How to void a check is pretty straightforward, yet many people dont know how to do it. Some people dont even know what a voided check is. This is primarily due to the increasing reliance on online transactions.

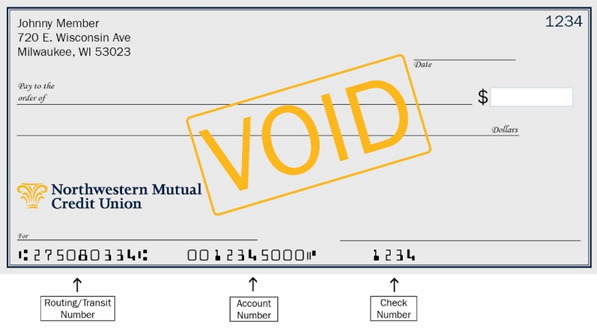

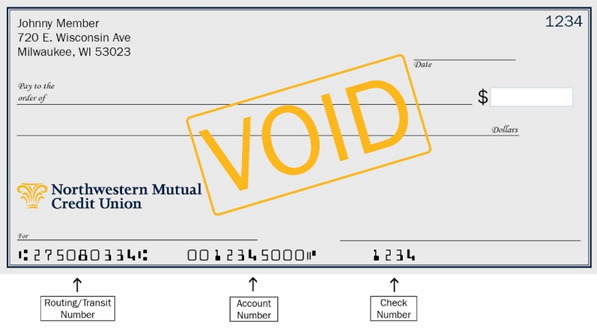

A voided check is a real check that can’t be used as legal tender. The word void is written across the front in large letters rendering the check useless for payment purposes.

The check comes in handy when setting up automatic bill payments or investments directly from your bank account. It provides important information for setting up an electronic link to your account. Here’s a step-by-step guide on how to void a check.

Reasons for Voiding a Check

After voiding a check it’s important to write the reason for voiding it. Here are some reasons you can highlight:

- Direct deposit: If your employer is making electronic payments, they may need your account information to send the money to the right place. A voided check is a simple way for the employer to get such information and ensure it’s accurate

- When making automatic money withdrawals: Banks and other financial institutions may need to withdraw money from your checking account, e.g., when making mortgage payments. You may need to provide a voided check to furnish them with the account details

- When correcting a mistake: If you make a mistake when writing a check, you can void check to correct it. For example, if you’re writing a $200 check but add another zero to make it $2000, you can void the check

- Setting up automatic electronic payments: Once you stop writing checks to pay for a mortgage, rent, or insurance, you may need to send a voided check to set up automatic electronic payments. After setting it up, the funds will be deducted from your account automatically every month

How to Void a Check

Voiding a check is as simple as writing the word ‘VOID’ across it. Here are the steps:

Use a Pen

You want to avoid using a pencil because the wording can be erased easily. Blue or black markers are ideal.

Write ‘VOID’ Across the Check

It’s important to write the word at the right place; otherwise, the check isn’t voided. You can write the word on the payee line, i.e., where you’d write the payee’s name. If you’ve already written their name, write ‘VOID’ over it.

Also, avoid writing the void over the account number at the bottom and the routing number. This is because the recipient uses this information to set up the bank account for withdrawals or direct deposit. Other areas to write ‘VOID’ are on the dateline, signature line, amount line, and the amount’s box.

It’s easy to miss one of the boxes or lines; hence many people write the word ‘VOID’ in large letters across the check. Also, avoid signing your name and writing the date.

Record the Voided Check

Record the check number and the reason in the checkbook or check register. Recordkeeping is critical to keeping track of the checks written from the account. While many banks provide such information via online banking sites and applications, it’s crucial to record them manually.

Note voiding a check is different from canceling a check. You cancel a check when you want to stop a payment after sending it. Also, canceling a check attracts a fee, while voiding it is free. Be sure to include all the necessary information about the check to save time.

How to Void a Blank Check

How to void a blank check is pretty similar to voiding a regular check. Write the word ‘VOID’ across the front of the check using a pen or a marker. Then record the check number in the checkbook or finance software.

You can take a photo or scan the check as proof if you want to use the same check in the future. A voided blank check can be handy when you need to provide banking information to an employer or other person. Instead of copying your account number and the bank’s routing, you can provide a voided blank check.

