What is a stop-limit order, and when can you use it? This is one question many investors ask when trading. Trading in the stock exchange market is wrought with many risks. And finding a way to mitigate them is critical to maximizing returns.

The U.S. equity market experiences periods of price dislocation and volatility, extending a long time or lasting a short duration. Stop orders reduce the impact of such changes by allowing investors to buy or sell shares at specific prices.

A stop-limit order is one such order that provides greater control over one’s trading securities. It allows the investor to determine the maximum or minimum prices for each order. Once the stock attains a specific price, the limit order triggers, instructing the broker to buy or sell it as the limit price.

The premise is reducing losses by identifying the point at which the investor is unwilling to sustain losses. Investors also use stop orders to protect their profit position in the event stock price declines.

Investors with a short position can use stop orders to reduce losses in case the price increases. However, once stop orders are triggered, they’re executed as market orders hence face the same risks as other market orders.

Placing limits on stop orders enables brokers to manage risks. A stop-limit order becomes a limit order when the stock exceeds or reaches the stop price. Using a stop-limit order instead of a regular stop order provides additional certainty that investors will receive the expected returns. The next part of the article explains the concept further.

The Difference Between Stop-Limit Order vs. Stop-Loss Order

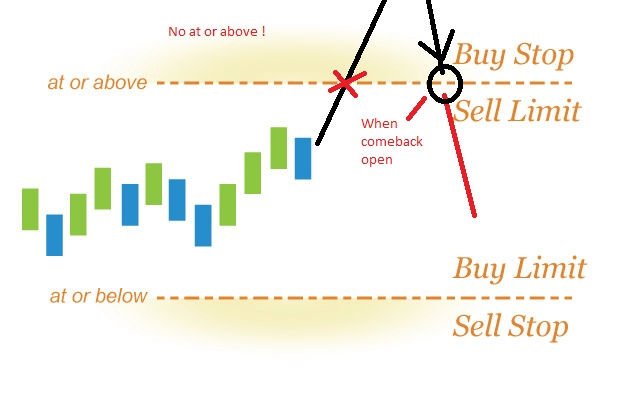

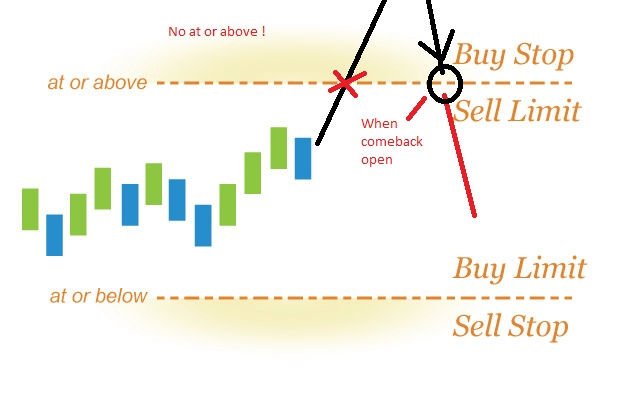

A stop-limit order consists of two prices: the stop price and the limit price. The stop price activates the order while the limit price is the price constraint for executing the order once it’s triggered.

So, what is a stop-limit order for buying stock? It’s called a buy stop-limit and investors use this kind to buy stock if the price hits a specific point. A buy stop-limit helps traders regulate the stock’s purchase price once they’ve identified an acceptable price per share.

A stop price and the limit price is then set once the trader determines the highest price they can pay for each share. The stop price is usually more than the market price, while the limit price is the highest the trader can pay per share.

For example, Kimberly wants to buy ABC Limited stocks valued at $50, and she expects its price to increase today. Kimberly can put a stop price at $55 and a limit price of $60. The order is processed after reaching $55, but it isn’t fulfilled if it exceeds $60.

And what is a stop-limit price to sell? It’s a conditional order to sell a stock when the price falls to a specific price, i.e., the stop price. The stop price is the price that activates the order, while the limit price is the lowest the trader can accept.

On that note, we should look at a stop-loss order as many investors confuse the two concepts. So what is a stop-limit order and a stop-loss order? The latter is pretty similar to a sell stop-limit as it describes a stop order in which the investor is selling shares.

However, stop-loss orders don’t have limit prices. The order is executed if the security can be bought or sold at the specified price. Using the previous example, Kimberly can put a stop price of $54 to lock in $4 per-share profit if the price falls to $54. If trading in a rapidly volatile market, it might be difficult to fulfill the stop-loss order.

