management in New York City.

Frequently Asked Questions

What is the role of the NYC Department of Finance in property tax assessment?

The NYC Department of Finance is responsible for assessing the value of all properties in the city, which determines the property taxes due. They ensure fair and accurate assessments to fund city services.

How are different types of properties assessed for tax purposes in NYC?

In NYC, residential and commercial properties are assessed differently. Residential properties are often assessed based on comparable sales, while commercial properties are assessed based on income potential, among other factors.

What is the annual assessment cycle for NYC property taxes?

The annual assessment cycle involves the Department of Finance reviewing property values each year, with preliminary assessments published in January, followed by a period for public review and potential appeals.

How does the NYC Dept of Finance use technology to improve property tax management?

The Dept of Finance adopts real estate tech such as automated valuation models and geographic information systems to enhance the accuracy and efficiency of property tax assessments and management.

How can property owners engage with the NYC Dept of Finance regarding property taxes?

Property owners can engage with the Dept of Finance through public hearings, providing feedback during the assessment review period, and participating in outreach programs aimed at educating taxpayers.

What opportunities are available for those interested in a career in property tax management in NYC?

Opportunities include training programs for aspiring appraisers, positions that offer practical experience and the chance to become a certified general appraiser, and roles in technology and data analysis within the Dept of Finance.