The person receiving the voided check uses the information to set up an electronic transaction. Knowing how to void a blank check is also important when you want to authorize a government agency to make direct deposits.

If you have a checking account, but it doesn’t offer checks, ask the bank for a starter check. The document still shows the necessary information for voiding purposes. Alternatively, you can use a deposit slip or other official document as long as it provides your bank account number and routing number.

Recommended Read | The Difference Between a Cashier’s Check vs Money Order

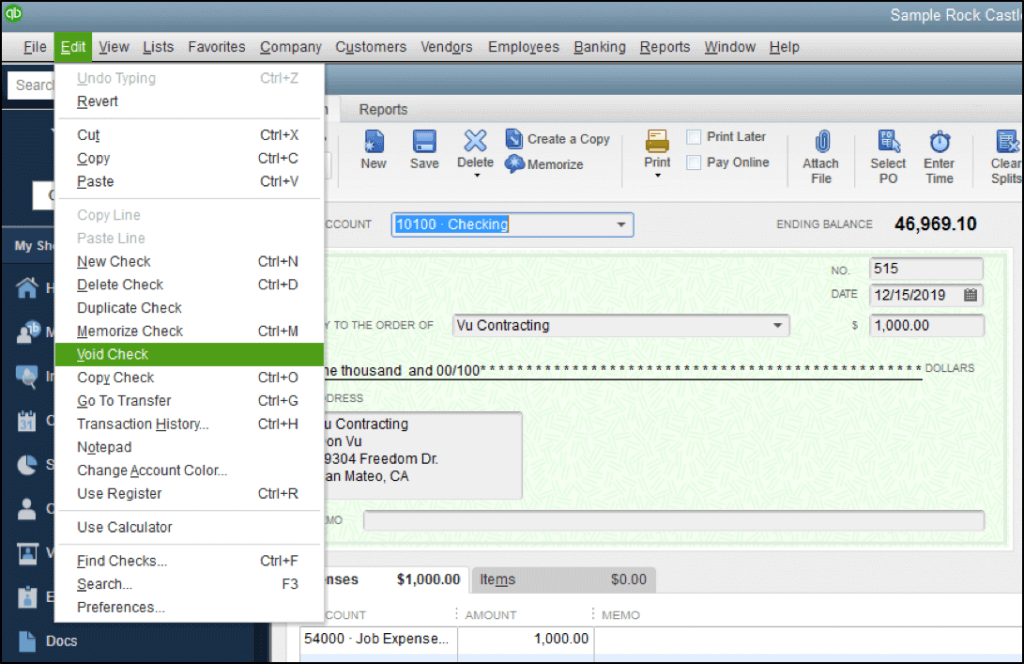

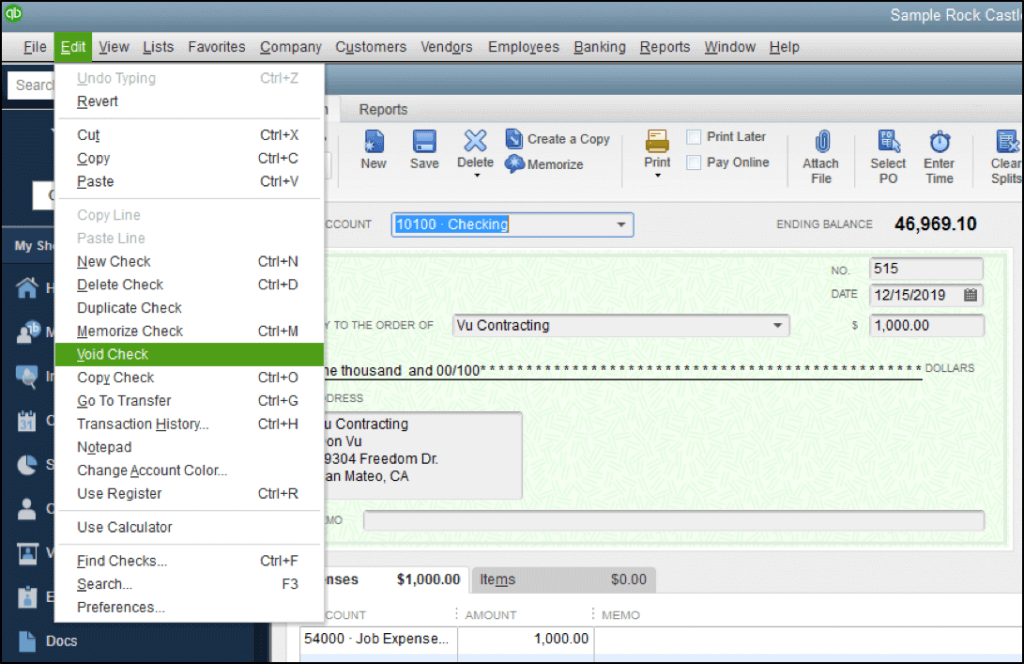

How to Void a Check in Quickbooks

It’s easy to make mistakes when paying clients and writing invoices using QuickBooks. For example, you can issue a check to the wrong person or enter the wrong amount. From an accounting perspective, you can void or delete the check in QuickBooks Online.

Both actions have a similar effect, but it’s better to void the check from a recordkeeping perspective. The voided check remains on the registry, but the check amount changes to zero.

For example, an accountant may have processed a $100 payment using check #1253 to a cleaning company. When presenting payment, the company’s head informs the accountant about a 10% discount on offer. The service now costs $ 90.

This means you need to write a new check for $90 and record it in QuickBooks. However, you must write off the initial check. Here’s how to void a check in Quickbooks:

- Identify the check you want to void. You can check the register by clicking on the banking toolbar or the bank account

- Click on ‘Go to Register’ on the next screen and look for the check you want to void. Use the filters on the page

- Then click on ‘Edit’ and ‘Void Check.’ Select ‘Yes’ once prompted with a message asking if you want to void the check. The changes update the company’s journal, automatically changing the check amount to zero. If you want to void the check using the date indicated initially, click ‘No.’ The action voids the check but doesn’t update the company’s journal

Voiding a Paper Check Within QuickBooks

- Select the ‘Banking’ and ‘Write Checks’ icons. Look for the account the check was written, e.g., under the Expenses section

- Type in the check number into the ‘Check Number’ field and the date. Enter $0 in the box with $ sign and type the payee’s name on the ‘Pay to the Order of’ field