For example, Kimberly purchased the stock at $50 and placed a stop-loss order of $48, but the stock closes at $45 a share. After that, catastrophic news about the company caused ABC’s share price to drop to $40. Kimberly can still execute the stop-loss order because the price has fallen below the order price. However, the order isn’t executed at $48 but at the prevailing market price of $40.

Recommended Read | Charge Card vs. Credit Card – Difference Explained in Detail

How Stop-Limit Orders Work

It’s essential to know how the stock market operates to understand how stop-limit orders work. Typically, shares are trading in a public exchange and recorded on the order book. As such, the order is active until it’s triggered, has expired or is canceled.

If an investor places a stop-limit order, they can indicate the valid duration, either during the current or futures market. Many investors allow a validity period of one day which means the order expires at the end of the market session even if it’s not fulfilled.

When to Use Stop-Limit Orders

When deciding the best time to use stop-limit orders, investors should understand that short-term price movements activate the orders. As such, they should consider the implications of such short-term price fluctuations in deciding when to use stop-limit orders and selecting the stop price.

What’s more, brokers use different standards when determining if the order’s stop price has reached. Some brokers use last-sale prices to trigger the order, while others use quotation prices. Check with your broker to determine the standard used for stop-limit orders.

With these points in mind, you can confidently determine when to use stop-limit orders. The idea is to maintain as much control over a transaction. You’re not just identifying the best time to buy or sell the stock but the maximum amount of money you can lose or gain.

For a buy stop-limit order, the order is triggered when the stock hits a specific price. However, if the price is moving faster, you want to execute the order as soon as possible as long it’s within the standard trading session.

BUY TESLA STOCK – THINGS TO KNOW BEFORE YOU INVEST IN TESLA

A typical trading market session opens at 9.30 a.m. and ends at 4.00 p.m. Therefore, stop-limit orders can’t be triggered outside a regular market session, e.g., during after-hours, weekends, when the stock halts, or market holidays. Instead, the investor may decide to allow a validity period to be good-til-cancelled (GTC). This means the order is valid in future market sessions until it’s canceled or triggered.

Stop-Limit Order Risks

While a stop-limit order helps investors monitor their price positions, investors should be prepared for these stop-limit order risks:

The Stop Prices Aren’t Guaranteed Execution Prices

As earlier highlighted, a stop order becomes a market order once the market attains the stop price. This means the resulting order is fully executed at the current market price, and it can be different from the investor’s stop price. During volatile market conditions, the price may vary significantly from the stop price, especially if the prices are moving rapidly.

Partial Fills

Since stop orders are triggering by short-lived price changes, partial fills are bound to occur. Partial fills happen when a part of the stock order shares are executed, leaving the order open. As such, the broker executes parts of a single order every trading day. While the idea is to maximize returns, such a strategy compels the investor to pay multiple commissions reducing their profits.

High Price Declines

During extreme volatility, selling stop-limit orders may cause drastic price declines. This is because the activation of sell stop-limit orders increases the downward price trend of a stock. If triggered during a steep price decline, the order may lead to an executing way below the stop price.

The risks inherent to stop-limit orders are higher when the market is volatile or during illiquid market hours. As such, investors should consider restricting the time of executing a stop-limit order to specific times.

Stop-Limit Order Examples

We’ll use two examples to help you understand what is a stop-limit order.

Stop-Limit Order Examples: Buy stop-limit

An investor has company shares valued at $25. The investor expects them to increase today and puts a stop price of $30 and a limit price of $32. It means that once the shares hit the $30, the order is triggered and turned into a market order. However, the limit price means the investor isn’t willing to pay more than $32 for a share.

If the shares reach the $30 stop price, the stop-limit order becomes a market order, and the broker can execute it before increasing above $32. There are two ways of implementing a stop-limit order: the investor can buy or sell a stop-limit order.

Stop-Limit Order Examples: Sell stop-limit

Let’s say Kimberly wants to sell ABC Limited shares. The current share price is $60 but has set the stop price at $55 and the limit order at $53. If the price falls to $55, Kimberly can execute the order, but the order remains unfulfilled if it falls below $53.

Knowing what is a stop-limit order is critical to any investor who has specific maximum and minimum prices for selling or buying in mind. The risks cause some investors a bit hesitant about this trading strategy. However, aligning it to your investment needs is critical to leveraging its benefits fully.