- Select ‘Edit’ and ‘Void Check’ to void the check. A prompt message appears to ask you if you want to void the check in the current period

- Click ‘record’ to finalize the process

How to Void a Check for Direct Deposit

Direct deposit is a payment method that allows an employer or other person to deposit money into your bank account directly. Social Security benefits and job paychecks are issued through direct deposit.

Since a check has this information, it’s an essential document during the direct deposit sign-up process. Of course, you won’t send a blank check but a voided one. A voided check prevents anyone from filling it out and withdrawing money from your account without consent. The following steps explain how to void a check for direct deposit:

1. Get a Direct Deposit Form

Ask your employer to give you a direct deposit form. The document authorizes the employer to send money to your bank account using the bank account number and routing number.

2. Filling the Direct Deposit Application Form

The details on the form vary by agency and organization. However, you must provide basic information like:

- Your name and address

- Bank account number

- Routing number

- Identification, e.g., an employee number or student

- Type of account

- Account holder’s name

After filling out the information, sign the form.

3. Determine the Amount to be Deposited

One cool feature with direct deposit is that you can split payments. Some people prefer the splitting the payment between:

- Checking and savings accounts or

- Their checking accounts and their spouse’s accounts

Recommended Read | What is Accounting?

4. Voiding the Check

Take out a blank check and write the word ‘Void’ across it. You may also write the reason for voiding the check. In this case, it’s to set up a direct deposit. Be sure to record the check number in the register for future reference. Also, the word VOID should occupy most of the space on the check’s face.

5. Submit the Application to the Agency

The last step is to forward the application to the organization. Check the form to ensure the information on the form is accurate before turning it in. Also, you must attach the check to the direct deposit application.

The employer should let you know how long it takes to set up the direct deposit. Depending on the organization, you may need to wait one or two pay periods.

Learning how to void a check paves the way for making multiple financial transactions. For example, you can make direct payroll payments and automatic debit bill payments.